Ares Capital (ARCC) Up on Q1 Earnings Meet, Y/Y Revenue Rise

Shares of Ares Capital Corporation ARCC gained 1.2% following the release of its first-quarter 2024 results. Core earnings of 59 cents per share met the Zacks Consensus Estimate. The bottom line reflects a rise of 3.5% from the prior-year quarter.

Results were primarily aided by an improvement in the total investment income. Also, the company’s portfolio activity was robust in the quarter. However, an increase in expenses hurt the results to an extent.

GAAP net income was $449 million or 76 cents per share, up from $278 million or 52 cents per share in the prior-year quarter. We projected net income of $375.3 million.

Total Investment Income Improves, Expenses Rise

Total investment income was $701 million, up 13.4% year over year. The rise was driven by an increase in interest income from investments, capital structuring service fees and dividend income. The top line marginally lagged the Zacks Consensus Estimate of $701.4 million.

Total quarterly expenses were $369 million, up 23.8% year over year. Our estimate for the metric was $357.3 million.

Portfolio Activities Robust

Gross commitments worth $3.6 billion were made in the first quarter to new and existing portfolio companies. This compares with $766 million of gross commitments in the prior-year quarter.

In the reported quarter, the company exited $3.4 billion of commitments compared with $1.9 billion a year ago.

The fair value of Ares Capital’s portfolio investments was $23.1 billion as of Mar 31, 2024. The fair value of accruing debt and other income-producing securities was $20.5 billion.

Balance Sheet Strong

As of Mar 31, 2024, the company’s cash and cash equivalents totaled $509 million, down from $535 million as of Dec 31, 2023.

Ares Capital had $5.5 billion available for additional borrowings under the existing credit facilities as of Mar 31, 2024. Total outstanding debt was $11.8 billion.

As of Mar 31, 2024, total assets were $24.3 billion and stockholders’ equity was $11.9 billion. Our estimate for total assets was $24 billion. We projected stockholders’ equity of $11.2 billion.

Net asset value was $19.53 per share, up from $19.24 as of Dec 31, 2023.

Our Take

Driven by a rise in the demand for customized financing, growth in total investment income is expected to continue in the quarters ahead. Increased investment commitments will likely keep supporting the company’s financials. However, its expansion strategies will likely lead to a rise in costs in the near term, which is expected to hurt the bottom line.

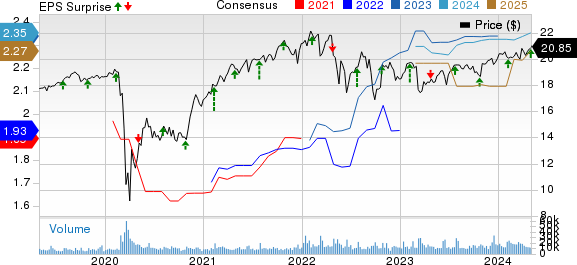

Ares Capital Corporation Price, Consensus and EPS Surprise

Ares Capital Corporation price-consensus-eps-surprise-chart | Ares Capital Corporation Quote

Currently, ARCC carries a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Finance Stocks

Ally Financial’s ALLY first-quarter 2024 adjusted earnings of 45 cents per share surpassed the Zacks Consensus Estimate of 33 cents. However, the bottom line reflects a decline of 45.1% from the year-ago quarter.

ALLY’s results were primarily aided by an improvement in other revenues. However, a decline in net financing revenues, along with higher expenses and provisions, were the undermining factors.

Navient Corporation NAVI reported first-quarter 2024 adjusted earnings per share (excluding regulatory-related and restructuring expenses) of 63 cents, surpassing the Zacks Consensus Estimate of 58 cents. The company reported 86 cents in the prior-year quarter.

NAVI’s results were driven by a rise in total other income and a fall in expenses. However, a decline in net interest income affected the results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report