First Horizon (FHN) Stock Rises 1.5% on Q3 Earnings Beat

Shares of First Horizon National Corporation FHN rallied 1.5% following the release of third-quarter 2021 results. Earnings per share of 50 cents beat the Zacks Consensus Estimate of 41 cents. Results excluded an after-tax impact of 9 cents per share from notable items related to the IBERIABANK Corporation Merger and early retirement of certain trust preferred securities.

Including these items, earnings per share were 41 cents compared with the prior-year quarter’s 53 cents.

Results reflect improved deposit balance, higher revenues and provision benefits, partly offset by higher expenses. Pressure on margin due to low interest rates is concerning.

Net income available to common shareholders (GAAP basis) was $224 million, down significantly from $523 million recorded in the prior-year quarter.

Segment wise, net income for regional banking increased to $236 million. Also, the specialty banking segment reported a net income of $142 million, down 10% from the year-ago quarter. Also, the corporate segment incurred a net loss of $143 million.

Revenues Decline, Expenses Fall

Total revenues were $738 million, down 46% year over year. Further, the top line missed the consensus estimate of $743 million.

Net interest income declined 8% year over year to $492 million. However, the net interest margin shrunk 44 basis points (bps) to 2.4%.

Non-interest income was $247 million, declining 70% from the year-ago level.

Non-interest expenses declined 10% year over year to $526 million.

The efficiency ratio was 71.21%, up from the year-ago period’s 43.31%. It should be noted that a rise in the efficiency ratio indicates a decrease in profitability. However, the adjusted efficiency ratio was 62.87% compared with the prior-year quarter’s 57.06%.

Total period-end loans and leases, net of unearned income, totaled $55.4 billion, down 2% from the prior quarter’s end. Total period-end deposits of $74.3 billion increased 1% from the prior quarter.

Credit Quality Improves

Non-performing loans and leases of $339 million declined 2% from the prior-year period. Further, as a percentage of period-end loans on an annualized basis, the allowance for loan losses was 1.32%, down 33 bps from the previous-year quarter.

The third quarter witnessed net charge-offs of $3 million, improving from the prior-year quarter’s $67 million. Moreover, provision for credit losses was a benefit of $85 million against expenses of $80 million in the prior-year quarter.

However, the allowance for loan and lease losses of $734 million increased 26% from the year-ago period.

Capital Ratios Improve

As of Sep 30, 2021, the Common Equity Tier 1 ratio was 10.1%, up from the 9.2% reported at the end of the year-earlier quarter. Additionally, the total capital ratio was 12.6%, up from the previous-year quarter’s 12.1%.

Tier 1 leverage ratio was 8.1%, down from 8.3% in the prior year.

Our Viewpoint

First Horizon continues to benefit from rising deposit balances. The company’s inorganic expansion efforts also support financials. Nevertheless, mounting expenses and near-zero interest rates remain major concerns.

First Horizon currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

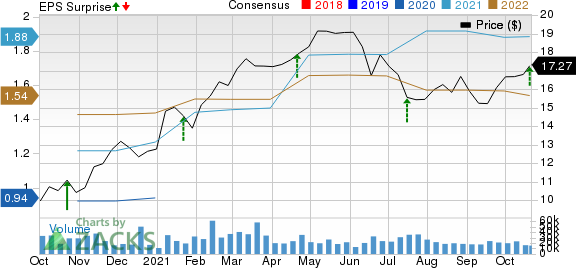

First Horizon Corporation Price, Consensus and EPS Surprise

First Horizon Corporation price-consensus-eps-surprise-chart | First Horizon Corporation Quote

Performance of Other Banks

Synovus Financial SNV reported third-quarter 2021 adjusted earnings of $1.20 per share, which beat the Zacks Consensus Estimate of $1.07 per share, aided by solid revenues. Also, the bottom line compared favorably with earnings of 89 cents per share recorded in the year-ago quarter.

Northern Trust Corporation NTRS has reported third-quarter 2021 earnings per share of $1.80, which surpassed the Zacks Consensus Estimate of $1.67 on the release of credit reserves. The bottom line increased year over year from $1.32.

M&T Bank Corporation MTB reported an earnings surprise of 6.82% in third-quarter 2021. Net operating earnings per share of $3.76 surpassed the Zacks Consensus Estimate of $3.52. The bottom line also compared favorably with $3.45 per share reported in the year-ago period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synovus Financial Corp. (SNV) : Free Stock Analysis Report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

First Horizon Corporation (FHN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research