2 Stocks to Buy Now After Powell Flips the Narrative... Again

After his two-day testimony in front of Congress, Federal Reserve Chair Jerome Powell brought some much need clarity to the markets. Since October, when the market hit extreme lows, the market narrative has slowly shifted to a Fed pivot. This means that market participants believed that the rate hiking cycle was near completion, and by the end of 2023, we would begin to see rate cuts.

But this narrative hinged on lower inflation led by a weakening economy and consumer. While inflation has begun to slow, it is not yet enough, and employment is still as strong as it has been in decades, even with all the tech lay-offs. Because disinflation has been slow to take hold, the Fed is likely going to raise rates more than the market has been expecting.

Thus, the narrative is shifting again, from “Fed Pivot,” to “higher for longer.” The likelihood of a soft-landing for the economy also begins to fade as it is clear the Fed will need to do more to slow consumption and the economy.

Expectations for the next FOMC meeting have seen odds of a 50bps rate hike go from extremely unlikely to highly likely. This comes after Powell stated that he believed it was possible there would be a 50bps hike. Although he did stress “that no decision has been made,” he included that “if the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.”

Image Source: CME Group

Friday morning the U.S. employment report will come out, and it is absolutely critical to Powell and the Fed’s decision on interest rates. Last month the report showed that the economy added over 500,000 jobs, which blew away expectations of 200,000 new jobs. A strong jobs market would mean strong wage inflation, which is ultimately bad for the economy.

Analysts are expecting 225,000 new jobs to be reported in tomorrow’s data. Whether the report shows hot, cold, or in line results will be a major determinant of policy at the next FOMC meeting.

Stocks

One way to avoid the volatility of changing policy is to focus on stocks with improving earnings expectations, and relative strength.

One stock with promising prospects is Deere and Company DE. Deere is the world’s largest producer of agricultural equipment and manufacturing machinery and was founded in 1837. It operates through four segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and Financial Services.

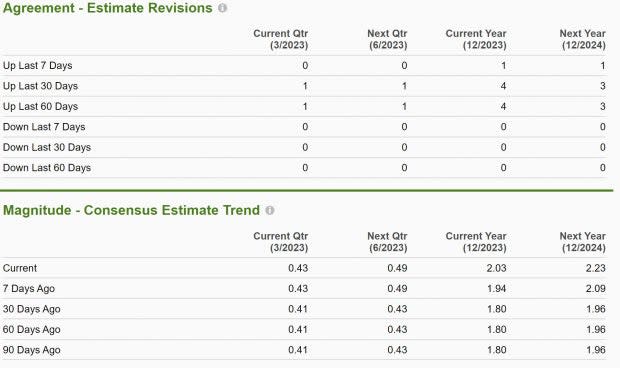

DE boasts a Zacks Rank #1 (Strong Buy) right now, indicating upward trending earnings revisions. Deere is expecting current quarter sales to grow 23% YoY to $14.8 billion and current quarter earnings to climb 24% to $8.45 per share. Over the last 60 days only a single analyst has revised earnings expectations lower. Across all timeframes earnings have been revised higher by 5-10%.

Image Source: Zacks Investment Research

Furthermore, DE has a compelling technical setup. Over the last two years Deere stock has built out an epic cup and handle pattern. A breakout above 440 can easily send the stock 10% higher. Alternatively, below 400 the setup is invalidated.

Image Source: Zacks Investment Research

Deere stock is trading at a very reasonable valuation as well. At 14x one-year forward earnings the stock is below its 10-year median of 16x, and below the market average.

Image Source: Zacks Investment Research

Another interesting stock is Amphastar Pharmaceuticals AMPH. Amphastar focuses primarily on developing, manufacturing, marketing, and selling generic and proprietary injectable and inhalation products. These include treatments for asthma, deep vein thrombosis, and opioid overdose among others.

If markets were to get dicey again like last year, healthcare stocks can be a defensive way to stay involved. Whether the economy is strong or not, people need healthcare and medicine. Furthermore, as a producer of generic pharmaceuticals, AMPH products are the cheapest options for those who need medicine, making Amphastar the choice when budgets are tight.

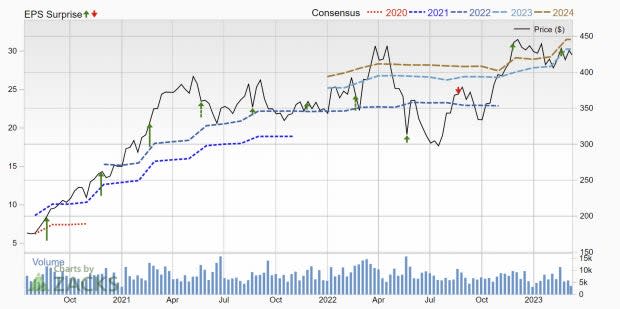

AMPH is a Zacks Rank #1 (Strong Buy) stock, indicating a strong upwards earnings revision trend. Analysts are in unanimous agreement in upgrading earnings expectations across timeframes.

Image Source: Zacks Investment Research

At 22x one-year forward earnings, AMPH is trading above its three-year median of 18x. The stock shows strong performance this year, already up 26% YTD.

Image Source: Zacks Investment Research

Conclusion

The future is uncertain in these markets, and one change in phrasing from the Fed can completely flip the script. Remain focused on what Powell says, look for stocks with improving expectations, and always manage your risk.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deere & Company (DE) : Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH) : Free Stock Analysis Report