Q4 Earnings Roundup: TEGNA (NYSE:TGNA) And The Rest Of The Broadcasting Segment

As the Q4 earnings season wraps, let's dig into this quarter's best and worst performers in the broadcasting industry, including TEGNA (NYSE:TGNA) and its peers.

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

The 8 broadcasting stocks we track reported a weak Q4; on average, revenues missed analyst consensus estimates by 0.7%, while next quarter's revenue guidance was 4.9% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. The beginning of 2024 saw mixed inflation data, however, leading to more volatile stock performance, and broadcasting stocks have had a rough stretch, with share prices down 17.7% on average since the previous earnings results.

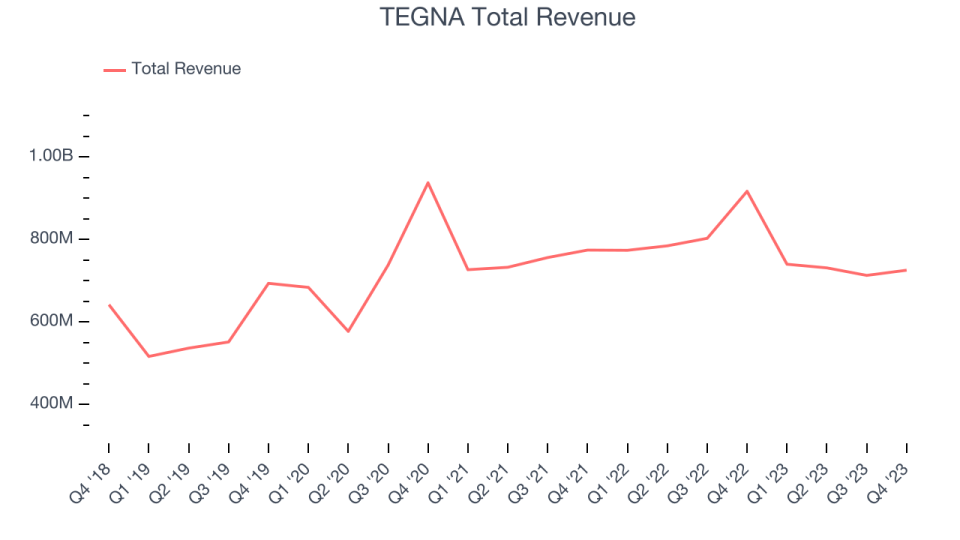

TEGNA (NYSE:TGNA)

Spun out of Gannett in 2015, TEGNA (NYSE:TGNA) is a media company operating a network of television stations and digital platforms, focusing on local news and community content.

TEGNA reported revenues of $725.9 million, down 20.9% year on year, falling short of analyst expectations by 3.3%. It was a weak quarter for the company, with a miss of analysts' earnings and revenue estimates.

“TEGNA is back on offense, operating from a position of strength. Our new capital allocation framework positions us well to execute our business strategy to drive shareholder value in a continually evolving media landscape,” said Dave Lougee, president and chief executive officer.

TEGNA delivered the weakest performance against analyst estimates of the whole group. The stock is down 2% since the results and currently trades at $13.26.

Read our full report on TEGNA here, it's free.

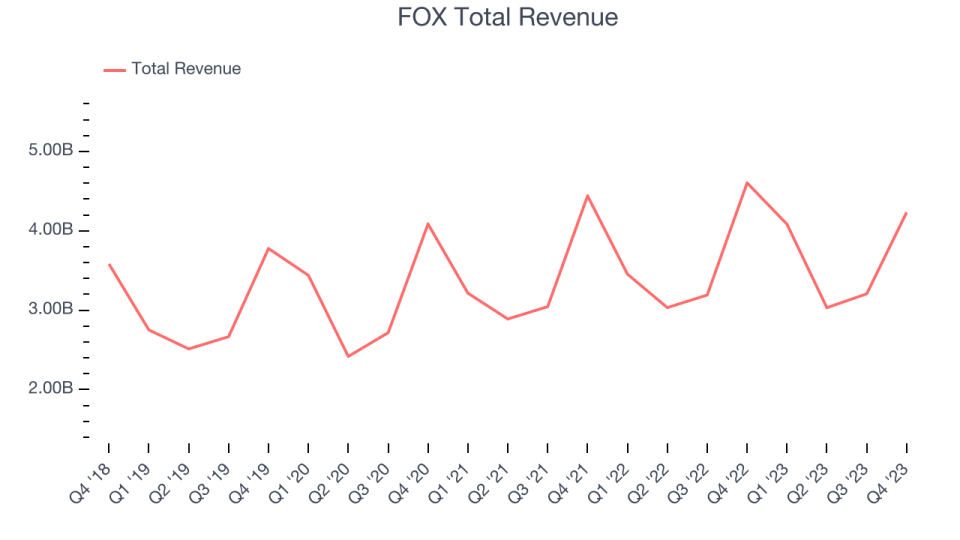

Best Q4: FOX (NASDAQ:FOXA)

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX reported revenues of $4.23 billion, down 8.1% year on year, in line with analyst expectations. It was a very strong quarter for the company, with an impressive beat of analysts' EBITDA and EPS estimates. Its revenue, although down year on year, also slightly beat thanks to better-than-expected affiliate (retransmission fee) and advertising revenue.

The stock is down 3.4% since the results and currently trades at $30.55.

Is now the time to buy FOX? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Sinclair (NASDAQ:SBGI)

Founded in 1971, Sinclair (NASDAQ:SBGI) is an American media company operating numerous television stations and providing multi-platform broadcasting services.

Sinclair reported revenues of $826 million, down 14% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates.

The stock is down 20.3% since the results and currently trades at $11.79.

Read our full analysis of Sinclair's results here.

Nexstar Media (NASDAQ:NXST)

Founded in 1996, Nexstar (NASDAQ:NXST) is an American media company operating numerous local television stations and digital media outlets across the country.

Nexstar Media reported revenues of $1.30 billion, down 12.3% year on year, falling short of analyst expectations by 0.8%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates. Adjusted EBITDA guidance for the full year was also below expectations.

The stock is down 2.2% since the results and currently trades at $158.87.

Read our full, actionable report on Nexstar Media here, it's free.

AMC Networks (NASDAQ:AMCX)

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

AMC Networks reported revenues of $678.8 million, down 29.6% year on year, in line with analyst expectations. It was a weak quarter for the company, with a miss of analysts' earnings estimates. A bright spot was that free cash flow came in better than expected. From a product perspective, the company pointed out that AMC+ (the streaming platform) launched "an ad-supported tier in the third quarter, with strong new sign-up activity on available platforms since launch."

AMC Networks had the slowest revenue growth among its peers. The stock is down 41.1% since the results and currently trades at $10.03.

Read our full, actionable report on AMC Networks here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.