Agios' (AGIO) Q2 Loss Narrows, Pipeline Makes Solid Progress

Agios Pharmaceuticals, Inc. AGIO reported a loss of $1.36 per share from continued operations for the second quarter, narrower than the Zacks Consensus Estimates of a loss of $1.39.

Following the sale of its oncology portfolio to France-based pharmaceutical company, Servier, the company recorded no revenues for the second quarter. The Zacks Consensus Estimate for the metric was $2 million. In the year-ago quarter, the company recorded $37.3 million in total revenues.

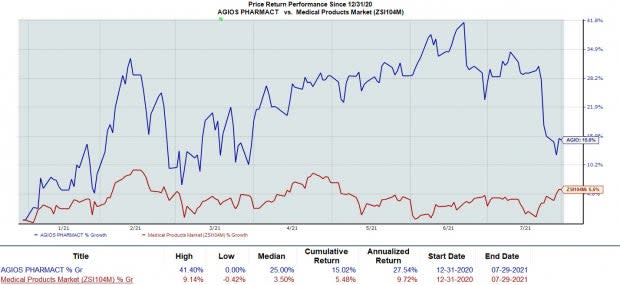

Shares of Agios have rallied 15% so far this year compared with the industry’s 5.5% growth.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development expenses increased 14.6% year over year to $62 million due to increased cost related to planned initiation of late-stage studies of mitapivat in thalassemia and sickle cell disease as well as the regulatory filings for mitapivat in pyruvate kinase (“PK”) deficiency and preparations for its potential launch.

Selling general and administrative expenses remained flat year over year at $29.2 million.

At the end of June 2021, cash, cash equivalents and marketable securities were $1.7 billion compared with $2.4 billion at the end of March 2021.

Pipeline Updates

In June 2021, Agios filed new drug application in the United States and marketing authorization application in the EU for mitapivat to treat patients with PK deficiency. The filings were based on results from two pivotal phase III studies, ACTIVATE and ACTIVATE-T, which evaluated mitapivat in adults who were not regularly transfused and regularly transfused, respectively.

Agios is also developing mitapivat for treating sickle cell disease (“SCD”), a blood disorder, and thalassemia. A phase II/III study on mitapivat for SCD is expected to begin by year-end. The company also plans to initiate two phase III studies, ENERGIZE and ENERGIZE-T, to evaluate mitapivat in patients with thalassemia by 2021-end.

Agios is also evaluating AG-946, its next-generation pyruvate kinase-R activator in a phase I study for the treatment of hemolytic anemia.

Agios Pharmaceuticals, Inc. Price

Agios Pharmaceuticals, Inc. price | Agios Pharmaceuticals, Inc. Quote

Zacks Rank & Stocks to Consider

Currently, Agios has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the biotech/drug sector include Repligen Corporation RGEN, SciSparc Ltd. SPRCY and Vanda Pharmaceuticals VNDA. While SciSparc sports a Zacks Rank #1 (Strong Buy), both Repligen and Vanda currently carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Repligen’s earnings per share estimates for 2021 have increased from $2.26 to $2.69 in the past 30 days while that of 2022 have increased from $2.56 to $2.94 over the same period. The stock has risen 25.8% in the year so far.

SciSparc’s loss per share estimates for 2021 have narrowed from $3.27 to $1.24 in the past 30 days while that of 2022 have narrowed from $2.79 to $1.25 over the same period. The stock has risen 45.3% in the year so far.

Vanda’s earnings per share estimates for 2021 have increased from $0.62 to $0.63 in the past 30 days while that of 2022 have increased from $0.80 to $0.86 over the same period. The stock has risen 35.9% in the year so far.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Agios Pharmaceuticals, Inc. (AGIO) : Free Stock Analysis Report

Vanda Pharmaceuticals Inc. (VNDA) : Free Stock Analysis Report

SciSparc Ltd. Sponsored ADR (SPRCY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research