REAL TIME PRICE

EXTENDED HOURS

| Day’s Range | - |

| 52 Week Range | - |

| Real Estate Investment Tr... | |

Elme Communities (ELME) Price Target Decreased by 7.45% to 14.79

The average one-year price target for Elme Communities (NYSE:ELME) has been revised to 14.79 / share. This is an decrease of 7.45% from the prior estimate of 15.98 dated March 28, 2024.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 14.14 to a high of 15.75 / share. The average price target represents an increase of 2.99% from the latest reported closing price of 14.36 / share.

Elme Communities Declares $0.18 Dividend

On February 15, 2024 the company declared a regular quarterly dividend of $0.18 per share ($0.72 annualized). Shareholders of record as of March 20, 2024 received the payment on April 3, 2024. Previously, the company paid $0.18 per share.

At the current share price of $14.36 / share, the stock's dividend yield is 5.01%.

Looking back five years and taking a sample every week, the average dividend yield has been 4.32%, the lowest has been 2.60%, and the highest has been 6.59%. The standard deviation of yields is 1.00 (n=233).

The current dividend yield is 0.69 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is -1.19. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is -0.40%.

What is the Fund Sentiment?

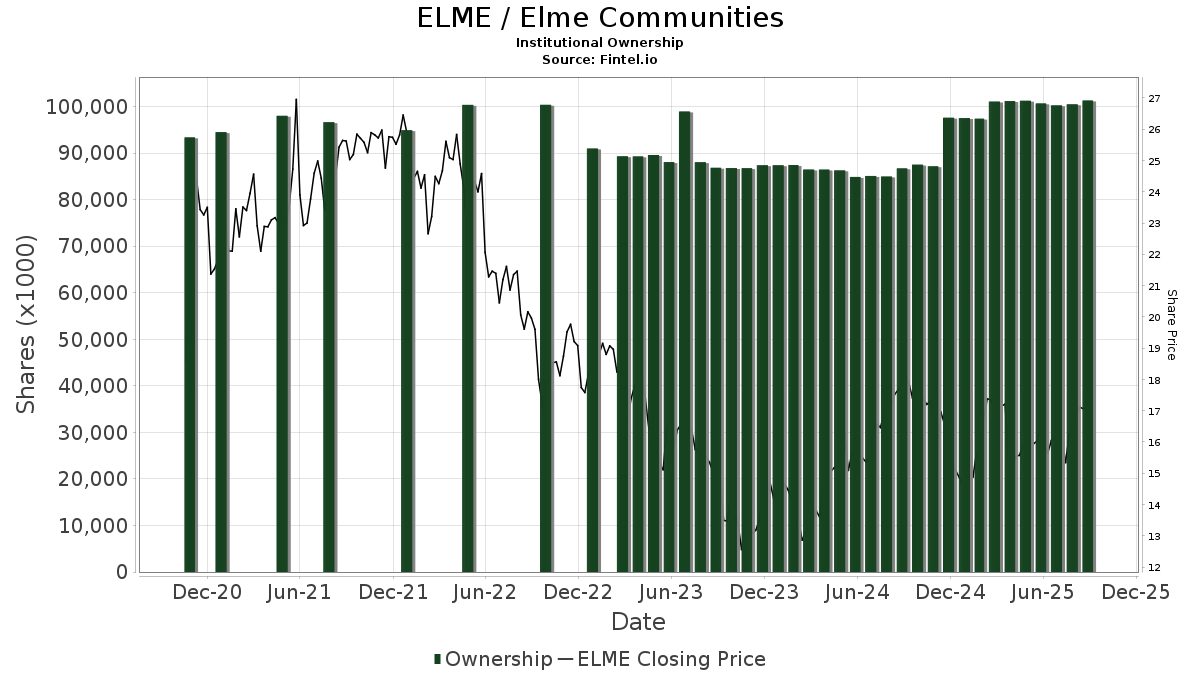

There are 484 funds or institutions reporting positions in Elme Communities.

This is an increase

of

4

owner(s) or 0.83% in the last quarter.

Average portfolio weight of all funds dedicated to ELME is 0.08%,

a decrease

of 6.45%.

Total shares owned by institutions decreased

in the last three months by 1.30% to 86,353K shares.

