Can Otis Worldwide (OTIS) Report Higher Earnings in Q2?

Otis Worldwide Corporation OTIS is scheduled to report second-quarter 2021 results on Jul 26, before the opening bell.

In the last reported quarter, the company’s earnings and revenues beat the Zacks Consensus Estimate by 16.1% and 8.8%, respectively. On a year-over-year basis, earnings and revenues grew 20% and 14.9%, respectively.

Otis’ earnings topped the consensus mark in all the last four quarters, with the average being 19.8%.

Trend in Estimate Revision

For the quarter to be reported, the Zacks Consensus Estimate for earnings per share has been unchanged at 71 cents over the past 60 days. The estimated figure indicates 26.8% growth from the year-ago level. The consensus mark for revenues is pegged at $3.46 billion, suggesting a 14.1% increase from the year-ago reported figure of $3.03 billion.

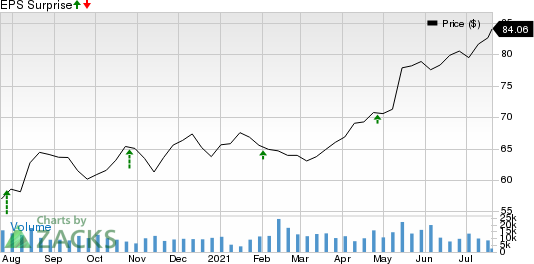

Otis Worldwide Corporation Price and EPS Surprise

Otis Worldwide Corporation price-eps-surprise | Otis Worldwide Corporation Quote

Key Factors to Note

The world's leading elevator and escalator manufacturing, installation and service company is expected to have registered higher revenues as well as earnings in the second quarter, given recovery in end-markets served backed by resurgence of global and North American economies.

Increased organic sales, margin expansion in both the segments (New Equipment and Service), strong business strategy as well as robust data and technology-based innovations are expected to benefit its quarterly results. Otis has been focusing on improving business on the back of various strategies like acquisitions, product innovations, and new technologies through continuous research and development.

The company expects New Equipment (accounting for 42% of total revenues) to be strong in the second quarter, but not as strong as the first quarter. The Zacks Consensus Estimate for New Equipment revenues is pegged at $1,557 million, which indicates an increase of 20.3% from $1,294 million in the year-ago period.

For Service (accounting for 58% of the company’s total revenues), it expects revenues to increase for the second quarter, given year-over-year comparisons. Service revenues were weak last year. The Zacks Consensus Estimate for Service revenues is pegged at $1,903 million, which indicates an increase of 9.7% from $1,735 million in the year-ago period.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Otis this time around. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, that is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Currently, Otis carries a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With Favorable Combination

Here are some companies in the Zacks Construction sector, which according to our model have the right combination of elements to post an earnings beat in their respective quarters to be reported.

Watsco, Inc. WSO has an Earnings ESP of +3.46% and a Zacks Rank #2.

ChampionX Corporation CHX has an Earnings ESP of +10.00% and holds a Zacks Rank #3.

United Rentals, Inc. URI has an Earnings ESP of +6.18% and a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Watsco, Inc. (WSO) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report

ChampionX Corporation (CHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research