Is Now The Time To Put Reliance Worldwide (ASX:RWC) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Reliance Worldwide (ASX:RWC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Reliance Worldwide

Reliance Worldwide's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Reliance Worldwide's EPS has grown 25% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

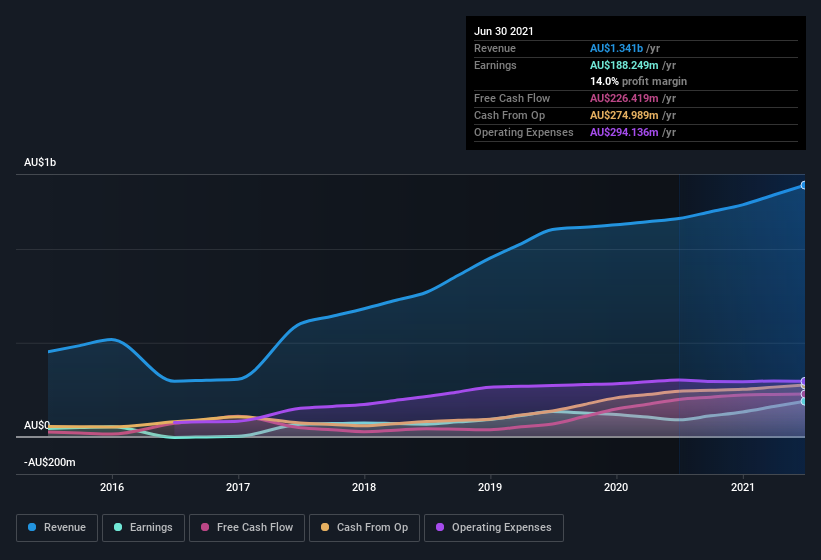

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Reliance Worldwide is growing revenues, and EBIT margins improved by 6.8 percentage points to 22%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Reliance Worldwide EPS 100% free.

Are Reliance Worldwide Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Reliance Worldwide insiders refrain from selling stock during the year, but they also spent AU$189k buying it. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Independent Non-Executive Director, Christine Bartlett, who made the biggest single acquisition, paying AU$58k for shares at about AU$5.84 each.

Should You Add Reliance Worldwide To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Reliance Worldwide's strong EPS growth. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Reliance Worldwide is a strong candidate for your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Reliance Worldwide. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Reliance Worldwide, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.