Cleveland-Cliffs (CLF) to Redeem Entire 1.50% Senior Notes

Cleveland-Cliffs Inc. CLF announced that it will fully redeem $294 million of its 1.50% Senior Notes due 2025. The notes are expected to be redeemed on Jan 18, 2022, the earliest possible date for redemption pursuant to the indenture governing the notes.

The noteholders may convert their notes prior to the redemption date. The company plans to pay 100% of the outstanding principal amount in cash upon redemption or early conversion.

Cleveland-Cliffs ended the third quarter with cash and cash equivalents of $42 million. Long-term debt was $5,350 million at the end of the quarter. Net cash provided by operating activities was $1,516 million in the third quarter.

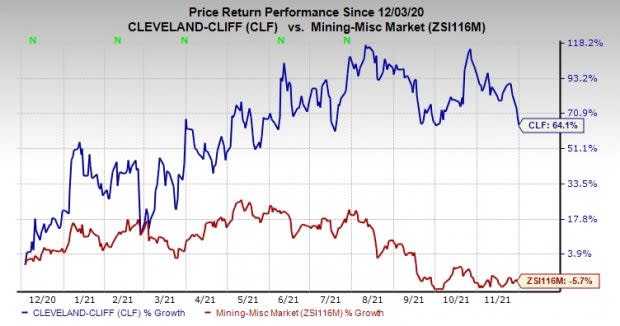

Shares of Cleveland-Cliffs have rallied 64.1% in a year against a 5.7% decline of the industry.

Image Source: Zacks Investment Research

Cleveland-Cliffs, in its last earnings call, stated that it expects higher average sales price next year, which will further strengthen its balance sheet and profitability. The integration of FPT, a leading prime scrap processor in the United States, is also expected to enable it to utilize more prime scrap. This will reduce the dependency on coke and lower carbon emissions. The company completed the FPT acquisition last month.

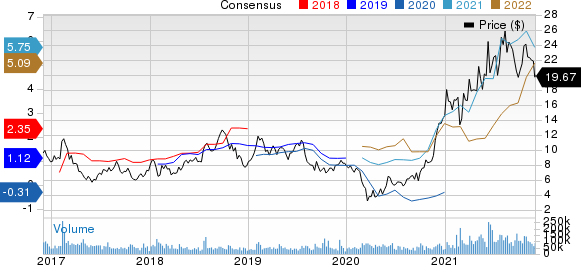

ClevelandCliffs Inc. Price and Consensus

ClevelandCliffs Inc. price-consensus-chart | ClevelandCliffs Inc. Quote

Zacks Rank & Key Picks

Cleveland-Cliffs currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Nucor Corporation NUE, The Chemours Company CC and Celanese Corporation CE.

Nucor has an expected earnings growth rate of 583.2% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 7.7% upward in the past 60 days.

Nucor beat the Zacks Consensus Estimate for earnings in two of the last four quarters, while missing the same twice. The company has a trailing four-quarter earnings surprise of roughly 2.74%, on average. The stock has surged around 91% in a year. NUE currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. CC has increased around 15.6% over a year. CC currently sports a Zacks Rank #1.

Celanese has a projected earnings growth rate of 139.5% for the current year. The consensus estimate for the current year has been revised 8.8% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters. CE has a trailing four-quarter earnings surprise of 12.7%, on average. The company’s shares have gained around 14.8% in a year. It currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

ClevelandCliffs Inc. (CLF) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research