CVS Health's (CVS) New Acquisitions Aid, Cost Woes Linger

CVS Health's CVS expanding pharmacy arm along with significant growth observed in the retail business is encouraging. Yet, rising pressure to reduce reimbursement rates for generic drugs dents growth. The stock carries a Zacks Rank #3 (Hold).

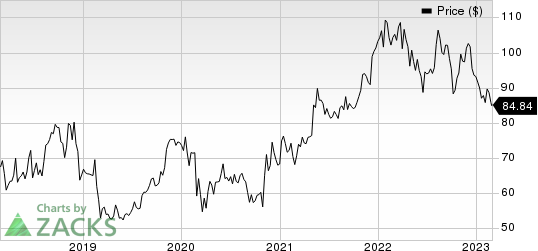

Over the past year, CVS Health outperformed its industry. The stock has lost 14.3% compared with a 19.4% decline of the industry.

CVS Health exited the fourth quarter of 2022 on a strong note, with earnings and revenues beating the respective Zacks Consensus Estimate. Robust sales growth across all three operating segments drove the top-line results. Within the Health Care Benefits arm, the continued growth across the entire range of insured and self-insured medical, pharmacy, dental and behavioral health products and services instills optimism.

CVS Health Corporation Price

CVS Health Corporation price | CVS Health Corporation Quote

Meanwhile, the company’s parallel announcement of entering into a colossal $10.6-billion acquisition agreement to purchase Oak Street Health is an added positive. Oak Street Health is a network of value-based primary care centers for adults on Medicare. The acquisition is expected to further advance CVS Health’s care delivery strategy for consumers.

During the fourth quarter, CVS Health increased unique digital customers by seven million to over 47 million, reached eight million active users on CVS Health’s individualized Health Dashboard and interacted with nearly five million customers daily across the community footprint. The company also launched a new functionality that gives patients more choices and convenience for filling prescriptions.

Following the acquisition of health insurance giant Aetna for a colossal sum of $70 billion, CVS Health introduced its Health Care Benefits business arm. This segment has been exhibiting continued strong momentum for the past few quarters. In the fourthquarter, the business delivered strong revenue growth of 11.3% year over year, banking on growth across all product lines.

During the reported quarter, Medical membershipincreased by 109,000 members, reflecting increases across all product lines.The segment witnessed favorable development of prior-periods’ healthcare cost estimates in its Government Services and Commercial businesses during the fourth quarter.

On the flip side, during fourth-quarter 2022, gross margin contracted 135 basis points (bps) to 16.5% on an 11.2% uptick in total cost (including Benefit Costs). The contraction of margins on escalating costs does not bode well. The decline in COVID-19 vaccinations and testing sales is a downside. Further, persistent pharmacy reimbursement headwinds also continued to impact business performance in the quarter under review.

Further, the reimbursement pressure in the Pharmacy Services segment is projected to be exacerbated by the cumulative effect on rebate guarantees of the lower brand name drug price inflation and a modest selling season. The company is making continued efforts to combat this reimbursement pressure by increasing volume and reducing costs.

Mounting costs and expenses are putting pressure on margins as well. Total cost (including Benefit Costs) rose 11.2%. The gross margin contracted 135 basis points (bps) to 16.5%.

The adjusted operating margin in the quarter under review contracted 24 bps to 4.4%, despite a 3.9% rise in adjusted operating profit.

Key Picks

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health, Inc. CAH and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has gained 5.4% against the industry’s 19.6% decline in the past year.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.6%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 6.4%.

Cardinal Health has gained 48.7% against the industry’s 0.8% decline over the past year.

Merit Medical, flaunting a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 28.1% against the industry’s 0.8% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report