Credit Acceptance (CACC) Q2 Earnings Beat, Revenues Rise Y/Y

Credit Acceptance Corporation’s CACC second-quarter 2021 earnings of $17.18 per share comfortably outpaced the Zacks Consensus Estimate of $10.08. The bottom line reflects substantial improvement from $5.40 earned in the prior-year quarter. These figures include certain non-recurring items.

Results were primarily aided by an increase in revenues and provision benefit. Loan balance was stable during the quarter, while operating expenses declined.

Excluding non-recurring items, net income (non-GAAP basis) was $230.3 million or $13.71 per share, up from $154.1 million or $8.63 per share in the prior-year quarter.

GAAP Revenues Improve, Expenses Fall

Total revenues were $471.7 million, up 16.1% year over year. The increase was driven by a rise in finance charges and premiums earned. The top line beat the Zacks Consensus Estimate of $456.6 million.

Provision for credit losses was a benefit of $30.5 million against a provision of $139.4 million in the year-ago quarter.

Operating expenses of $70.2 million declined 14%. Lower salaries and wages, and sales and marketing costs led to the fall.

As of Jun 30, 2021, net loans receivable amounted to $6.8 billion, relatively stable with the December-2020 level. Total assets were $7.8 billion as of the same date, up from $7.5 billion as of Dec 31, 2020. Total stockholders’ equity was $2.4 billion, up 3.9% from December 2020 end.

Share Repurchase Update

During the quarter, Credit Acceptance repurchased 0.6 million shares.

Our Take

Credit Acceptance remains well-poised for revenue growth, given the gradual increase in the demand for consumer loans. However, elevated expenses pose a major headwind.

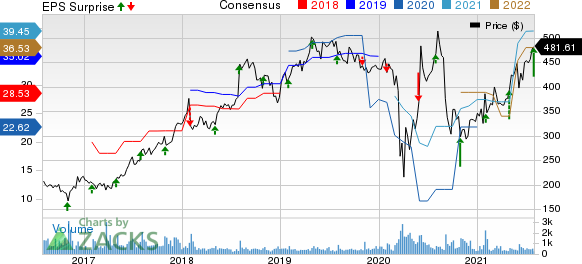

Credit Acceptance Corporation Price, Consensus and EPS Surprise

Credit Acceptance Corporation price-consensus-eps-surprise-chart | Credit Acceptance Corporation Quote

Currently, Credit Acceptance sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Consumer Loan Providers

Ally Financial’s ALLY second-quarter 2021 adjusted earnings of $2.33 per share surpassed the Zacks Consensus Estimate of $1.55. The bottom line showed significant improvement from 61 cents recorded a year ago.

Sallie Mae SLM reported second-quarter 2021 core earnings per share of 45 cents, which handily surpassed the Zacks Consensus Estimate of 39 cents. The bottom line reflected substantial improvement from a loss of 22 cents incurred in the prior-year quarter.

Navient Corporation NAVI reported second-quarter 2021 core earnings per share of 94 cents, surpassing the Zacks Consensus Estimate of 85 cents. Also, the bottom line came in higher than the year-ago quarter figure of 92 cents.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

Credit Acceptance Corporation (CACC) : Free Stock Analysis Report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research