Associated Banc-Corp (ASB) Q2 Earnings Beat, Revenues Fall Y/Y

Associated Banc-Corp’s ASB second-quarter 2021 earnings of 56 cents per share surpassed the Zacks Consensus Estimate of 52 cents. The bottom line improved significantly from adjusted earnings of 26 cents in the prior-year quarter.

Results gained from lower expenses and provision benefits. However, weak lending scenario, fall in revenues and lower rates were the major headwinds.

Net income available to common shareholders was $86.1 million, substantially down from $144.6 million in the year-ago quarter. The prior year included net gain on the sale of Associated Benefits and Risk Consulting.

Revenues & Expenses Fall

Net revenues came in at $253 million, down 43.1% year on year. The top line also missed the Zacks Consensus Estimate of $260.5 million.

Net interest income was $179.5 million, down 5%. Net interest margin (NIM) was 2.37%, down 12 basis points (bps).

Non-interest income plunged 71% to $73.4 million. The drastic fall was mainly due to absence of net gain on sale of assets, as well as lower net mortgage banking income and net capital markets fees.

Non-interest expenses declined 5% to $174.5 million. The decline was mainly due to a fall in almost all cost components, except for occupancy, legal and professional costs, business development and advertising charges, and equipment costs.

Efficiency ratio (on a fully tax-equivalent basis) was 64.88%, up from the 42.46% in the prior-year quarter. A rise in efficiency ratio indicates a deterioration in profitability.

As of Jun 30, 2021, net loans were $23.6 billion, down almost 1% sequentially. Total deposits decline 1.5% to $27.3 billion.

Credit Quality Improves

Provisions for credit losses were a benefit of $35 million against the provision of $61 million in the prior-year quarter. As of Jun 30, 2021, the ratio of net charge-offs to annual average loans was 0.08%, down 28 bps.

As of Jun 30, 2021, total non-performing assets were $171.1 million, down 11% year over year. Further, total non-accrual loans came in at $147.1 million, declining 14%.

Capital Ratios Improve, Profitability Ratios Worsen

As of Jun 30, 2021, Tier 1 risk-based capital ratio was 11.81%, up from the 11.62% recorded in the corresponding period of 2020. Common equity Tier 1 capital ratio was 10.70%, up from 10.25%.

At the end of June quarter, annualized return on average assets was 1.06%, down from the 1.72% recorded in the prior-year period. Return on average tangible common equity was 13.19% compared with the year-ago quarter’s 25.45%.

2021 Outlook

NIM is projected to be 2.45-2.55%.

Non-interest income is expected to be the $315-$325 million range.

Management expects commercial loan growth (excluding paycheck protection program) of 2-4%, driven by a 4-6% increase in commercial real estate loans, and a 1-2% increase in commercial and business lending loans.

Expenses are expected to be $695-$700 million.

The company continues to experience positive credit trends due to economic conditions and expects provision to adjust with changes to risk grade, other indications of credit quality and loan volume.

Annual tax rate is expected to be 19-21%, assuming no change in the corporate tax rate.

Our Take

Associated Banc-Corp’s business restructuring efforts are likely to keep supporting financials in the quarters ahead. The company has a solid balance-sheet position, which makes it well poised for growth. Nevertheless, margin pressure due to lower rates and weak loan demand are major concerns.

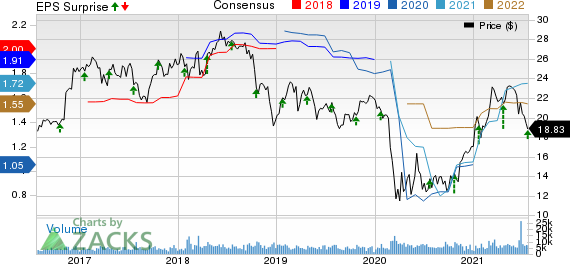

Associated BancCorp Price, Consensus and EPS Surprise

Associated BancCorp price-consensus-eps-surprise-chart | Associated BancCorp Quote

Associated Banc-Corp currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Zions Bancorporation’s ZION second-quarter 2021 net earnings per share of $2.08 surpassed the Zacks Consensus Estimate of $1.25. The bottom line marks a significant improvement from 34 cents earned in the year-ago quarter.

Hancock Whitney Corporation’s HWC second-quarter 2021 adjusted earnings per share of $1.37 surpassed the Zacks Consensus Estimate of $1.15. The bottom line improved significantly from the prior-year quarter’s loss of $1.36.

First Horizon National Corporation’s FHN second-quarter 2021 adjusted earnings per share of 58 cents beat the Zacks Consensus Estimate of 43 cents. Further, the bottom line shows significant improvement from the prior-year quarter’s 20 cents.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION) : Free Stock Analysis Report

First Horizon Corporation (FHN) : Free Stock Analysis Report

Associated BancCorp (ASB) : Free Stock Analysis Report

Hancock Whitney Corporation (HWC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research