Top Three UK Dividend Stocks To Watch In May 2024

As the FTSE 100 mirrors a positive trend in global markets and with recent political and regulatory developments capturing attention, investors are closely monitoring the evolving landscape of London's financial scene. In such a dynamic environment, identifying dividend stocks that offer potential stability and consistent returns becomes increasingly pertinent.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.38% | ★★★★★★ |

Keller Group (LSE:KLR) | 4.04% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.06% | ★★★★★☆ |

DCC (LSE:DCC) | 3.46% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.96% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.15% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.59% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.03% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.32% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.08% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

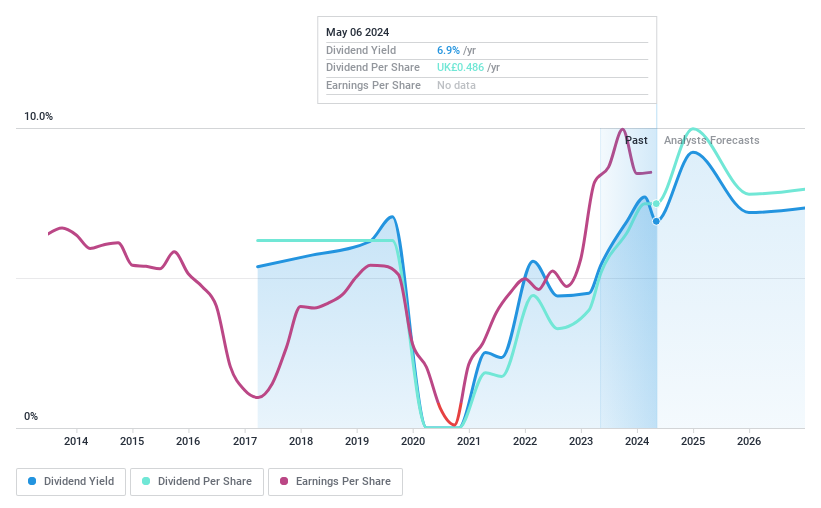

HSBC Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc operates globally, offering banking and financial services with a market capitalization of approximately £131.01 billion.

Operations: HSBC Holdings plc generates its revenue through four main segments: Commercial Banking with $19.43 billion, Wealth and Personal Banking at $24.34 billion, Global Banking and Markets contributing $15.80 billion, and Corporate Centre adding $3.33 billion.

Dividend Yield: 6.9%

HSBC Holdings plc recently announced a first interim dividend of US$0.1 per share for 2024, reflecting a cautious approach amidst modest financial performance with net income slightly reduced to US$10,584 million from US$10,745 million year-over-year. The impending retirement of CEO Noel Quinn, who has been instrumental in strategic transformations and profitability improvements, introduces uncertainties about leadership continuity and future strategies. This scenario presents a mixed outlook for dividend stability and growth prospects for investors focusing on long-term income generation from UK dividend stocks.

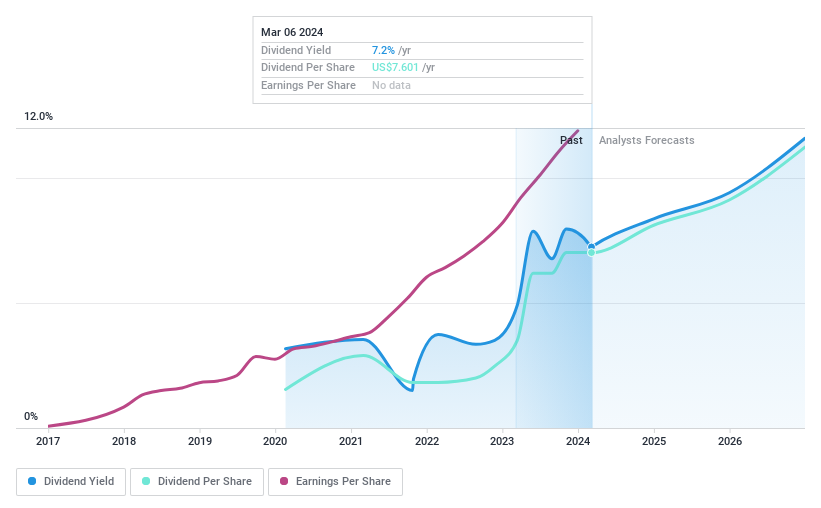

Kaspi.kz

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Joint Stock Company Kaspi.kz operates in the Republic of Kazakhstan, offering payments, marketplace, and fintech solutions for consumers and merchants, with a market capitalization of $22.83 billion.

Operations: Kaspi.kz generates revenue through its fintech, payments, and marketplace segments, totaling ₸1.02 billion, ₸478.68 million, and ₸448.22 million respectively.

Dividend Yield: 6.3%

Kaspi.kz, a Kazakhstan-based company, reported a robust year-over-year growth in net income and revenue for Q1 2024. Despite this performance, its dividend history is marked by instability with significant fluctuations in annual payments. Recently, Kaspi.kz announced an 850 KZT per share dividend at its AGM, underlining its commitment to returning value to shareholders. However, the company's dividends are only moderately covered by earnings and cash flows with payout ratios of 72.2% and 61% respectively, indicating potential pressure on future payouts if earnings do not continue to grow at the projected rate of approximately 17% per year.

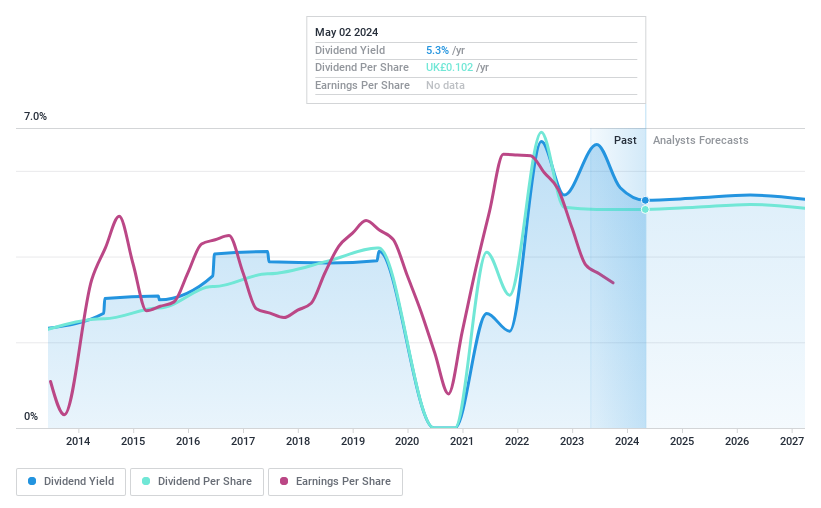

Norcros

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc is a company that develops, manufactures, and markets bathroom and kitchen products in the United Kingdom and South Africa, with a market capitalization of approximately £173.38 million.

Operations: Norcros plc generates £422.70 million from its Building Products segment.

Dividend Yield: 5.3%

Norcros, a UK-based company, anticipates its underlying operating profit for the fiscal year ended March 2024 to align with market expectations, despite a revenue decline to £390 million from £441 million the previous year. The company's dividend yield of 5.27% is below the top UK dividend payers. However, its dividends are sustainably covered by earnings and cash flows with payout ratios of 60.2% and 30.4%, respectively. Despite this coverage, Norcros has experienced volatility in dividend payments over the past decade, reflecting some instability in its dividend history.

Summing It All Up

Unlock more gems! Our Top Dividend Stocks screener has unearthed 52 more companies for you to explore.Click here to unveil our expertly curated list of 55 Top Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:HSBALSE:KSPI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com