Here's Why You Should Retain Allscripts (MDRX) Stock For Now

Allscripts Healthcare Solutions, Inc. MDRX is well-poised for growth in the coming quarters, backed by its strategic alliances over the past few months. A robust third-quarter 2021 performance, along with various innovation milestones, is expected to contribute further. However, concerns related to consolidation in the healthcare industry and integration risks persist.

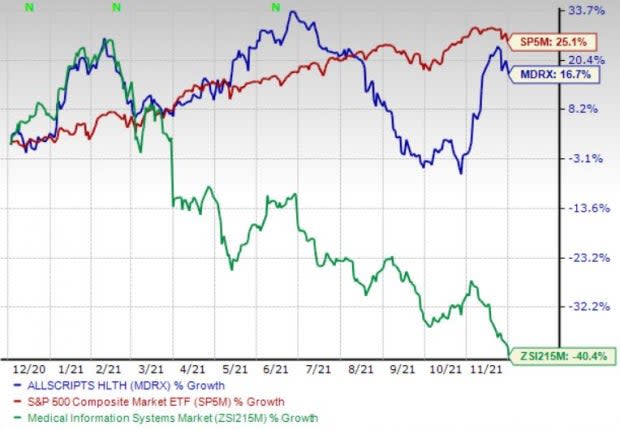

Over the past year, this Zacks Rank #3 (Hold) stock has surged 16.7% against 40.4% fall of the industry it belongs to. The S&P 500 composite rose 25.1% in the said time frame.

The renowned IT solutions and services provider has a market capitalization of $2.01 billion. The company projects 9.8% growth for the next five years and expects to maintain its strong performance. It has delivered an earnings surprise of 34.07% for the past four quarters, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Q3 Results: Allscripts’ solid third-quarter 2021 earnings buoy our optimism. The year-over-year uptick in the top and the bottom lines, along with a surge in total bookings during the reported quarter, is impressive. Revenues from both the segments also rose during the quarter, which is encouraging. Management is also upbeat about its strong domestic and global pipelines for health systems, which further buoy our optimism on the stock. Expansion of both margins is another positive.

Strategic Alliances: We are optimistic about Allscripts’ partnerships over the past few months. The company, during its third-quarter earnings call in November, confirmed that Lompoc Valley Medical Center, California signed a 10-year agreement for Sunrise Community Care deployed on Microsoft Azure. In Iowa, Shenandoah Medical Center also signed a 10-year agreement for Sunrise Community Care.

Innovation: Allscripts’ portfolio consists of various innovation milestones achieved over the past few months, which raise our optimism. The company, in October, announced the launch of Guided Scheduling, the latest addition to its automation features in Allscripts Practice Management. Allscripts Guided Scheduling, launching in Allscripts Practice Management, is an artificial intelligence scheduling application that utilizes real-time provider, practice and industry data to improve providers’ days.

Downsides

Consolidation in the Healthcare Industry: Many healthcare providers are consolidating to create integrated healthcare delivery systems with greater market power. As provider networks and managed care organizations consolidate, this decreases the number of market participants. Thus, competition to provide products and services like Allscripts will intensify, and the importance of establishing and maintaining relationships with key industry participants will increase. These industry participants may try to use their market power to negotiate price reductions for Allscripts’ products and services.

Integration Risks: Allscripts’ continued reliance on mergers and acquisition activities presents a substantial integration risk for the company. It needs to develop operational synergies from these expansion activities so that they do not turn out to be a waste of resources. The integration of foreign acquisitions presents additional challenges associated with integrating operations across different cultures and languages, as well as currency and regulatory risks associated with specific countries.

Estimate Trend

Allscripts is witnessing a positive estimate revision trend for 2021. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 13.9% north to 90 cents.

The Zacks Consensus Estimate for the company’s fourth-quarter 2021 revenues is pegged at $386.9 million, suggesting a 6.7% fall from the year-ago quarter’s reported number.

Key Picks

A few better-ranked stocks in the broader medical space are AmerisourceBergen Corporation ABC, Thermo Fisher Scientific Inc. TMO and AMN Healthcare Services AMN.

AmerisourceBergen, carrying a Zacks Rank #2 (Buy), reported fourth-quarter fiscal 2021 adjusted earnings per share (EPS) of $2.39, which beat the Zacks Consensus Estimate by 1.3%. Revenues of $58.91 billion outpaced the consensus mark by 3.9%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AmerisourceBergen has an estimated long-term growth rate of 11.3%. The company surpassed estimates in the trailing four quarters, the average surprise being 5.48%.

Thermo Fisher reported third-quarter 2021 adjusted EPS of $5.76, which surpassed the Zacks Consensus Estimate by 23.3%. Third-quarter revenues of $9.33 billion outpaced the Zacks Consensus Estimate by 12%. It currently carries a Zacks Rank #2.

Thermo Fisher has an estimated long-term growth rate of 14%. The company surpassed estimates in the trailing four quarters, the average surprise being 9.02%.

AMN Healthcare reported third-quarter 2021 adjusted EPS of $1.73, which surpassed the Zacks Consensus Estimate by 29.1%. Third-quarter revenues of $877.8 million outpaced the Zacks Consensus Estimate by 12.3%. It currently sports a Zacks Rank #1.

AMN Healthcare has an estimated long-term growth rate of 16.2%. The company surpassed estimates in the trailing four quarters, the average surprise being 19.51%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research