Eni (E) in Negotiations to Buy Neptune Energy for up to $6B

Eni SpA E is in negotiations to acquire private-equity-backed oil and gas producer Neptune Energy for $5-$6 billion, per a Reuters report.

The transaction will be one of the largest oil and gas deals in recent years if it progresses. The companies are in the early stages of discussions. Notably, Neptune Energy could opt for alternative dealings, such as an initial public offering.

Neptune Energy primarily operates in the U.K. and Norway, where most of its hydrocarbon production comprises natural gas. Beside this, Neptune Energy operates in the Netherlands, Germany, Algeria, Egypt and Indonesia.

In 2021, Neptune Energy produced 130,000 net barrels of oil equivalent per day (Boe/d). About 75% of the company’s overall production is natural gas. At 2021 end, it had 2P reserves of 604 million barrels of oil equivalent. The company expects its 2022 post-tax operating cash flow to reach $2.5-$3 billion.

Neptune Energy expects near-term production growth, with projects expected to add 47,000 Boe/d of production. The company plans to raise production to more than 165,000 Boe/d in 2023. Neptune Energy intends to store more carbon than is emitted from its operations and the use of its products by 2030.

European oil majors have been more likely to divest oil and gas assets than to purchase them as they aimed to reduce carbon emissions and shift to renewables. For Eni, the acquisition will help expand its natural gas business, which is crucial to its growth strategy. The company aims to boost gas to be more than 90% of its hydrocarbon production by 2050, while reducing crude production and lowering the carbon footprint of its portfolio.

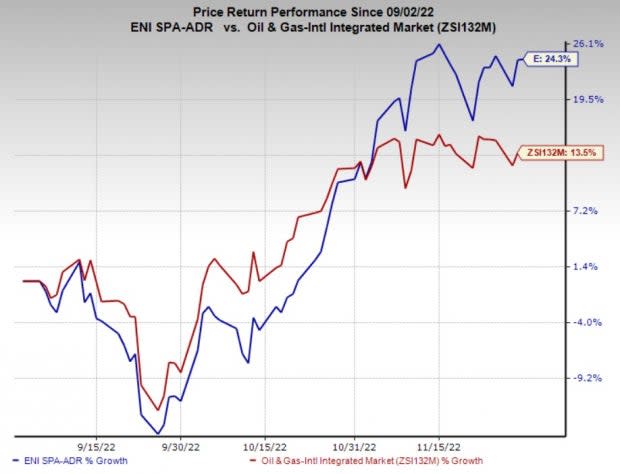

Price Performance

Shares of Eni have outperformed the industry in the past three months. The stock has gained 24.3% compared with the industry’s 13.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Eni currently carries a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Petrobras PBR is one of the largest publicly-traded Latin America oil companies, which dominates Brazil’s oil and gas sector. PBR’s third-quarter 2022 earnings per ADS of $1.35 beat the Zacks Consensus Estimate of $1.32.

Petrobras is expected to see an earnings surge of 135.3% in 2022. In further good news for investors, PBR plans to pay RMB 43.7 billion or $8.5 billion in total dividends in 2022.

Liberty Energy Inc. LBRT offers hydraulic fracturing services to onshore upstream energy companies across multiple basins in North America. LBRT’s third-quarter 2022 earnings per share of 78 cents beat the Zacks Consensus Estimate of 63 cents.

Liberty is expected to see an earnings surge of 298% in 2022. As of Sep 30, 2022, Liberty had $298 million of available liquidity, including $24 million of cash on hand and supported by the revolving credit facility. LBRT’s debt-to-capitalization stands at just 15.2% compared with most peers hugely burdened with debts.

MPLX LP MPLX is a master limited partnership that provides a wide range of midstream energy services, including fuel distribution solutions. MPLX’s third-quarter earnings of 96 cents per unit beat the Zacks Consensus Estimate of 81 cents.

MPLX is expected to see an earnings rise of 29.7% in 2022. MPLX’s distribution per unit was 77.5 cents for the third quarter, indicating a 10% hike from the prior distribution of 70.5 cents. The distribution will be paid out on Nov 22, 2022, to common unitholders of record as of Nov 15, 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

Eni SpA (E) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report