Regions' (RF) Q4 Earnings Miss Estimates, Revenues Fall

Regions Financial RF reported fourth-quarter 2021 adjusted earnings of 44 cents per share, missing the Zacks Consensus Estimate of 49 cents on top-line frailty. Nonetheless, results compare favorably with the prior-year figure of 61 cents.

Results were driven by a rise in loan and deposit balances. Also, credit metrics were robust during the fourth quarter. Fall in expenses also provided some respite. However, capital position and revenues witnessed a fall.

Including certain one-time items, net income available to common shareholders was $414 million or 43 cents per share compared with the earnings of $588 million or 61 cents reported in the year-ago period.

For 2021, income from continuing operations available to common shareholders was $2.4 billion compared with the $991 million reported in 2020. Earnings per share from continuing operations were $2.49, up from the prior year’s $1.03. Results include certain one-time items. The Zacks Consensus Estimate was pinned at $2.55 per share.

Revenues Decrease, Expenses Fall

Total revenues came in at $1.63 billion in the reported quarter, outpacing the Zacks Consensus Estimate of $1.62 billion. However, the top line slid 1.3% from the year-ago quarter’s reported number.

In 2021, total revenues were up 2.4% from the prior-year level to $6.44 billion. The top line beat the Zacks Consensus Estimate of $6.43 billion.

On a fully-taxable equivalent (FTE) basis, net interest income (NII) was $1.03 billion, up 1.2% year over year. However, net interest margin (NIM) shrank 3 basis points (bps) to 2.83%.

Non-interest income decreased 9.6% year over year to $615 million. This downside mainly resulted from lower card and ATM fees, capital markets income, mortgage income, bank-owned life insurance and other income.

Non-interest expense decreased marginally year over year to $983 million, mainly due to a fall in salaries and employee benefits, net occupancy expense and other expenses. On an adjusted basis, non-interest expenses rose 4% year over year to $967 million.

Adjusted efficiency ratio came in at 59.8% compared with the prior-year quarter’s 55.8%. A higher ratio indicates a fall in profitability.

Balance Sheet Position

As of Dec 31, 2021, loans, net of unearned income, increased 5% on a sequential basis to $87.8 billion. Moreover, total deposits came in at $136 billion, 5% up from the prior quarter’s level.

As of Dec 31, 2021, low-cost deposits as a percentage of end-of-period deposits, were 95.6% compared with the prior-year quarter’s 95.7%. In addition, deposit costs came in at 4 bps during the October-December months.

Credit Quality

Credit metrics were robust during the fourth quarter. Non-performing assets as a percentage of loans, foreclosed properties and non-performing loans held for sale, shrank 37 bps from the prior-year quarter’s level to 0.54%. Additionally, non-accrual loans, excluding loans held for sale as a percentage of loans, came in at 0.51%, contracting 36 bps.

Allowance for credit losses as a percentage of loans, net of unearned income was 1.81%, down 100 bps from the year-earlier quarter’s level. RF’s total business services criticized loans fell 23%.

Moreover, annualized net charge-offs as a percentage of average loans came in at 0.2% (lowest annual net charge-off ratio since 2006), contracting 23 bps. However, provision for credit losses of $110 million was recorded during the quarter against the year-earlier quarter’s benefit of $38 million.

Capital Position

Regions Financial’s estimated ratios remained well above the regulatory requirements under the Basel III capital rules. As of Dec 31, 2021, Basel III Common Equity Tier 1 (CET1) ratio (fully phased-in) and the Tier 1 capital ratio were estimated at 9.5% and 11%, respectively, indicating a decline from the corresponding ratios of 9.8% and 11.4% recorded in the year-earlier quarter.

Our Viewpoint

Regions Financial put up a decent performance during the October-December months on higher loans and deposit balances. RF’s favorable funding mix, attractive core business and revenue-diversification strategies will likely yield stellar earnings in the upcoming period.

Though a fall in revenues is a concern, we are optimistic about the bank’s branch-consolidation plan and an improved credit quality. Nevertheless, margin pressure is expected to prevail.

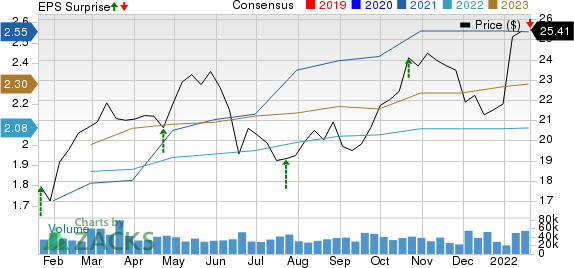

Regions Financial Corporation Price, Consensus and EPS Surprise

Regions Financial Corporation price-consensus-eps-surprise-chart | Regions Financial Corporation Quote

Currently, Regions Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

First Republic Bank’s FRC fourth-quarter 2021 earnings per share of $2.02 surpassed the Zacks Consensus Estimate of $1.91. Additionally, the bottom line improved 26.3% from the year-ago quarter’s level.

FRC’s quarterly results were supported by an increase in net interest income and non-interest income. Moreover, First Republic’s balance-sheet position was strong in the quarter. However, higher expenses and elevated net loan charge-offs were the offsetting factors.

Citigroup Inc. C delivered an earnings surprise of 5.04% in fourth-quarter 2021. Income from continuing operations per share of $1.46 outpaced the Zacks Consensus Estimate of $1.39. However, the reported figure declined 24% from the prior-year quarter’s level.

Citigroup’s investment banking revenues jumped in the quarter under review, driven by equity underwriting as well as growth in advisory revenues. However, fixed-income revenues were down due to declining rates and spread products.

U.S. Bancorp USB reported fourth-quarter 2021 earnings per share of $1.07, which missed the Zacks Consensus Estimate of $1.11. Results, however, compare favorably with the prior-year quarter’s figure of 95 cents.

Though lower revenues and escalating expenses were disappointing factors, credit quality acted as a tailwind. Growth in loan and deposit balance and a strong capital position were encouraging factors. Moreover, U.S. Bancorp closed the acquisition of San Francisco-based fintech firm TravelBank, which offers technology-driven cost and travel management solutions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Citigroup Inc. (C) : Free Stock Analysis Report

Regions Financial Corporation (RF) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

Safe Bulkers, Inc (SB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research