3 Waste Removal Services Stocks to Watch Amid Industry Challenges

The Zacks Waste Removal Services industry stands to benefit from the gradual resumption of business activities and reopening of the economy, which have led to increased waste production from industrial and commercial sectors. Government initiatives for sustainable waste management, increasing environmental awareness, rising population, rapid industrialization and urbanization, and growing adoption of advanced waste collection solutions are the other positives.

Waste Management, Inc. WM, Republic Services, Inc. RSG and Clean Harbors, Inc. CLH are some stocks likely to gain from the abovementioned factors.

Industry Description

The Zacks Waste Removal Services industry comprises companies engaged in the collection, transportation, treatment, disposal, inspection and regulation of any form of waste. The companies serve residential, municipal, commercial and industrial customers in the United States and internationally. Some industry participants provide non-hazardous solid waste collection, transfer, recycling, disposal, and energy services for small-container, large-container, municipal and residential, and energy services customers in the United States and Puerto Rico, while others provide waste management environmental services to residential, commercial, industrial, and municipal customers in North America. Some industry players operate as environmental infrastructure and solutions companies, providing water handling and recycling solutions.

What's Shaping the Future of the Waste Removal Services Industry?

A Healthy Demand Environment: The industry is mature, with growth coming from volume and price increases. Income has grown steadily over the past few years, enabling most industry players to pursue acquisitions and other investments.

Reopening of Economic Activities Bodes Well: With the reopening of the economy and the resumption of business activities, waste generation is bound to increase, especially in the industrial and commercial sectors. The proper disposal of medical waste will always remain an utmost priority to curb the spread of infection. Increase in population, industrialization and urbanization should remain the key drivers of the industry as it leads to a significant rise in garbage and recycling. Also, the use of advanced collection and recycling solutions are expected to pick up pace. This should enhance business opportunities for waste management companies.

Government initiatives as well as stringent rules and regulations to advance sustainable waste management mechanisms and put a check on illegal dumping are also expected to boost the industry.

High Operating Costs a Woe: Waste management is a time-consuming and complex process. It requires higher capital and operating costs to manage waste collection vehicles, bins, and processing equipment along with a huge number of workers. Such high operational expenses are likely to keep the bottom line of the companies in this industrial cohort under pressure.

Zacks Industry Rank Indicates Gloomy Prospects

The Zacks Waste Removal Services industry, which is housed within the broader Zacks Business Services sector, currently carries a Zacks Industry Rank #189. This rank places it in the bottom 25% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Despite the cloudy prospects, we present a few stocks that investors can buy or retain given their sturdy potential. But before that let’s take a look at the industry’s recent stock market performance and its current valuation.

Industry's Performance

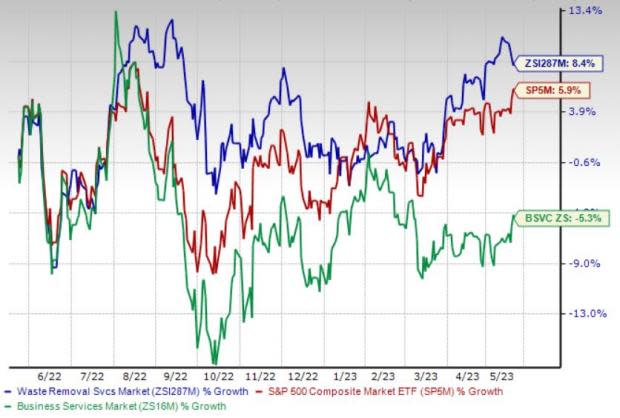

The Zacks Waste Removal Services industry has outperformed the broader Zacks Business Services sector and the Zacks S&P 500 composite over the past year.

The industry has gained 8.4% over this period against 5.3% decline of the broader sector. The Zacks S&P 500 composite has risen 5.9% in the said time frame.

