Amtech Systems' (NASDAQ:ASYS) investors will be pleased with their strong 163% return over the last three years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For example, the Amtech Systems, Inc. (NASDAQ:ASYS) share price has soared 163% in the last three years. How nice for those who held the stock! It's also good to see the share price up 24% over the last quarter.

So let's assess the underlying fundamentals over the last 3 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Amtech Systems

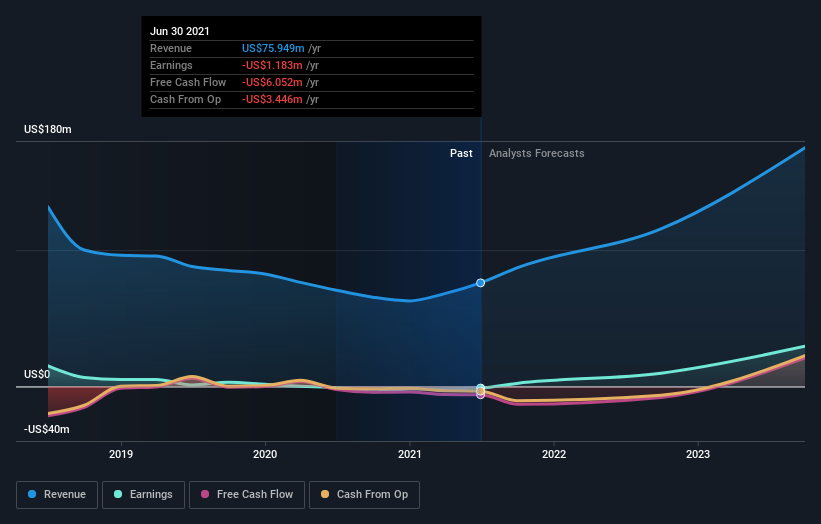

Given that Amtech Systems didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Amtech Systems saw its revenue shrink by 20% per year. So we wouldn't have expected the share price to gain 38% per year, but it has. It's fair to say shareholders are definitely counting on a bright future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Amtech Systems in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Amtech Systems shareholders have received a total shareholder return of 100% over one year. That's better than the annualised return of 21% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Amtech Systems may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.