What Lies Ahead for Wolverine (WWW) This Earnings Season?

We expect Wolverine World Wide, Inc. WWW to report year-over-year increases in its both top and the bottom line when it releases second-quarter 2021 results on Jul 29 before market open. The Zacks Consensus Estimate for the quarterly earnings has been revised a penny upward in the past seven days to 47 cents, which suggests a significant improvement from 8 cents earned in the year-earlier quarter. The consensus estimate of $567 million for quarterly revenues suggests growth of nearly 62% from the prior-year quarter’s reported number.

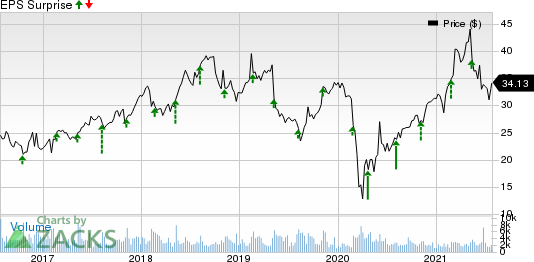

A glance at this Rockford, MI-based company’s performance in the trailing four quarters shows that it has an earnings surprise of 52.8%, on average.

Key Factors to Note

Last month, management stated that second-quarter 2021 revenues are likely to surpass the 2019 actuals. We note that it generated revenues worth $568.6 million during the same quarter of 2019. Management cited that the company’s performance improved in the second quarter on progress in its largest brands and product innovation.

Per the company, it is continuously experiencing momentum and stronger-than-expected trends across roughly all its brands with Merrell, Saucony and Sperry leading the way. Also, order book was impressive since the end of the previous quarter with solid gains in the company’s international business.

Wolverine has been gaining from its enhanced digital capabilities, a diversified global business model and brand strength for a while now. The company is leveraging its digital capabilities to expedite information and product flow apart from strengthening the distribution centers to boost growth in the digital arena. Its direct-to-consumer channels and Global Growth Agenda initiative are also displaying continued progress. Such strengths are most likely to aid the company’s results in the quarter under review.

What Our Zacks Model Says

Our proven model predicts an earnings beat for Wolverine this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Wolverine World Wide, Inc. Price and EPS Surprise

Wolverine World Wide, Inc. price-eps-surprise | Wolverine World Wide, Inc. Quote

Wolverine currently has a Zacks Rank #2 and an Earnings ESP of +3.38%.

More Stocks With Favorable Combinations

Here are a few other companies worth considering from the same space as our model shows that these too have the right combination of elements to beat on earnings this season:

PVH Corp. PVH has an Earnings ESP of +1.29% and a Zacks Rank of 1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Deckers DECK has an Earnings ESP of +41.18% and a Zacks Rank #2, currently.

Steven Madden SHOO has an Earnings ESP of +6.67% and a Zacks Rank of 2 at present.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Wolverine World Wide, Inc. (WWW) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

Steven Madden, Ltd. (SHOO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research