UPS Q2 Earnings & Revenues Beat on Package Delivery Demand

United Parcel Service UPS reported second-quarter 2021 earnings (excluding a penny from non-recurring items) of $3.06 per share, beating the Zacks Consensus Estimate of $2.75. The bottom line surged 43.7% year over year with strong performances across all segments.

Quarterly revenues of $23,424 million also outperformed the Zacks Consensus Estimate of $23,085.4 million. The top line increased 14.5% year over year, driven by higher package delivery demand. Overall operating profit soared 47.3% year over year to $3.3 billion in the second quarter, boosted by double-digit growth in adjusted operating profit across all segments.

At the end of the second quarter, UPS generated free cash flow of $6,804 million, up 74.7% year over year. The company’s capital expenditures were $1,670 million at the end of the same period.

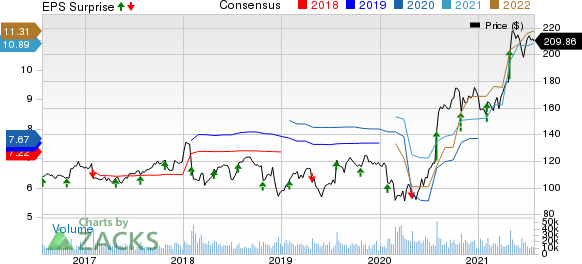

United Parcel Service, Inc. Price, Consensus and EPS Surprise

United Parcel Service, Inc. price-consensus-eps-surprise-chart | United Parcel Service, Inc. Quote

Segmental Details

U.S. Domestic Package revenues increased 10.2% year over year to $14,402 million in the second quarter, driven by 13.4% increase in revenue per piece owing to robust improvement in all products. Segmental operating profit (adjusted) jumped 37.9% year over year to $1,675 million in the quarter. Adjusted operating margin in the June quarter was 11.6%.

Revenues at the International Package division summed $4,817 million, up 30%. The segment’s performance was driven by strong demand in Europe. Segmental operating profit (adjusted) totaled $1,190 million in the reported quarter, up 41.3%.

Supply Chain and Freight revenues augmented 14.3% to $4,205 million, aided by strength in demand across all businesses. Operating profit (on an adjusted basis) soared 52.8% to $408 million in the June quarter.

Outlook

UPS, currently carrying a Zacks Rank #3 (Hold), anticipates consolidated operating margin to be approximately 12.7% in the current year. Return on invested capital is expected to be approximately 28%. Capital expenditures are estimated to be $4 billion in 2021. For the remainder of the year, the company expects effective tax rate of about 23%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sectorial Snapshots

Within the broader Transportation sector, Delta Air Lines DAL, J.B. Hunt Transport Services JBHT and Kansas City Southern KSU recently reported second-quarter 2021 results.

Delta, currently carrying a Zacks Rank of 3, incurred a loss (excluding $2.09 from non-recurring items) of $1.07 per share, narrower than the Zacks Consensus Estimate of a loss of $1.41. Total revenues of $7,126 million also topped the Zacks Consensus Estimate of $6,340.9 million.

J.B. Hunt, presently carrying a Zacks Rank #3, reported earnings of $1.61 per share, surpassing the Zacks Consensus Estimate of $1.55. Total operating revenues of $2908.4 million outperformed the Zacks Consensus Estimate of $2722 million.

Kansas City Southern, carrying a Zacks Rank #4 (Sell) at present, reported earnings (excluding $6.23 from non-recurring items) of $2.06 per share, missing the Zacks Consensus Estimate of $2.16. Quarterly revenues of $749.5 million surpassed the Zacks Consensus Estimate of $733.1 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research