Cleveland-Cliffs (CLF) Earnings Miss Estimates in Q2, Sales Beat

Cleveland-Cliffs Inc. CLF logged profits of $795 million or $1.33 per share in the second quarter of 2021 against a loss of $108 million or 31 cents per share in the prior-year quarter. The bottom line in the reported quarter includes charges associated with acquisition-related loss, debt extinguishment costs and amortization of inventory step-up.

Barring one-time items, adjusted earnings came in at $1.46 per share that missed the Zacks Consensus Estimate of $1.48.

Revenues were $5,045 million for the reported quarter, up more than fourfold from $1,093 million in the prior-year quarter. The figure beat the Zacks Consensus Estimate of $4,899.9 million.

Second-quarter revenues and net income were quarterly records, reflecting the successful integration of the two acquisitions (AK Steel and ArcelorMittal USA) into Cleveland-Cliffs as well as strong demand for its products, the company noted. Solid demand for steel across all sectors also supported strong prices.

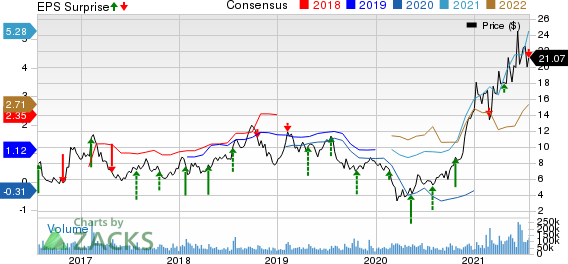

ClevelandCliffs Inc. Price, Consensus and EPS Surprise

ClevelandCliffs Inc. price-consensus-eps-surprise-chart | ClevelandCliffs Inc. Quote

Operational Highlights

The company reported Steelmaking revenues of $4.9 billion for the second quarter. Average net selling price per net ton of steel products was $1,118 for the quarter. External sales volumes for steel products were 4.2 million net tons.

Financial Position

Cleveland-Cliffs ended the second quarter with cash and cash equivalents of $73 million, flat year over year. Long-term debt was $5,368 million at the end of the quarter, up around 21% year over year.

Net cash provided by operating activities was $132 million for the six months ended Jun 30, 2021.

Outlook

Moving ahead, Cleveland-Cliffs expects adjusted EBITDA of around $1.8 billion for the third quarter. It also expects free cash flows of $1.4 billion for the quarter. The company also raised its full-year adjusted EBITDA guidance to $5.5 billion. Demand for steel remains solid and the company continues to negotiate its contract businesses with several clients in different sectors, Cleveland-Cliffs noted.

Price Performance

Cleveland-Cliffs’ shares have surged 272.9% in the past year compared with 27.2% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Cleveland-Cliffs currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Nucor Corporation NUE, ArcelorMittal MT and Cabot Corporation CBT, each sporting a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Nucor has a projected earnings growth rate of 447.6% for the current year. The company’s shares have surged around 120% in a year.

ArcelorMittal has an expected earnings growth rate of 1,484.4% for the current year. The company’s shares have shot up around 176% in the past year.

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have gained roughly 34% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ArcelorMittal (MT) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

ClevelandCliffs Inc. (CLF) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research