Transportation Stocks Jul 29 Earnings Roster: WAB, SAIA & More

The widely-diversified transportation sector is benefiting from the uptick in economic activities, courtesy of the relaxation of restrictions and increased vaccination drives. In fact, results of companies, which already reported second-quarter financial numbers gained from easy year-over-year comparisons as second-quarter 2020 was worst hit by the COVID crisis, massively hurting earnings in the process.

The resurgence in economic activities during the April-June period spurred air-travel demand (particularly for leisure), thereby boosting the performances of airlines like Delta Air Lines DAL and United Airlines UAL. Similarly, recovery in the freight scene across the United States aided results of railroads like Union Pacific Corporation UNP.

However, the increase in average fuel price per gallon as oil prices move north has been a bane for the bottom lines of those industry players who have released earnings so far. Oil price jumped to the tune of 24.2% in the June quarter.

Akin to the participants who already announced their financial numbers, we expect the above factors to have impacted the quarterly performances of the transportation stocks that are lined up for second-quarter 2021 earnings release.

Against this backdrop, investors interested in the Zacks Transportation sector will await the earnings reports of Westinghouse Air Brake Technologies Corporation WAB, Saia SAIA, Schneider National SNDR, Kirby Corporation KEX and Werner Enterprises WERN. These five companies are scheduled to post June-quarter results on Jul 29.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Our quantitative model indicates that a company with the perfect combination of positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has high chances of delivering an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

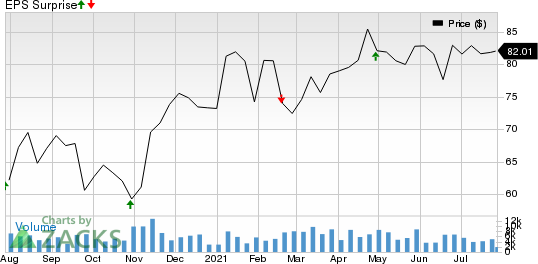

We expect the second-quarter performance of Westinghouse Air Brake Technologies Corporation, which operates as Wabtec, to have been aided by the uptick in economic activities. Both its segments, namely Freight and Transit are likely to have recorded improved sales owing to the recovery in freight volumes and equipment utilization as well as higher demand for freight aftermarket services. Owing to these tailwinds, the stock has seen the Zacks Consensus Estimate for second-quarter earnings inch up in excess of 1% over the past 60 days.

Our proven Zacks model predicts an earnings beat for Wabtec this time around as the company currently has a Zacks Rank #3 and an Earnings ESP of +1.54%.

Westinghouse Air Brake Technologies Corporation Price and EPS Surprise

Westinghouse Air Brake Technologies Corporation price-eps-surprise | Westinghouse Air Brake Technologies Corporation Quote

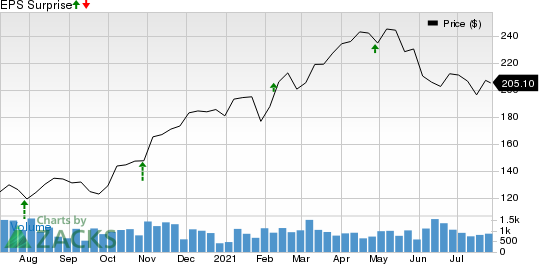

We expect the second-quarter performance of Saia to have been boosted by the upturn in trucking volumes. This, in turn, is likely to have expanded revenues for this trucking company in the to-be-reported quarter. The stock has seen the Zacks Consensus Estimate for second-quarter earnings being revised above 1.5% over the past 60 days.

Our proven Zacks model predicts an earnings beat for Saia this time around as the company currently has a Zacks Rank of 3 and an Earnings ESP of +1.37%.

Saia, Inc. Price and EPS Surprise

Saia, Inc. price-eps-surprise | Saia, Inc. Quote

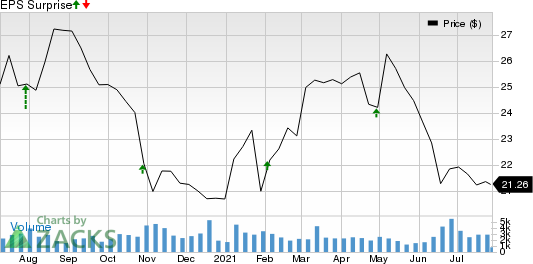

We expect the ramp-up in freight activities to have contributed to the second-quarter performance of Schneider National, a leading transportation and logistics services company. The company’s prudent cost-control efforts and higher intermodal revenues are also likely to have bumped up its performance.

Backed by these tailwinds, the stock has seen the Zacks Consensus Estimate for second-quarter earnings increase 7.7% over the past 60 days. Our proven Zacks model predicts an earnings beat for Schneider National this time around as the company currently has a Zacks Rank #2 and an Earnings ESP of +2.81%.

Schneider National, Inc. Price and EPS Surprise

Schneider National, Inc. price-eps-surprise | Schneider National, Inc. Quote

We expect Kirby’s second-quarter performance to have been aided by a strong performance at the distribution and services segment, driven by a continued recovery in activity levels. On the flip side, weakness in the marine transportation segment due to low pricing and poor barge utilization is likely to have been a dampener. Increased labor costs are likely to have dented the bottom-line performance.

The stock has seen the Zacks Consensus Estimate for second-quarter earnings remain stable at 12 cents over the past 60 days. Our proven Zacks model does not predict an earnings beat for Kirby this time around as the company currently has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%.

Kirby Corporation Price and EPS Surprise

Kirby Corporation price-eps-surprise | Kirby Corporation Quote

We expect Werner’s second-quarter performance to have been aided by the improved freight market conditions. Decline in operating expenses owing to this transportation and logistics company’s cost-control measures is likely to have aided its bottom-line performance. Despite this betterment, however, the Truckload Transportation Services segment (major revenue-generating unit at Werner) is likely to have registered lower revenues than its pre-coronavirus levels.

The stock has seen the Zacks Consensus Estimate for second-quarter earnings being raised 1.2% over the past 60 days. Our proven Zacks model does not predict an earnings beat for Werner this time around as the company is currently Zacks #3 Ranked and has an Earnings ESP of -0.97%.

Werner Enterprises, Inc. Price and EPS Surprise

Werner Enterprises, Inc. price-eps-surprise | Werner Enterprises, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Saia, Inc. (SAIA) : Free Stock Analysis Report

Werner Enterprises, Inc. (WERN) : Free Stock Analysis Report

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research