Kaiser (KALU) Board Okays 7% Hike in Quarterly Dividend Rate

Kaiser Aluminum Corporation KALU announced a 7% hike in the quarterly dividend rate. The improved rewards to shareholders reflect a strong cash position and belief in profitability.

This is the 11th consecutive year of a dividend increment announcement made by Kaiser.

The company’s shares gained 2.77% yesterday, ending the trading session at $101.14.

Inside the Headlines

As noted, Kaiser’s board of directors approved a hike of 5 cents per share in the quarterly dividend rate, which now stands at 77 cents per share. The previous quarterly dividend rate was 72 cents. On an annualized basis, the dividend rate has been improved from $2.88 to $3.08.

The company will pay out the revised quarterly dividend on Feb 15, 2022, to shareholders of record as of Jan 24.

Sound Capital-Allocation Strategies

Kaiser follows sound capital-allocation strategies, aiming to improve shareholder values. Free resources are primarily used for product development, end-market penetration, and rewarding shareholders handsomely through dividend payments and share buybacks.

In the first nine months of 2021, the company paid out dividends totaling $35 million, up 7% from $32.7 million disbursed in the year-ago period. On a quarterly basis, the company paid out 72 cents per share for each quarter of 2021. The last payment was made on Nov 15, 2021.

The company refrained from repurchasing any shares in the first three quarters of 2021, while it bought back shares worth $12.5 million in the first nine months of 2020.

Zacks Rank, Price Performance and Earnings Estimate Trend

With a market capitalization of $1.6 billion, Kaiser currently carries a Zacks Rank #5 (Strong Sell). The company faces headwinds from input cost inflation, restricted supply chain, and labor problems.

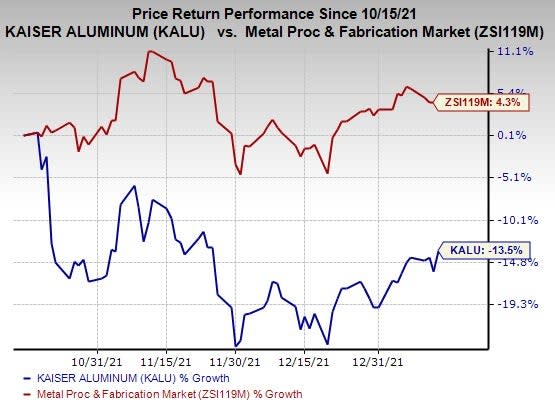

In the past three months, Kaiser’s shares have lost 13.5% against the industry’s growth of 4.3%.

Image Source: Zacks Investment Research

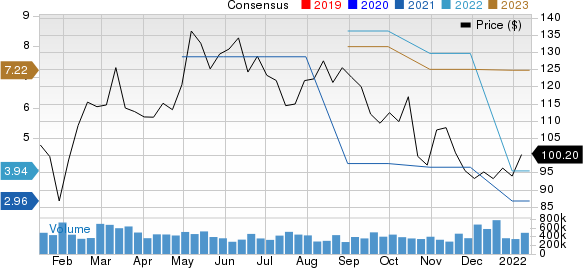

The Zacks Consensus Estimate for Kaiser’s earnings is pegged at $2.96 for 2021 (results not yet released) and $3.94 for 2022. The consensus estimate reflects a decline of 27.1% for 2021 and 49.3% for 2022 from the respective 60-day-ago figures.

Kaiser Aluminum Corporation Price and Consensus

Kaiser Aluminum Corporation price-consensus-chart | Kaiser Aluminum Corporation Quote

Dividend Hikes by Three Players in the Industry

Below we discussed three companies belonging to the industry, which reward its shareholders with hiked quarterly dividend rates.

Worthington Industries, Inc. WOR hiked its quarterly dividend rate by 12% or 3 cents per share to 28 cents in March 2021. Dividends totaling $29.3 million were paid in the first half of fiscal 2022 (ended November 2021).

Worthington presently carries a Zacks Rank #3 (Hold). WOR’s earnings estimates improved 9.1% for fiscal 2022 (ending May 2022) and decreased 15.2% for fiscal 2023 (ending May 2023) in the past 60 days.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Timken Company TKR increased its quarterly dividend rate by 3% or 1 cent per share in May 2021. Total dividend disbursements were $69.5 million in the first nine months of 2021.

Timken’s earnings estimates have decreased 0.6% for 2021 and 0.3% for 2022 in the past 60 days. TKR presently carries a Zacks Rank #3.

Mueller Industries Inc. MLI hiked its quarterly dividend rate by 30% or 3 cents per share in February 2021. In the first three quarters of 2021, MLI’s dividend payments totaled $21.8 million, while the same was $16.8 million in the year-ago period.

Mueller presently carries a Zacks Rank #3. In the past 60 days, earnings estimates for the company have been unchanged for 2021 and 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Timken Company The (TKR) : Free Stock Analysis Report

Mueller Industries, Inc. (MLI) : Free Stock Analysis Report

Kaiser Aluminum Corporation (KALU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research