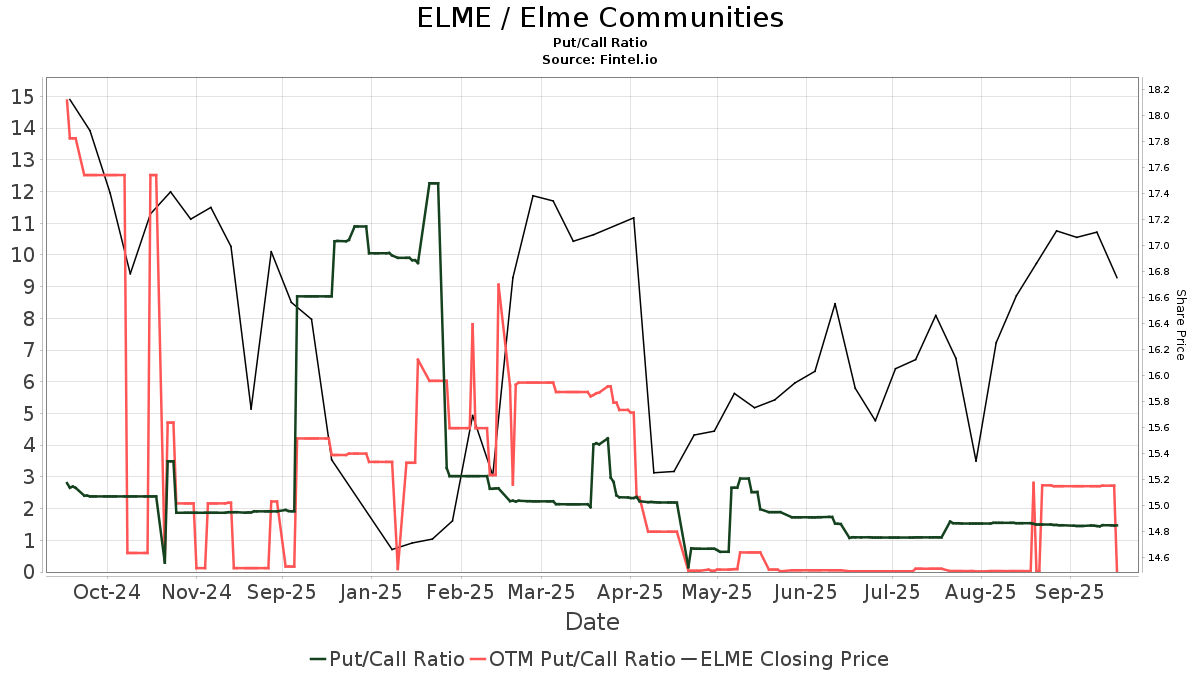

The put/call ratio of ELME is 0.13, indicating a

bullish

outlook.

The put/call ratio of ELME is 0.13, indicating a

bullish

outlook.

What are Other Shareholders Doing?

IJR - iShares Core S&P Small-Cap ETF holds 5,881K shares representing 6.69% ownership of the company. In it's prior filing, the firm reported owning 5,931K shares, representing a decrease of 0.85%. The firm decreased its portfolio allocation in ELME by 8.21% over the last quarter.

VGSIX - Vanguard Real Estate Index Fund Investor Shares holds 3,549K shares representing 4.04% ownership of the company. In it's prior filing, the firm reported owning 3,617K shares, representing a decrease of 1.90%. The firm decreased its portfolio allocation in ELME by 2.48% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 2,813K shares representing 3.20% ownership of the company. In it's prior filing, the firm reported owning 2,782K shares, representing an increase of 1.12%. The firm decreased its portfolio allocation in ELME by 3.27% over the last quarter.

Thornburg Investment Management holds 2,356K shares representing 2.68% ownership of the company. No change in the last quarter.

TIBAX - Thornburg Investment Income Builder Fund - holds 2,355K shares representing 2.68% ownership of the company. No change in the last quarter.

Elme Communities Background Information

(This description is provided by the company.)

WashREIT owns and operates uniquely positioned real estate assets in the D.C. Metro region. Its portfolio of 43 properties includes approximately 3.4 million square feet of commercial space and 6,863 multifamily apartment units across the region. The company currently has an enterprise value of approximately $3.0 billion. With a track record of driving returns and delivering satisfaction, WashREIT is a trusted authority in one of the nation’s most competitive real estate markets.

Stories by George Maybach

Loop Capital Initiates Coverage of Louisiana-Pacific (LPX) with Hold Recommendation

Fintel reports that on May 3, 2024, Loop Capital initiated coverage of Louisiana-Pacific (NYSE:LPX) with a Hold recommendation.

Argus Research Initiates Coverage of Arcadium Lithium (ALTM) with Buy Recommendation

Fintel reports that on May 3, 2024, Argus Research initiated coverage of Arcadium Lithium (NYSE:ALTM) with a Buy recommendation.

B of A Securities Initiates Coverage of Avidity Biosciences (RNA) with Buy Recommendation

Fintel reports that on May 3, 2024, B of A Securities initiated coverage of Avidity Biosciences (NasdaqGM:RNA) with a Buy recommendation.

Jefferies Upgrades Arista Networks (ANET)

Fintel reports that on May 3, 2024, Jefferies upgraded their outlook for Arista Networks (NYSE:ANET) from Hold to Buy.

Lake Street Initiates Coverage of Biodesix (BDSX) with Buy Recommendation

Fintel reports that on May 3, 2024, Lake Street initiated coverage of Biodesix (NasdaqGM:BDSX) with a Buy recommendation.

Wedbush Upgrades Diebold Nixdorf (DBD)

Fintel reports that on May 3, 2024, Wedbush upgraded their outlook for Diebold Nixdorf (NYSE:DBD) from Neutral to Outperform.

Stifel Initiates Coverage of Phathom Pharmaceuticals (PHAT) with Buy Recommendation

Fintel reports that on May 3, 2024, Stifel initiated coverage of Phathom Pharmaceuticals (NasdaqGS:PHAT) with a Buy recommendation.

Mizuho Upgrades Avista (AVA)

Fintel reports that on May 3, 2024, Mizuho upgraded their outlook for Avista (NYSE:AVA) from Underperform to Neutral.