4 Coal Stocks to Accumulate Right Now Before the Rally Ends

Coal as a fuel source was losing its dominance globally, primarily due to rising awareness about emissions and its impact on climate change. Coal was a major source of fuel in electricity generation, and other heavy industries like steel and cement but the increasing usage of clean burning natural gas as well as renewable sources of energy to generate electricity has pushed back coal as a fuel source. The outbreak of COVID-19 last year and the resultant decline in commercial and industrial activities have further lowered demand for coal on a global scale.

Nonetheless, things have started to change in favor of the coal industry, as is quite evident from the Zacks Coal industry’s surge of 275% in the past 12 months compared with the Zacks S&P 500 composite’s 28.4% rally. Increasing medical knowledge to effectively deal with the virus and rollout of vaccines on a global scale have restarted economic activities, creating a demand for electricity. With prices of natural gas remaining high, coal has again become a preferred source of fuel for utility operators.

The World Steel Association in its Short Range Outlook for 2021 and 2022 forecasts that steel demand will grow 5.8% in 2021 and reach 1,874.0 million tons (Mt). It is projected to see further growth of 2.7% and touch 1,924.6 Mt in 2022. Metallurgical coal (met coal) is the primary source of carbon used in steelmaking. An increase in steel production will also increase the demand for met coal globally.

Per the U.S. Energy Information Administration release, coal production in the United States will increase 12.3% year over year to 601 million short tons (MMst) in 2021. Coal production is expected to increase further by 47 MMst in 2022 and reach 648 MMs. Coal exports from the United States are expected to increase from 69.1 MMst in 2020 to 90.5 MMst in 2021 and 94 MMst in 2022.

Peabody Energy Corporation BTU, which currently carries a Zacks Rank #2 (Buy), and other companies that have exposure to thermal coal and met coal are well poised to benefit from the revival in domestic and international coal markets. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The expected increase in U.S. met coal exports in the 2021-2022 time period is going to benefit other coal stocks such as Arch Resources Inc. ARCH, Ramaco Resources METC and CONSOL Energy Inc. CEIX. While Arch Resources and Ramaco sport a Zacks Rank #1, CONSOL Energy has a Zacks Rank of 2 at present.

Steel, cement, and other coal-intensive industries in European and Asian countries are expected to restart operations in full steam backed by government stimulus, and rising demand due to the opening up of economic activities.

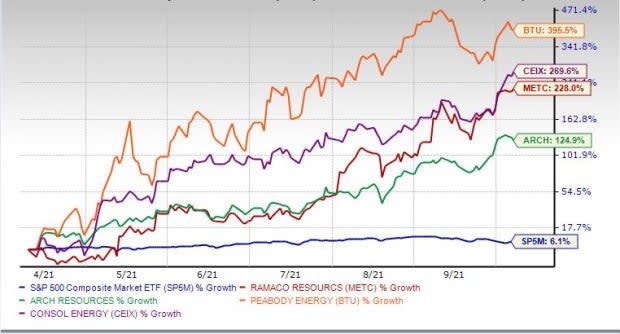

All the coal stocks mentioned above have outperformed the Zacks S&P 500 composite in the past six months.

Price Performance (Six months)

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for 2021 earnings of Peabody Energy, Arch Resources, Ramaco Resources, and CONSOL Energy has moved up 358%, 148%, 153.2%, and 53.1%, respectively, in the past 90 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Peabody Energy Corporation (BTU) : Free Stock Analysis Report

Arch Resources Inc. (ARCH) : Free Stock Analysis Report

Ramaco Resources, Inc. (METC) : Free Stock Analysis Report

Consol Energy Inc. (CEIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research