BD's (BDX) Latest Combination Test Receives the FDA's EUA

Becton, Dickinson and Company BDX, popularly known as BD, recently received the FDA’s Emergency Use Authorization (EUA) for a new molecular diagnostic combination test for SARS-CoV-2, Influenza A + B and Respiratory Syncytial Virus (RSV) — BD Respiratory Viral Panel assay for BD MAX System. The test, for use on the BD MAX Molecular Diagnostic System, is expected to aid in combatting illness in the current and future respiratory virus seasons.

The BD Respiratory Viral Panel assay for BD MAX System was CE marked in May 2022. The product, which has not been cleared or approved by the FDA yet, has been authorized for emergency use by the FDA under EUA for use by authorized laboratories. Also, the product has been authorized only for the detection and differentiation of nucleic acid of SARS-CoV-2, influenza A, influenza B and RSV and not for any other viruses or pathogens.

The latest regulatory approval is expected to solidify BD’s foothold in the global Molecular Diagnostics business, thereby boosting its overall Life Sciences segment.

Significance of the Launch

The BD Respiratory Viral Panel assay for BD MAX System uses a single nasal swab or a single nasopharyngeal swab sample to identify and distinguish if a patient has COVID-19, the flu, RSV or some combination of the three. The results are likely to be available within a few hours.

The test is expected to help eliminate the need for multiple tests or doctor visits and enable clinicians to implement the right treatment plan quickly. The co-testing approach is also likely to help in increasing testing capacity during the busy flu/RSV season and accelerate the time to diagnosis.

Per management, although the possibility of a tripledemic in the current respiratory season has largely lessened, accurately differentiating influenza and RSV from COVID-19 and providing appropriate treatment remains a challenge for BD’s customers. Management believes that this diagnostic test would provide the ability to identify multiple pathogens using a single sample and quickly identify the causative virus or viruses and enable clinicians to administer appropriate treatment at the earliest in the course of infection.

Industry Prospects

Per a report by MarketsandMarkets, the global molecular diagnostics market is anticipated to reach $30.2 billion by 2027 from $23.2 billion in 2022 at a CAGR of 5.4%. Factors like the emergence of new viruses, technological advancements in molecular diagnostics and the growing awareness of early disease diagnosis are likely to drive the market.

Given the market potential, the latest regulatory clearance is expected to significantly strengthen BD’s business worldwide.

Recent Developments in the Life Sciences Arm

This month, BD announced a new instrument for single-cell multiomics analysis that will enable scientists to run high-throughput studies without compromising sample integrity. This is expected to potentially accelerate time to discovery across a wide range of disciplines, including immunology, genetic disease research and cancer and chronic disease research.

Also, this month, BD reported its first-quarter fiscal 2023 results, wherein it registered an improvement in the overall base revenues. BD Life Sciences segment saw the Integrated Diagnostic Solutions unit’s strong growth in the base business (driven by strong demand for BD’s respiratory testing portfolio, which was partly aided by the timing of dealer orders, strong BD Kiestra lab automation installations and leveraging its higher BD MAX installed base for molecular In Vitro Diagnostic assay growth) and strength in the Biosciences unit.

Last month, BD introduced a new robotic track system for the BD Kiestra microbiology laboratory solution — the BD Kiestra 3rd Generation Total Lab Automation System — that automates lab specimen processing. This is expected to aid in reducing manual labor and wait time for results.

Price Performance

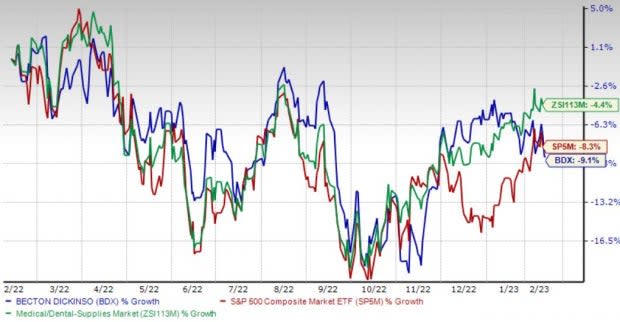

Shares of BD have lost 9.2% in the past year compared with the industry’s 4.5% decline and the S&P 500's 8.3% fall.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, BD carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health, Inc. CAH and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has lost 8.3% compared with the industry’s 22.9% decline in the past year.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.6%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 6.4%.

Cardinal Health has gained 48.9% against the industry’s 4.5% decline over the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 22.9% against the industry’s 4.5% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report