Do init innovation in traffic systems' (ETR:IXX) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like init innovation in traffic systems (ETR:IXX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for init innovation in traffic systems

How Fast Is init innovation in traffic systems Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. init innovation in traffic systems managed to grow EPS by 5.2% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

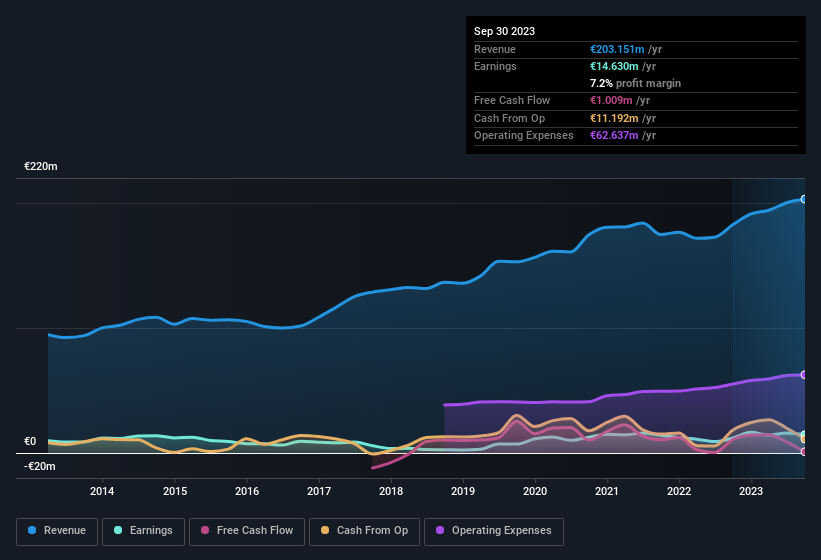

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. init innovation in traffic systems maintained stable EBIT margins over the last year, all while growing revenue 11% to €203m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for init innovation in traffic systems?

Are init innovation in traffic systems Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that init innovation in traffic systems insiders own a significant number of shares certainly is appealing. Actually, with 39% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. To give you an idea, the value of insiders' holdings in the business are valued at €114m at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add init innovation in traffic systems To Your Watchlist?

One important encouraging feature of init innovation in traffic systems is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We don't want to rain on the parade too much, but we did also find 1 warning sign for init innovation in traffic systems that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in DE with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.