TEVA Q2 Earnings Beat Estimates, Revenues Miss, Stock Up

Teva Pharmaceutical Industries Limited TEVA reported second-quarter 2021 earnings of 59 cents per share, which beat the Zacks Consensus Estimate of 57 cents. Earnings rose 7.3% year over year due to higher operating profit.

Revenues of this Israeli generic drugmaker came in at $3.91 billion, which missed the consensus estimate of $4.03 billion. Sales rose 1% on a reported basis but declined 2% in constant currency terms year over year due to lower revenues in the North America segment. Revenues were also affected by the impact of the COVID-19 pandemic.

Segment Discussion

Teva reports through the following segments based on three regions — North America (United States and Canada), Europe and International Markets.

North America segment sales were $1.94 billion, down 5% year over year due to lower sales of Anda and Copaxone, which offset higher sales of generic products, Austedo and Ajovy. The segment has seen lower demand for some products due to lower physician and hospital activity amid the pandemic. However, demand for some products in North America increased related to the treatment of COVID-19 symptoms.

In the United States, sales declined 6% to $1.82 billion.

Copaxone posted sales of $152 million in North America, down 36% year over year due to generic erosion.

Combined sales of Bendeka and Treanda rose 3% to $106 million as recovery from the pandemic led to improved sales of oncology products, which partially offset the competitive pressure. The launch of a competing bendamustine solution called Belrapzo by Eagle Pharmaceuticals EGRX in June 2019 has been hurting sales of Bendeka/Treanda.

ProAir sales declined 16% to $55 million. Austedo, approved to treat chorea associated with Huntington’s disease and tardive dyskinesia, recorded sales of $174 million in the quarter in North America, up 8% year over year due to volume growth.

Ajovy, Teva’s migraine treatment, recorded sales of $46 million in the quarter, up 32% year over year.

Generic products revenues rose 3% to $951 million in the North America segment driven by higher sales of Truxima (Teva’s biosimilar to Roche’s [RHHBY] Rituxan), generic version of Viatris’ VTRS EpiPen and ProAir authorized generic, which offset lower volume and pricing of other generic products.

Distribution revenues, generated by Anda, declined 16% in the quarter to $316 million due to lower demand for generic products for Anda’s customers.

The Europe segment recorded revenues of $1.18 billion, up 18% year over year. In constant currency terms, sales rose 8% mainly due to favorable comparison with the year-ago quarter, which was hurt due to reversal of stockpiling benefits and fewer patient visits to doctors due to the pandemic. Sales of generic and OTC products, Copaxone and Ajovy rose in the segment.

In the International Markets segment, sales declined 1% to $485 million. In constant currency terms, sales declined 3% due to lower sales in Japan, partially offset by higher revenues in most other markets. Sales declined in Japan due to regulatory price reductions, generic erosion of some products as well as divestment of the majority of assets of the Japanese business venture.

The Other segment (API manufacturing business and certain contract manufacturing services) recorded revenues of $298 million, down 11% year over year on a reported basis (down 13% in constant currency terms).

Margins Rise

Adjusted gross margin rose 130 basis points (bps) to 53.3% in the quarter due to higher profitability in North America and Europe, resulting from the change in product mix as well as network optimization activities. Adjusted research & development expenses rose 4.3% year over year to $243 million due to an increase in the number of respiratory and biosimilar/generic pipeline candidates. Selling and marketing (S&M) expenditure rose 4.1% from the year-ago level to $582 million. General and administrative (G&A) expenses declined 1.7% to $231 million. Adjusted operating income rose 6% in the quarter to $1.03 billion due to higher profit in Europe.

2021 Guidance

Teva lowered its sales guidance for 2021 due to the effects of the ongoing business disruption from the pandemic while keeping the earnings range intact. It expects revenues to be in the range of $16.0-$16.4 billion compared with $16.4-$16.8 billion previously. The earnings guidance was maintained in the range of $2.50-$2.70 per share.

Our Take

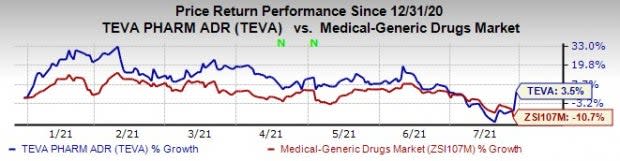

Teva’s second-quarter results were mixed as it beat estimates for earnings but missed the same for sales. Despite the mixed results and modest reduction in full-year top-line outlook, shares were up 12% on Wednesday. Teva’s share price has risen 3.5% this year so far against the industry’s decrease of 10.7%.

Image Source: Zacks Investment Research

Though Teva saw a recovery in sales in some countries and for some products, some markets and products were impacted by the lingering effects of the pandemic. This led management to lower the revenue guidance.

Teva faces several lawsuits, which claim that it is one of the several companies whose opioid-based drugs are responsible for fueling nationwide opioid epidemic. Though Teva was part of the 2019 agreement in principle with attorney generals of some states along with J&J and three opioid distributors, it was not part of the recent proposed $26 billion settlement by these four companies related to thousands of opioid abuse litigations. Teva’s chief executive officer, Kare Schultz, said on the conference call that the company is optimistic of reaching a settlement on a nationwide basis in opioid litigation in the “coming year.” This statement probably explains why shares were up so much despite the somewhat disappointing second-quarter results.

Currently, Teva has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

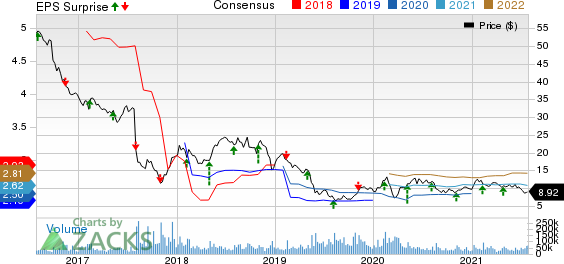

Teva Pharmaceutical Industries Ltd. Price, Consensus and EPS Surprise

Teva Pharmaceutical Industries Ltd. price-consensus-eps-surprise-chart | Teva Pharmaceutical Industries Ltd. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

Eagle Pharmaceuticals, Inc. (EGRX) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research