Is Now The Time To Put CBM Bancorp (NASDAQ:CBMB) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like CBM Bancorp (NASDAQ:CBMB). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for CBM Bancorp

How Fast Is CBM Bancorp Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. CBM Bancorp boosted its trailing twelve month EPS from US$0.21 to US$0.26, in the last year. I doubt many would complain about that 24% gain.

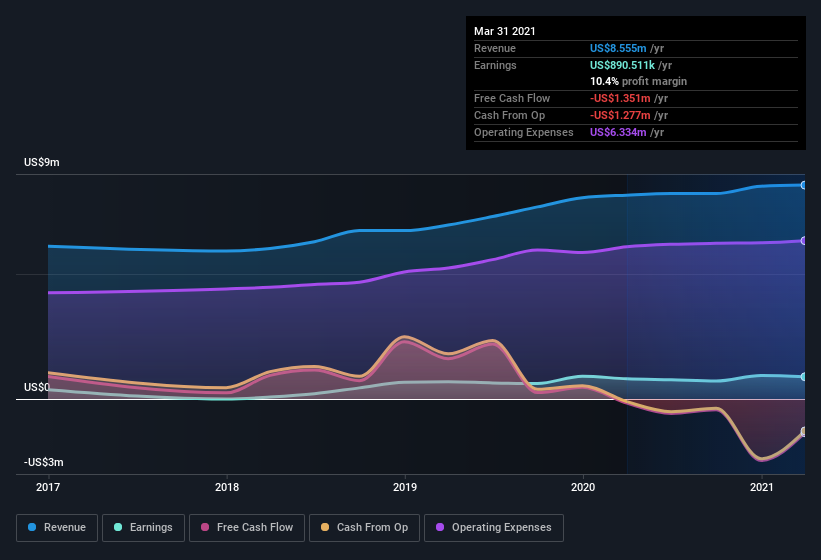

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that CBM Bancorp's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. CBM Bancorp maintained stable EBIT margins over the last year, all while growing revenue 4.9% to US$8.6m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

CBM Bancorp isn't a huge company, given its market capitalization of US$54m. That makes it extra important to check on its balance sheet strength.

Are CBM Bancorp Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations under US$200m, like CBM Bancorp, the median CEO pay is around US$551k.

The CEO of CBM Bancorp only received US$205k in total compensation for the year ending . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is CBM Bancorp Worth Keeping An Eye On?

One important encouraging feature of CBM Bancorp is that it is growing profits. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all I think it's worth at least considering for your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for CBM Bancorp you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.