Auto Stock Roundup: Buyout Deals of MGA and MGO, TSLA-BHP Deal & More

Last week, a handful of auto companies reported second-quarter 2021 earnings results. Auto retailer AutoNation AN delivered a comprehensive beat, and witnessed significant year-over-year growth in earnings and revenues. Encouragingly, the firm increased the share-buyback authorization up to an additional $1 billion, boosting investors’ confidence. Close peer Lithia Motors also put up a stellar Q2 show, with earnings and revenues handily beating the Zacks Consensus Estimate. In fact, for the reported quarter, Lithia Motors claims to have reported the highest quarterly earnings and revenues in its history.

Auto replacement parts supplier Genuine Parts GPC also outpaced the consensus estimate. Backed by strong results, the firm raised full-year sales, earnings and free cash flow projections. Meanwhile, automotive products supplier, Gentex Corp. not only missed the earnings and sales mark for second-quarter 2021 but also dimmed the outlook for full-year 2021, taking into account the impact of high commodity, freight and labor expenses.

U.S. motorcycle giant Harley Davidson HOG topped earnings estimates but missed automotive sales mark. Investors were particularly disappointed with its bleak guidance for the back half of 2021. Taking into account the $80-million tariff impact, the firm anticipates operating margin as a percentage of revenues to range from negative to mid-single digit for the latter half of the year.

Apart from major earnings reports, buyout updates from Magna International MGA, Winnebago Industries WGO, and news from auto giants like Tesla TSLA as well as General Motors GM grabbed eyeballs. Read on to know more.

Last Week’s Top Stories

1. Magna entered into an agreement to acquire Veoneer in a bid to expand its advanced driving assistance systems (ADAS) portfolio. The deal, worth $3.8 billion, is expected to be completed by 2021-end, subject to certain regulatory approvals. The buyout will bolster Magna’s existing strengths and make the company’s ADAS business a global leader with augmented capabilities as well as enhanced engineering and software competencies. It will help Magna achieve annual cost savings of roughly $100 million by 2024. Post completion of the transaction, Veoneer will be integrated into Magna’s electronics operating unit.

2. Winnebago inked a deal to acquire Barletta Pontoon Boats — a premium pontoon boat manufacturer — for an initial consideration of $255 million, of which $230 million will be funded in cash and $25 million in the newly-issued Winnebago shares. The firm expects the transaction to complete in first-quarter fiscal 2022. Barletta's high-end, innovative pontoon boats naturally complement Winnebago’s legacy business of RVs and are highly differentiated from Winnebago’s Chris-Craft brand. Post the deal’s completion, Barletta will operate as a distinct business unit within Winnebago.

3. General Motors announced plans of rolling out a new all-electric GMC pickup. This will be the U.S. auto giant’s third electric pickup after the GMC Hummer EV, scheduled to hit the market later in the ongoing year, and the mass-market Chevrolet Silverado e-truck, which is likely to go into production late next year. Meanwhile, the firm slashed truck production of most of its full-size pickup trucks in North America amid chip crunch. The Flint Assembly plant in Michigan will run for only one production shift during the week of Jul 26. Fort Wayne Assembly plant in Indiana and Silao Assembly plant in Mexico will cease operations for the entire week. All the three plants are expected to restart regular production starting the week of Aug 2. General Motors currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

4. Tesla recently inked a deal with BHP Group to secure the supply of nickel from the latter’s Nickel West mine based in Western Australia. Per the latest alliance, Tesla and BHP will also collaborate to make the battery supply chain more efficient as well as sustainable, with key focus on raw material procurement using blockchain and exchange of know-how for battery raw-material production. The agreement confirms that Tesla will become one of the biggest customers of BHP for sustainable and reliable supply of quality nickel that is crucial to the EV maker’s growth plans.

Price Performance

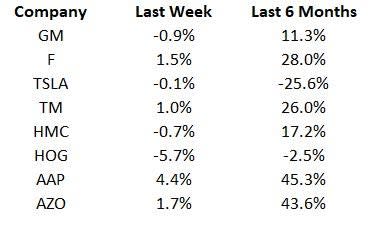

The following table shows the price movement of some of the major auto players over the past week and six-month period.

Image Source: Zacks Investment Research

In the past six months, all stocks have increased, apart from Tesla and Harley-Davidson. The past week displayed a mixed price performance, with Harley-Davidson losing the most and Advance Auto Parts registering maximum gains.

What’s Next in the Auto Space?

Stay tuned for quarterly releases of major auto companies including S&P 500 sector components like Tesla, PACCAR, Ford, O’Reilly and LKQ Corp, which are set to report this week.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

HarleyDavidson, Inc. (HOG) : Free Stock Analysis Report

AutoNation, Inc. (AN) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.