Church & Dwight (CHD) Cuts View Despite Q2 Earnings & Sales Beat

Church & Dwight Co., Inc. CHD reported a solid second-quarter 2021 performance, as both top and bottom lines increased year over year and surpassed the Zacks Consensus Estimate. Results continued to gain from strong demand for the company’s products amid the pandemic. However, supply-chain hurdles, and input and transportation cost inflation caused management to lower its guidance for 2021. That said, the company’s pricing actions are likely to offer some respite.

Quarter in Detail

Church & Dwight posted adjusted earnings of 76 cents per share that topped the Zacks Consensus Estimate of 70 cents, while it declined 1.3% from the year-ago quarter level.

Church & Dwight Co., Inc. Price, Consensus and EPS Surprise

Church & Dwight Co., Inc. price-consensus-eps-surprise-chart | Church & Dwight Co., Inc. Quote

Net sales of $1,271.1 million advanced 6.4% year over year and surpassed the Zacks Consensus Estimate of $1,255 million. Results were backed by continued increase in pandemic-led demand for a number of the company’s products. Global online sales increased 7.2% and formed 14.2% of quarterly sales. Organic sales rose 4.5%, fueled by volume gains.

Church & Dwight continued to witness robust consumption in the quarter. The company saw consumption gains in 13 out of 16 domestic categories, such as gummy vitamins, dry shampoo, water flossers and cat litter. The company’s personal care category is gaining on higher consumer mobility. The company’s international business saw a broad-based organic sales improvement despite a number of countries undergoing lockdowns.

Gross margin declined 340 basis points (bps) to 43.4% due to elevated distribution costs and increased manufacturing costs, largely owing to commodities and elevated tariffs. This was partly offset by productivity and improved price and volumes.

Marketing expenses fell 4.3% to $117 million. As a percentage of sales, it fell 100 bps to 9.2%. Adjusted SG&A expenses, as a percentage of sales, contracted 140 bps, thanks to reduced litigation costs and incentive compensation.

Image Source: Zacks Investment Research

Segment Details

Consumer Domestic: Net sales in the segment rose 3.1% to $959.7 million owing to higher household and personal care sales, as well as gains from buyouts. Organic sales improved 2.8%, driven by volume growth and higher price and product mix. The upside was fueled by BATISTE dry shampoo, WATERPIK oral care products, TROJAN condoms, ARM & HAMMER clumping cat litter and NAIR hair removal products.

Consumer International: Net sales in the segment increased 21% to $226.8 million, mainly on the back of organic sales improvement of Global Markets Group and positive currency impacts. Even amid lockdowns, organic sales improved 10.4% on higher volumes, partly negated by unfavorable price and product mix. Organic sales gained from the strength in WATERPIK and ARM & HAMMER liquid laundry detergent in the Global Markets Group; GRAVOL nausea relief products and ARM & HAMMER litter in Canada; and WATERPIK, BATISTE and STERIMAR nasal spray in Europe.

Specialty Products: Sales in the segment advanced 11.8% to $84.6 million, mainly on the back of dairy product demand. Organic sales increased on better pricing and volumes. Meanwhile, milk prices have been stable in the U.S. dairy market.

Other Financial Updates

Church & Dwight ended the quarter with cash on hand of $149.8 million and total debt of $1,946.9 million. During the first six months of 2021, cash from operating activities was $344.3 million and the company incurred capital expenditures of $43.3 million.

Additionally, on Jul 28, the company announced a dividend of 25.25 cents per share, which is payable on Sep 1, 2021, to shareholders of record as of Aug 16. Notably, this marks the company’s 482nd straight regular dividend.

Cost Woes & Guidance

In the second quarter, Church & Dwight encountered shortage of several raw materials. Apart from this, the company is facing supply-related hurdles due to labor shortages and transportation hiccups. The company further stated that it pulled back on marketing in the second quarter for certain products, mainly household products, owing to a reduced case fill rate. Management expects escalated input and transportation costs for the rest of 2021. Its gross margin guidance reflects considerable material and component cost inflation.

That said, management expects supply headwinds to reduce as the company remains focused on undertaking growth efforts. Church & Dwight has been on track with its pricing efforts to counter commodity, labor and transportation cost hikes. Apart from these, the company remains optimistic about its category growth and solid brands.

Management lowered its sales outlook for 2021 due to supply-chain headwinds. It now expects reported sales growth of roughly 5% compared with a 5-6% rise anticipated earlier. Organic sales are now expected to rise nearly 4% compared with the 4-5% growth projected earlier. Management now expects 2021 adjusted earnings per share growth to be at the lower end of its previously issued range of 6-8%.

Management now expects additional input costs of $125 million for 2021 compared with $90 million expected before. However, this is likely to be partly negated by reduced coupons and promotions, lower SG&A and the announced price hikes. However, full benefit from pricing actions will only be experienced in 2022. Gross margin in 2021 is expected to decrease 75 bps compared with the earlier view of being flat year over year. The company expects adjusted operating margin to expand 70 bps now compared with 80 bps anticipated before.

Q3 Outlook

For the third quarter of 2021, the company expects roughly a 3% increase in reported sales and organic sales are expected to rise nearly 1.5%, given the temporary supply constraints. Price hikes are likely to have an impact on gross margin growth. Adjusted earnings per share are expected to be 70 cents in the third quarter, in line with the year-ago quarter’s figure.

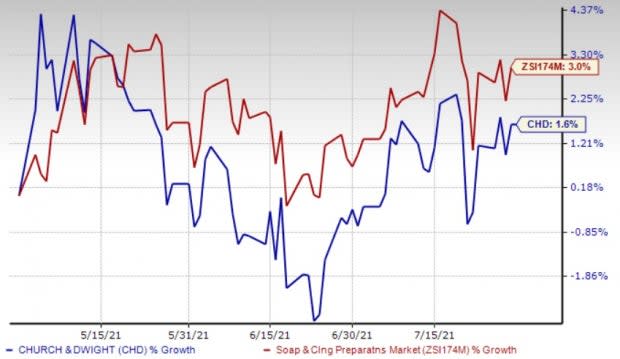

In the past three months, shares of this Zacks Rank #3 (Hold) company have gained 1.6% compared with the industry’s growth of 3%.

Check These Solid Consumer Staples Stocks

Darling Ingredients DAR, which currently carries a Zacks Rank #1 (Strong Buy), has a trailing four-quarter earnings surprise of 29.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The J.M. Smucker SJM has a Zacks Rank #2 (Buy) and its bottom line outpaced the Zacks Consensus Estimate by 17.8% in the trailing four quarters, on average.

Medifast MED has a Zacks Rank #2 and its bottom line outpaced the Zacks Consensus Estimate by 12.7% in the trailing four quarters, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Darling Ingredients Inc. (DAR) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research