Is ecotel communication ag (ETR:E4C) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that ecotel communication ag (ETR:E4C) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for ecotel communication ag

What Is ecotel communication ag's Debt?

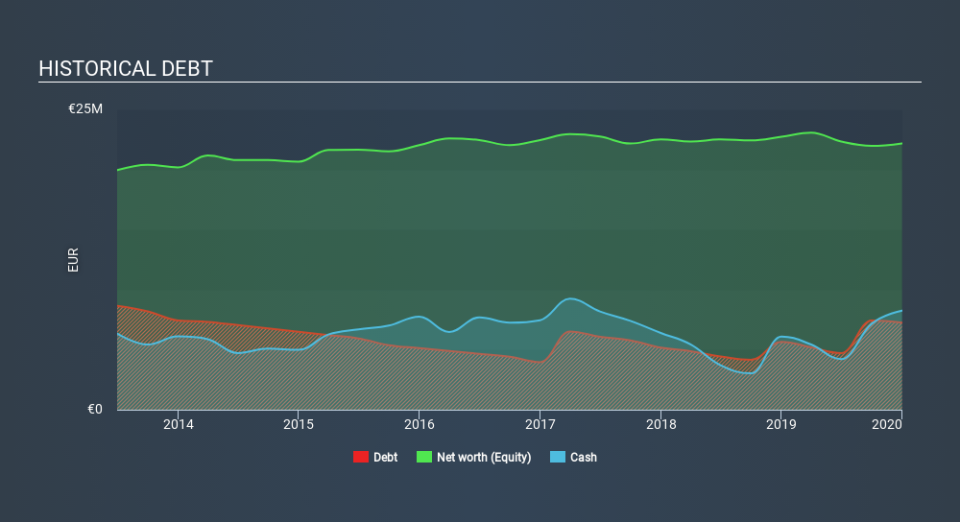

The image below, which you can click on for greater detail, shows that at December 2019 ecotel communication ag had debt of €7.25m, up from €5.66m in one year. But on the other hand it also has €8.25m in cash, leading to a €1.00m net cash position.

A Look At ecotel communication ag's Liabilities

According to the last reported balance sheet, ecotel communication ag had liabilities of €18.1m due within 12 months, and liabilities of €16.5m due beyond 12 months. Offsetting this, it had €8.25m in cash and €10.4m in receivables that were due within 12 months. So it has liabilities totalling €16.0m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of €24.0m, so it does suggest shareholders should keep an eye on ecotel communication ag's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, ecotel communication ag also has more cash than debt, so we're pretty confident it can manage its debt safely.

Importantly, ecotel communication ag's EBIT fell a jaw-dropping 31% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since ecotel communication ag will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While ecotel communication ag has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, ecotel communication ag recorded free cash flow worth 61% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

Although ecotel communication ag's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €1.00m. So while ecotel communication ag does not have a great balance sheet, it's certainly not too bad. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with ecotel communication ag (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.