One-Year Price Performance

Industry's Current Valuation

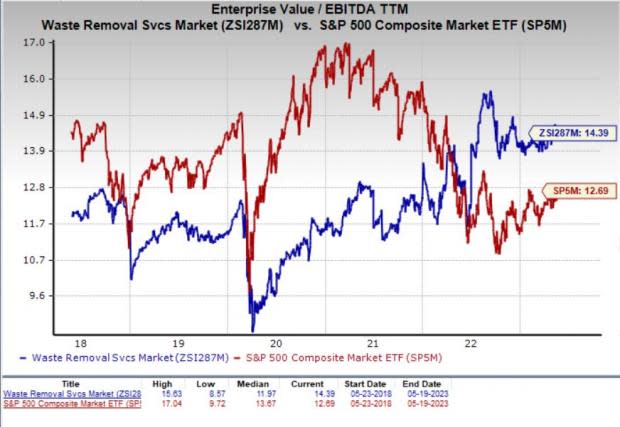

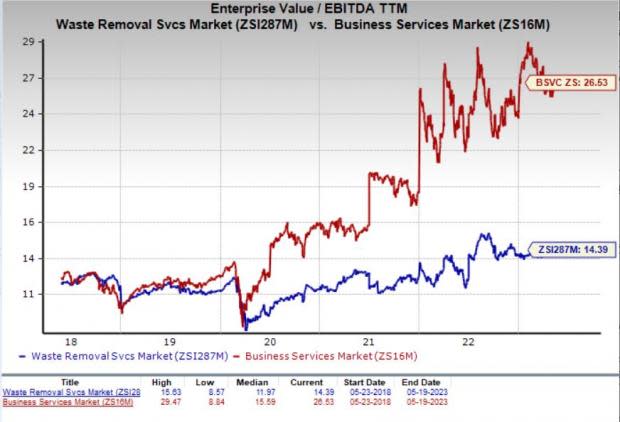

On the basis of EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation and amortization), which is commonly used for valuing waste removal services stocks because of their high debt levels, the industry is currently trading at 14.39X compared with the S&P 500’s 12.69X and the sector’s 26.53X.

Over the past five years, the industry has traded as high as 15.63X, as low as 8.57X and at the median of 11.97X, as the charts below show.

EV/EBITDA Ratio

3 Waste Removal Services Stocks to Keep a Close Eye On

We are presenting three stocks that carry a Zacks Rank #3 (Hold) and are well-positioned to grow in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Waste Management: Waste Management provides environmental solutions to residential, commercial, industrial, and municipal customers in the United States and Canada. WM’s top line has been benefiting from acquisition revenues and growth from yield. WM’s revenue growth for 2023 is expected to be between 4% and 5.5%, which includes organic revenue growth of nearly 5.5% from the collection and disposal business.

The Zacks Consensus Estimate for WM’s 2023 EPS has improved 0.5% in the past 90 days. WM stock has gained 5.4% so far this year.

Price & Consensus: WM

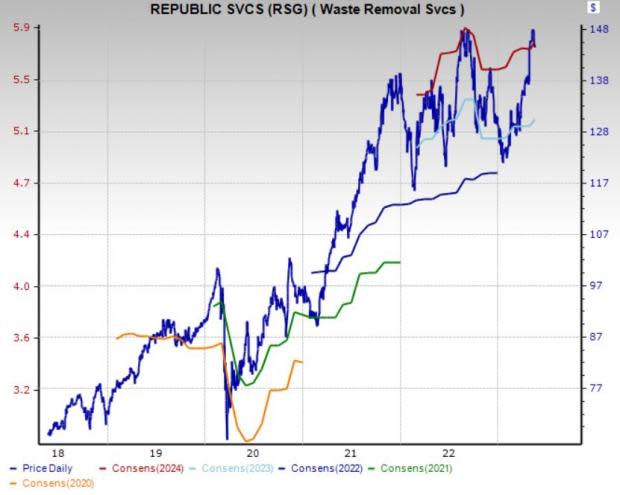

Republic Services: Republic Services offers environmental services in the United States. The positive impact of acquisitions and internal growth has been aiding RSG’s top-line growth. RSG is focused on increasing its operational efficiency by shifting to compressed natural gas collection vehicles and converting rear-loading trucks to automated-side loaders to reduce costs and improve profitability.

The Zacks Consensus Estimate for RSG’s 2023 EPS has improved 1.6% in the past 90 days. RSG stock has gained 12.5% so far this year.

Price & Consensus: RSG

Clean Harbors: This Massachusetts-based company provides environmental and industrial services in the United States and internationally. Clean Harbors focuses on improving its efficiency and lowering operating costs through enhanced technology, process efficiencies and stringent cost management. It continues to make capital investments to enhance its service quality and comply with government and local regulations. Buyouts help the company expand its business across multiple lines of services. Consistency in rewarding shareholders through share buybacks boosts investor confidence and positively impacts earnings per share.For 2023, adjusted EBITDA is anticipated between $1.02 billion and $1.06 billion, up from the previous range of $1.01 billion and $1.05 billion. The rise reflects the company’s acquisition of Thompson Industrial Services.

The Zacks Consensus Estimate for CLH’s 2023 EPS has moved up 2.1% in the past 90 days. CLH stock has gained 21.5% so far this year.

Price & Consensus: CLH

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report