Merit Medical's (MMSI) New Launch to Boost its Product Suite

Merit Medical Systems, Inc. MMSI recently announced the expansion of its SwiftNINJA Steerable Microcatheter product line, which belongs to its delivery systems portfolio. The new sizes include a low-profile 2.4F distal diameter option in 125-cm and new longer 150-cm lengths.

The latest launch is expected to boost Merit Medical’s Vascular – Peripheral product line of the broader Peripheral Intervention business, a component of the Cardiovascular segment.

Significance of the Release

The 180-degree articulating microcatheter has been designed to provide access to challenging peripheral and coronary vasculature without the use of a guide wire. This is a notable addition to the company’s broader Merit Vascular portfolio that includes other products like sheath introducers, inflation devices, embolics and other procedural solutions.

Per an expert associated with Merit Medical, the tip shape and angle can be changed in real-time while inside a patient. This will likely enable shorter procedures with less radiation exposure. Also, without the need for a guide wire, there is the possibility for significant cost savings, thereby benefiting the patients. The SwiftNINJA is also expected to improve embolization care.

Per management, the SwiftNINJA (which is the only widely offered steerable microcatheter in the United States at present) is expected to provide the additional sizes that physicians require. This will likely enable the SwiftNINJA to be used with a range of devices in more procedures, diagnose and treat more complex cases.

Industry Prospects

Per a report by MarketsandMarkets, the global microcatheter market is anticipated to reach $1,082 million by 2027 from $828 million in 2022 at a CAGR of 5.5%. Factors like the rising prevalence of cardiovascular and neurovascular diseases, the increasing number of invasive diagnostic procedures and widespread unhealthy lifestyle choices are likely to drive the market.

Given the market potential, the latest launch is expected to provide a significant boost to Merit Medical’s business in the niche space.

Notable Developments

Last month, Merit Medical announced fourth-quarter 2022 results, where it saw a year-over-year uptick in the top and bottom lines. The company also registered revenue growth in its Cardiovascular segment and across the majority of its product categories within its Cardiovascular unit. Robust performances in the United States and outside were also recorded.

The same month, Merit Medical announced the FDA’s grant of Breakthrough Device Designation for the SCOUT MD Surgical Guidance System. This expands the company’s portfolio of products to optimize oncology for breast and other soft tissue cancers, which includes the SCOUT Radar Localization system with the new SCOUT Mini Reflector and SCOUT Bx Delivery System, and the SAVI Brachy System.

In December 2022, Merit Medical announced the successful enrollment of the first patient in its prospective, observational study of EmboCube Embolization Gelatin used to control bleeding or hemorrhage.

Price Performance

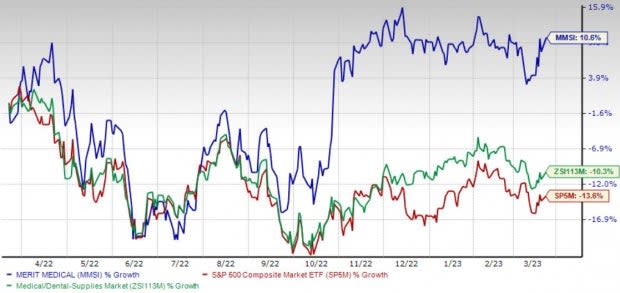

Merit Medical stock has gained 10.7% over the past year against the industry’s 10.2% decline and the S&P 500's 13.6% fall.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Merit Medical carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 2.8% against the industry’s 17.2% decline in the past year.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 10.9% compared with the industry’s 10.2% decline over the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 12.1% compared with the industry’s 17.2% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report