LyondellBasell (LYB) Buys Mepol Group, Enhances CirculenRecover

LyondellBasell Industries N.V. LYB recently announced that it has entered into a definitive agreement to acquire Mepol Group, a manufacturer of recycled, high-performing technical compounds, which has presence in Italy and Poland. Mepol Group consists of Mepol s.r.l and its subsidiaries Polar s.r.l and Industrial Technology Investments Poland Sp.z.o.o. The buyout is subject to regulatory approval and other closing conditions.

The company stated that this deal will further enhance its commitment to expanding the circular economy. The company also stated that this acquisition will boost its CirculenRecover and other sustainable solutions.

LyondellBasell remains committed to providing circular and low-carbon solutions to its customers. The company started engineering work for a new advanced recycling plant in Wesseling, Germany, in 2022.

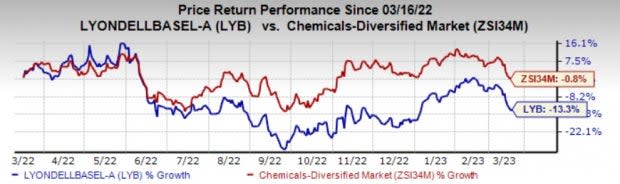

Shares of LyondellBasell have lost 13.3% in the past year compared with 0.8% fall of the industry.

Image Source: Zacks Investment Research

The company, on its fourth-quarter call, said that it expects the challenging economic environment to continue, at least in the first half of 2023. It noted stable demand from consumer packaging, oxyfuels and refining markets during January. While aligning its production process with global demand trends, LYB expects utilization rates for its operating assets to be 80% for its Olefins & Polyolefins and intermediates & derivatives segments. LYB also sees seasonal demand improvements in 2023.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are ATI Inc. ATI, Olympic Steel, Inc. ZEUS and Cal-Maine Foods, Inc. CALM. ATI currently carries a Zacks Rank #2 (Buy), while ZEUS and CALM sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ATI’s shares have gained 48.3% in the past year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 1.4% upward in the past 60 days. The company has an earnings growth rate of 9% for the current year.

ATI topped Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.4% on average.

Olympic Steel’s shares have gained 54.5% in the past year. The Zacks Consensus Estimate for its current-year earnings has been revised 61% upward in the past 60 days. ZEUS topped Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.2% on average.

Cal-Maine’s shares have gained 14.7% in the past year. The company has an earnings growth rate of 515.8% for the current year. The Zacks Consensus Estimate for CALM’s current-year earnings has been revised 19% upward in the past 60 days.

CALM topped Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 15.3% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report