Investors Who Bought Endava (NYSE:DAVA) Shares A Year Ago Are Now Up 139%

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the Endava plc (NYSE:DAVA) share price had more than doubled in just one year - up 139%. Also pleasing for shareholders was the 34% gain in the last three months. Endava hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Endava

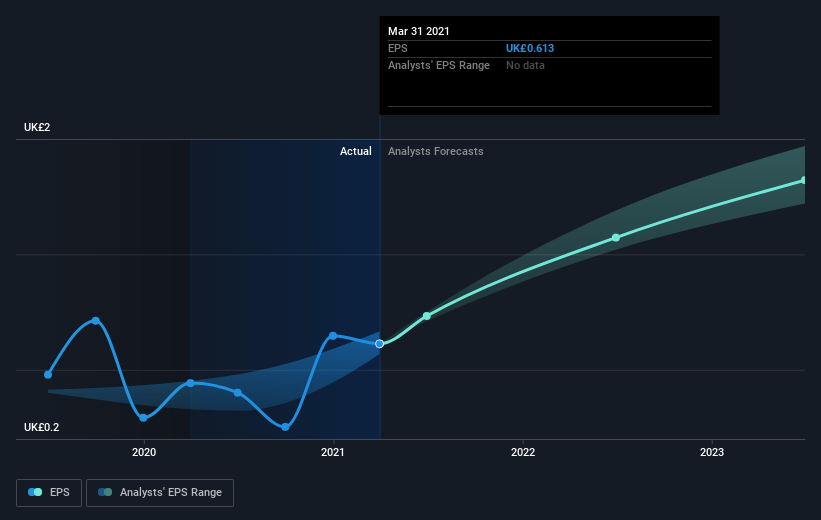

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Endava was able to grow EPS by 38% in the last twelve months. The share price gain of 139% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 134.02 also points to this optimism.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Endava's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Endava shareholders should be happy with the total gain of 139% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 34% in that time. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Endava you should know about.

But note: Endava may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.