Walgreens (NASDAQ:WBA) has High Debt, but Here is Why They Can Successfully Manage It

This article was originally published on Simply Wall St News

Walgreens Boots Alliance, Inc. (NASDAQ:WBA) is a US$42b market cap company with a very stable income. Some investors might be concerned by the debt portfolio of the company, and that is why we will analyze if both sort term and long term debt or liabilities should be a cause for anxiety.

We will start by looking at the company's long term debt, then move on to working capital and short term liabilities. Finally, we will look at the current and future income estimates, which will give us a better sense for the value and sustainability of dividend payments for Walgreens.

See our latest analysis for Walgreens Boots Alliance

What Is Walgreens Boots Alliance's Net Debt?

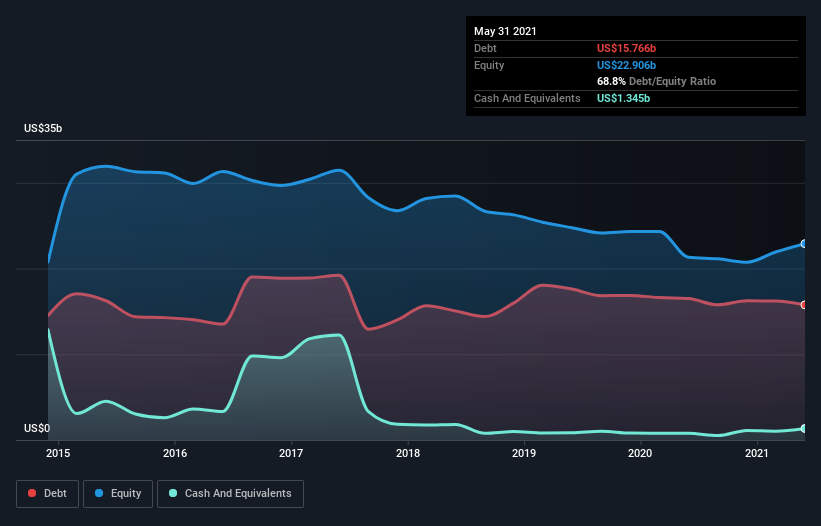

The image below, shows that Walgreens Boots Alliance had debt of US$15.8b at the end of May 2021, a reduction from US$16.5b over a year.

However, it does have US$1.35b in cash offsetting this, leading to net debt of about US$14.4b.

The company operates with a low cash margin, and while returning cash to shareholders is a healthy policy, investors might feel safer knowing that the company has some safety for bad times.

Even though the debt to equity ratio may seem to be approaching dangerous levels at face value, we note that total liabilities are 53% of total assets, which gives us some stability.

How Healthy Is Walgreens Boots Alliance's Balance Sheet?

We start off by looking at short term assets vs liabilities, which initially strike us as bad because short term liabilities are larger at US$34.5b v.s. short term assets at US$26.6b. However, it seems that this is a function of working capital management and the company has much more accounts payable than accounts receivable, which means that it is operating at high efficacy, and offloading costs to suppliers.

In working capital management, companies are considered successful if they manage to settle accounts receivable as soon as possible while delaying the settlement of accounts payable. This allows them to buy stock from suppliers, sell it to customers, and settle what they owe with the money generated from the transactions with consumers. Essentially, suppliers are giving the company both stock and credit for the transaction. We can see that Walgreens has great working capital management!

Now we turn more closely to the debt load.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover).

The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Walgreens Boots Alliance's debt is 2.8 times its EBITDA, and its EBIT cover its interest expense 7.0 times over. This suggests that while the debt levels are significant, they are hardly problematic. Walgreens Boots Alliance also grew its EBIT by 9.6% in the last year.

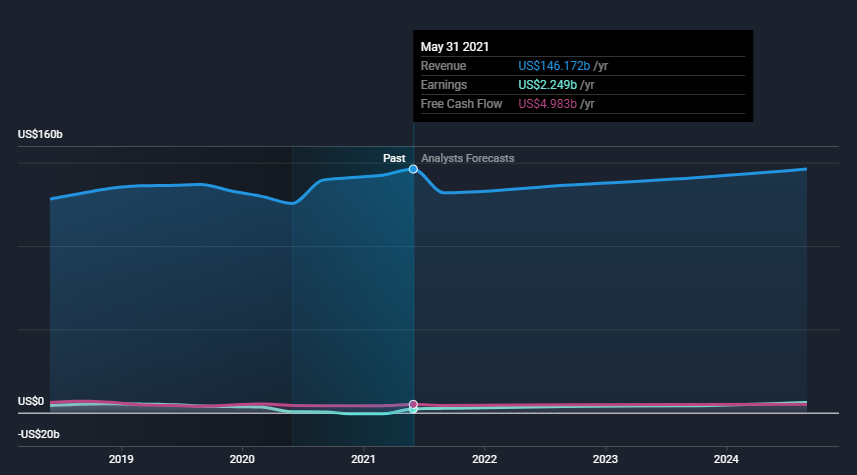

A company cannot pay debt with paper profits, it needs cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow.

Happily for any shareholders, Walgreens actually produced more free cash flow than EBIT over the last three years.

The chart blow shows that clearly, and also outlines how analysts estimate future income.

We see that the last 12 months produced an unusual situation for Walgreens, which is expected to normalize starting from next quarter. After that, analysts expect that the company will have a stable 2.8% revenue growth rate.

Everything we do has to be in some ways connected to the future potential gains from the company. We need these evaluations to see both if the stock price is close to the true value of the cash flows in the company, and will investors see additional returns in dividends and/or buybacks.

It seems that the valuation of the company has a bright outlook according to our Free Cash Flow to Equity model, and this gives us even more confidence that the company can sustain it dividend payments and the close to 4% dividend yield to shareholders.

Key Takeaways

Walgreens Boots Alliance's level of total debt and net debt to EBITDA are well managed, and the company is successfully using working capital to maximize short term efficacy.

Revenues will normalize in 2022 and express stable growth thereafter. The company is in a good position to sustain dividend payments and leaves large potential for the price to converge to intrinsic value.

Every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Walgreens Boots Alliance that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com