Medifast (MED) Worth Relishing on OPTAVIA Strength, Growth Plans

Medifast, Inc. MED appears to be in a robust shape, which has been largely gaining from the strength of its OPTAVIA lifestyle solution and coaching support system. Apart from this, the company’s focus on strategic growth initiatives, including capacity expansion and technological advancements, has been working well.

We note that OPTAVIA remained a key driver for the company’s second-quarter 2021 results, wherein earnings and sales grew year over year and beat the Zacks Consensus Estimate. The Zacks Rank #2 (Buy) company, on its second-quarter earnings call, said that it expects demand for the OPTAVIA-branded products to accelerate in the quarters ahead. Importantly, Medifast raised its guidance for 2021.

MEDIFAST INC Price, Consensus and EPS Surprise

MEDIFAST INC price-consensus-eps-surprise-chart | MEDIFAST INC Quote

Factors Shaping Medifast’s Growth Path

Given the evolving consumer interests in health and wellness, Medifast’s OPTAVIA lifestyle solution and coaching support system bodes well. In the second quarter, OPTAVIA-branded products contributed 94.1% of the consumable units sold, up from the preceding quarter’s 88.9% and the year-ago quarter’s 83%. The total active earning OPTAVIA Coaches jumped 62.2% to 59,200. The average revenue per active earning OPTAVIA coach increased 13.9% to $6,662, up from the year-ago quarter’s $5,851. Certainly, the relevance of the company’s offerings amid an environment where consumers are choosing health and wellness options has been an upside. Medifast’s constant focus on developing tools and programs to increase the efficiency of coaches has been yielding results.

OPTAVIA follows a holistic approach by focusing on the six key areas of a human being, namely weight, eating and hydration, motion, sleep, mind and surroundings. OPTAVIA combines scientifically-proven programs, effective products as well as guidance from its coaches to help consumers lead a healthier lifestyle. The OPTAVIA product line is sold through its community of independent coaches, who offer support and guidance to their clients. Notably, Medifast’s second-quarter 2021 performance can be attributed to exceptional growth at its independent OPTAVIA Coaches, which reached new highs as well as efforts to improve the productivity of these Coaches.

Moving on, the company has been speeding up its long-term supply-chain efforts to ensure that it is able to manage its anticipated growth in the next few years. To this end, Medifast is focused on optimizing and increasing capacity by strengthening its network of co-manufacturers. This helped the company achieve its manufacturing capacity target of $2 billion ahead of plan in the second quarter of 2021. The company is also expanding its distribution network via expansions in existing facilities along with building on the current 3PL relationships and alliances to set up a distribution system, which is in line with its manufacturing capacity.

Medifast is focused on making technological investments, as part of which it opened a new technology center in Utah in the beginning of 2020. We note that OPTAVIA Coaches have been focused on utilizing technology, including the company’s own app-based platforms along with social media channels and field-led training platforms. Incidentally, the company announced the launch of the OPTAVIA app, which is likely to enhance Clients’ experience with Lean & Green recipes along with an access to past order record; auto-ship details and account information among other things. Apart from this, Medifast’s Connect App has been working well for Coaches on the go. The company’s constant investments in digital tools as well as in its new, fully integrated mobile apps are likely to enhance the connection between clients and coaches.

Image Source: Zacks Investment Research

A Look at Q2 & Ahead

The company posted earnings of $3.96 per share in the second quarter, which crushed the Zacks Consensus Estimate of $3.30 and surged a whopping 112.9% on a year-over-year basis. Net revenues of $394.2 million soared 79.2% year over year and beat the Zacks Consensus Estimate of $366 million. We note that consumers’ increased inclination toward health, together with a solid OPTAVIA coach-based model, has been helping Medifast draw new clients.

Medifast remains committed to making further investments to improve its infrastructure in order to aid growth. Management now anticipates revenues of $1.425-$1.525 billion for 2021. The full-year earnings per share are envisioned to be $12.70-$14.17. The company earlier anticipated revenues to come in the range of $1.4-$1.475 billion. The full-year earnings per share were envisioned to be $12.69-$14.14. In full-year 2020, revenues and earnings per share came in at $934.8 million and $9.14, respectively.

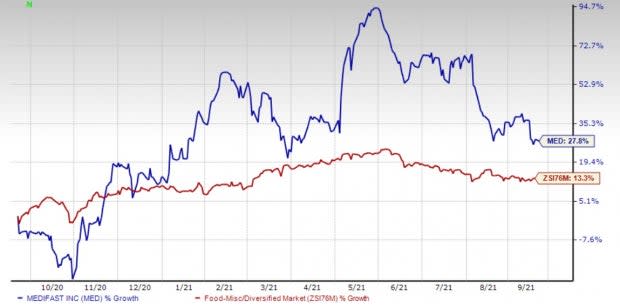

Shares of this manufacturer and distributor of weight loss, weight management, healthy living products, and other consumable health and nutritional products have rallied 27.8% in the past year, outpacing the industry’s rise of 13.3%.

3 Other Tempting Food Stocks

The Zacks #1 (Strong Buy) Ranked J&J Snack Foods’ JJSF bottom line has outpaced the Zacks Consensus Estimate by a wide margin in the preceding four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Darling Ingredients DAR, also currently sporting a Zacks Rank #1, has a trailing four-quarter earnings surprise of 39.1%, on average.

Sysco Corporation SYY, carrying a Zacks Rank #2, has a trailing four-quarter earnings surprise of 13.3%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Darling Ingredients Inc. (DAR) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research