Duke Realty (DRE) Q2 FFO Beats Estimates, Revenues Miss

Duke Realty Corporation’s DRE second-quarter 2022 core funds from operations (FFO) per share of 48 cents surpassed the Zacks Consensus Estimate of 47 cents. Moreover, the figure increased 9.1% from the year-ago tally of 44 cents.

DRE reported rental and related revenues of $280.1 million, up 10.3% year over year. However, the figure missed the Zacks Consensus Estimate of $283.6 million. This industrial REIT registered same-property net operating income (“NOI”) year-over-year growth on a cash basis of 5.9%.

The second quarter has been notable, with Prologis PLD announcing a definitive merger agreement in June to acquire Duke Realty in an all-stock transaction valued at $26 billion, including the assumption of debt. The transaction for Duke Realty’s purchase is expected to be complete in the fourth quarter of 2022, subject to the approval of the shareholders of both the companies and other customary closing conditions.

Considering the company’s proposed merger with Prologis, DRE will neither offer guidance nor affirm past guidance.

Quarter in Detail

Per Duke Realty’s earlier announced non-financial operating results for the second quarter of 2022, it leased 9.9 million square feet of space during the period. Tenant retention was 78.1% in the reported quarter, while effective retention, including immediate backfills, was 98.9%.

As of Jun 30, 2022, DRE’s stabilized portfolio was 99.7% leased, improving 30 basis points (bps) from the previous quarter’s end level and 150 bps from the prior-year quarter’s reading.

As of the same date, the company’s total portfolio, including developments under construction, was 95.7% leased compared with 95.8% at the prior quarter-end and 94.6% at the end of the year-ago quarter.

Duke Realty reported net effective rental rate growth of 69% in the quarter, and on a cash basis, the rental rate growth was 57.1%.

Duke Realty’s second-quarter capital transactions amounted to $412 million for development starts (expected costs), $56 million in building acquisitions and $34 million in building dispositions.

The company exited the second quarter of 2022 with $44.2 million of cash and cash equivalents, down from $69.8 million as of Dec 31, 2021.

Currently, DRE carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

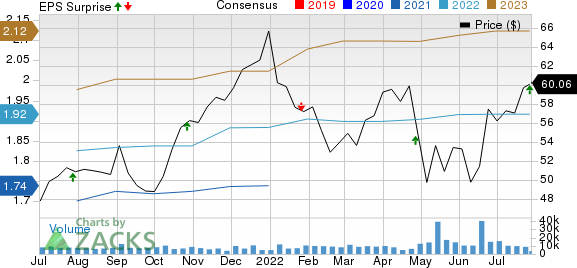

Duke Realty Corporation Price, Consensus and EPS Surprise

Duke Realty Corporation price-consensus-eps-surprise-chart | Duke Realty Corporation Quote

Stocks That Warrant a Look

Here are some stocks from the REIT sector — Public Storage PSA and SBA Communications Corporation SBAC — that you may want to consider as our model shows that these have the right combination of elements to report a surprise this quarter, i.e, a positive Earnings ESP and a Zacks Rank #1, 2 (Buy) or 3 (Hold).

Public Storage, slated to release quarterly numbers on Aug 4, has an Earnings ESP of +0.31% and carries a Zacks Rank of 3 at present.

SBA Communications Corporation, scheduled to report quarterly numbers on Aug 1, currently has an Earnings ESP of +0.95% and carries a Zacks Rank of 3.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Duke Realty Corporation (DRE) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research