Here's Why Investors Should Buy Descartes Systems (DSGX)

The Descartes Systems Group DSGX appears to be a promising stock to add to the portfolio to tackle the current macroeconomic and geopolitical uncertainties and benefit from its healthy fundamentals and growth prospects.

Let’s look at the factors that make the stock an attractive pick:

Shares Outperformed: Wall Street is facing extreme volatility due to macroeconomic factors, such as rising inflation and interest rate hikes by the Federal Reserve, increased crude oil prices and lingering supply-chain woes.

The above-mentioned factors are taking a toll on major U.S. indices. In the past year, the S&P 500 has fallen 13.3%.

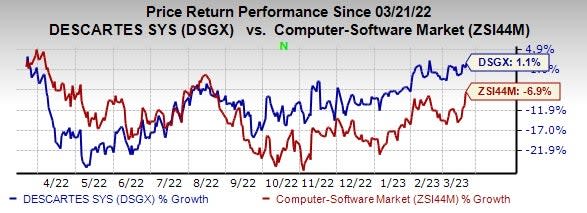

The stock is down 2.1% from its 52-week high level of $79.08 on Mar 22, 2022, making it relatively affordable for investors. DSGX’s shares have inched up 1.1% in the past year against a 6.9% decline in the Zacks sub-industry.

Image Source: Zacks Investment Research

Solid Rank: DSGX has the favorable combination of a Growth Score of B and currently has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or 2 (Buy) and a Growth Score of A or B offer solid investment opportunities.

Positive Earnings Surprise History: DSGX has an impressive surprise record. Earnings outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average being 7.1%.

Robust Estimates: The Zacks Consensus Estimate for 2024 and 2025 earnings is pegged at $1.76 and $2.26, indicating year-over-year growth of 49.2% and 28.6%, respectively.

Also, revenues for 2024 and 2025 are estimated to be $547 million and $607.2 billion, indicating year-over-year growth of 12.6% and 11%, respectively.

The company reported diluted earnings of 34 cents per share for fourth-quarter 2023, exceeding the Zacks Consensus Estimate of 31 cents. The company had reported earnings of 22 cents per share in the previous-year quarter.

Total revenues increased 11% year over year to $125.1 million, beating the Zacks Consensus Estimate of $123.7 million.

Factors That Augur Well

Descartes Systems Group provides logistics and supply chain management software-as-a-service solutions to businesses, including transportation and logistics, manufacturing, retail and healthcare. The company's software offerings include messaging services between logistics trading partners, book-to-bill services for contract carriers and private fleet management services.

Per a report from Market Research Future, the global logistic software market is expected to reach around $17.76 billion by 2030, registering a CAGR of 8.31% during the forecast period between 2020 and 2030.

The company is likely to benefit from the growing demand for the company’s transportation management businesses owing to rising shipments for the company’s MacroPoint's real-time visibility solution.

The company has also been active on the acquisition front. Buyouts have aided growth by expanding product portfolio and adding competence. In the last fiscal year, the company acquired four companies to boost its e-commerce business.

In February, the company completed the acquisition of GroundCloud. Going ahead, the company expects its GroundCloud safety and driver training solutions to increase its customer base.

In January, the company acquired Supply Vision to combine its real-time shipment visibility solutions, like MacroPoint, with Supply Vision’s comprehensive digital system, which helps logistics service providers to effectively manage the life cycle of shipments for customers.

Few Headwinds

Apart from its solid fundamentals, the company is prone to several risks. The company operates in a highly competitive and capital-intensive software-as-a-service market. This is likely to negatively impact the company’s performance.

Also, the volatile macroeconomic environment and unfavorable foreign currency movement are major concerns.

Other Stocks to Consider

Some other top-ranked stocks in the broader technology space are Arista Networks ANET, Perion Network PERI and Pegasystems PEGA, each presently sporting a Zacks Rank #1.

The Zacks Consensus Estimate for Arista Networks 2023 earnings is pegged at $5.79 per share, rising 11.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 14.2%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 14.2%. Shares of ANET have increased 23.3% in the past year.

The Zacks Consensus Estimate for Perion’s 2023 earnings is pegged at $2.69 per share, rising 16% in the past 60 days. The long-term earnings growth rate is anticipated to be 25%.

Perion’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 31.7%. Shares of PERI have increased 64.9% in the past year.

The Zacks Consensus Estimate for Pegasystems 2023 earnings is pegged at $1.35 per share, rising 101.5% in the past 60 days.

Pegasystems earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, the average surprise being 11.2%. Shares of the company have declined 39.4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Perion Network Ltd (PERI) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report

The Descartes Systems Group Inc. (DSGX) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report