Plexus (PLXS) Q3 Earnings Beat Estimates, Revenues Up Y/Y

Plexus PLXS reported third-quarter fiscal 2021 adjusted earnings of 99 cents per share that beat the Zacks Consensus Estimate by 28.6%. The figure decreased 17.5% year over year.

Revenues of $814.4 million beat the consensus mark by 1.8%. However, the figure decreased 5% year over year due to lower Europe, and the Middle East and Africa (“EMEA”), and Asia-Pacific (“APAC”) revenues.

APAC revenues decreased 7.3% year over year to $447 million. EMEA revenues were $76 million, down 17.4%. However, revenues in the Americas increased 4.2% to $319 million.

Plexus won 31 manufacturing contracts during the quarter, worth $275 million in annualized revenues. Trailing four-quarter manufacturing wins totaled more than $1.1 billion in annualized revenues.

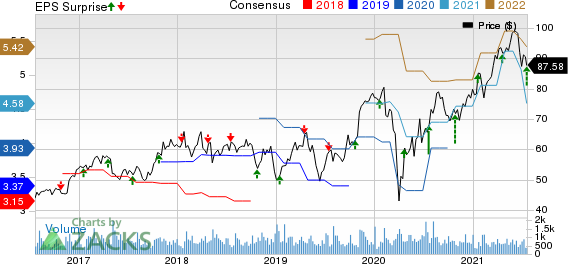

Plexus Corp. Price, Consensus and EPS Surprise

Plexus Corp. price-consensus-eps-surprise-chart | Plexus Corp. Quote

Market Sector Details

Industrial revenues fell 3.6% year over year to $372 million and accounted for 45.7% of total revenues. Beginning first-quarter fiscal 2021, Plexus consolidated the previously reported Industrial/Commercial and Communications market sectors to form the Industrial market sector.

Healthcare/Life Sciences revenues decreased 1.8% from the year-ago quarter to $324 million. The sector accounted for 39.8% of total revenues.

Aerospace/Defense revenues decreased 16.3% year over year to $118 million and accounted for 14.5% of total revenues.

Notably, the top 10 customers of the company accounted for 55% of net revenues.

Operating Details

Gross profit on a GAAP basis decreased 10.7% year over year to $74.1 million. Gross margin contracted 60 basis points (bps) year over year to 9.1%.

Selling and administrative expenses (4.5% of revenues) decreased 1.6% from the year-ago quarter to $38.3 million.

Plexus reported adjusted operating income of $37.6 million, down 18% year over year. Adjusted operating margin contracted 70 bps on a year-over-year basis to 4.6%

Balance Sheet & Cash Flow

As of Jul 3, 2021, Plexus had cash & cash equivalents worth $303.3 million compared with $294.5 million as of Apr 3, 2021.

As of Jul 3, 2021, the company had long-term debt of $187.7 million compared with $239 million as of Apr 3, 2021.

In third-quarter fiscal 2021, cash flow provided by operations was $42.7 million. The company reported free cash flow of $31.5 million.

ROIC (tax-effected annualized adjusted operating income divided by average invested capital over two quarters) was 15.9% for third-quarter fiscal 2021, much higher than Plexus’ weighted average cost of capital of 8.1%.

Guidance

For fourth-quarter fiscal 2021, revenues are projected between $875 million and $915 million. GAAP operating margin is expected between 4.8% and 5.2%.

GAAP earnings are expected between $1.13 and $1.29 per share.

The Zacks Consensus Estimate for fourth-quarter earnings is pegged at $1.09 per share, implying 26.9% decline from the figure reported in the year-ago quarter. The consensus mark for revenues stands at $872.4 million, suggesting decline of 4.5% from the year-ago quarter’s reported figure.

Industrial revenues are expected to increase low double digit. Both Healthcare/Life Sciences and Aerospace/Defense revenues are anticipated to increase high single digit.

Zacks Rank & Stocks to Consider

Plexus currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader technology sector are Apple AAPL, Advanced Micro Devices AMD and MSCI MSCI. All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

All three aforementioned companies are set to report their quarterly earnings on Jul 27.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Plexus Corp. (PLXS) : Free Stock Analysis Report

MSCI Inc (MSCI) : Free Stock Analysis Report

To read this article on Zacks.com click here.