Things to Keep in Mind Before McCormick's (MKC) Q4 Earnings

McCormick & Company, Incorporated MKC is likely to register top-and bottom-line growth when it reports fourth-quarter fiscal 2021 numbers on Jan 27. The Zacks Consensus Estimate for revenues is pegged at $1,701 million, suggesting a rise of 9.2% from the prior-year quarter’s reported figure. The consensus mark for fiscal 2021 revenues is pegged at $6,296 million, indicating growth of 12.4% from the year-ago period’s reported figure.

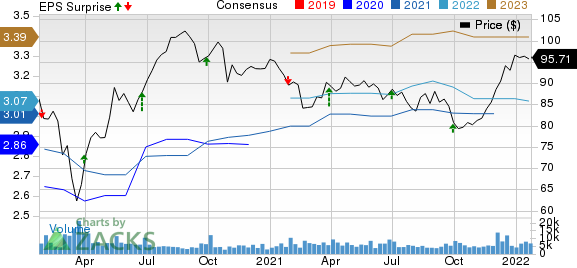

The Zacks Consensus Estimate for quarterly earnings is unchanged in the past 30 days at 80 cents per share, suggesting an increase of 1.3% from the figure reported in the prior-year quarter. The company’s consensus mark for fiscal 2021 bottom line is pegged at $3.01 per share, indicating growth of 6.4% from the year-ago period’s reported figure. In the last reported quarter, the company delivered an earnings surprise of 9.6%. This manufacturer, marketer and distributor of spices, seasoning mixes, condiments and other flavorful products has a trailing four-quarter earnings surprise of 10.3%, on average.

McCormick & Company, Incorporated Price, Consensus and EPS Surprise

McCormick & Company, Incorporated price-consensus-eps-surprise-chart | McCormick & Company, Incorporated Quote

Things to Note

McCormick is benefiting from a sustained shift in consumer demand for at-home consumption compared with the pre-pandemic levels. Gradual recovery in demand from restaurant and other foodservice customers is a contributing factor. Gains from acquisitions, including FONA (acquired in December 2020) and Cholula (acquired in November 2020), have been contributing to the top-line performance. Management, in its last earnings call, highlighted that it expects to deliver organic sales growth in both the segments through 2021, backed by new products, brand marketing, category management and differentiated customer engagement. The company expects fiscal 2021 sales growth of 12-13% (up 9-10% at constant currency) year over year.

However, McCormick has been grappling with higher costs stemming from the coronavirus outbreak. Management expects incurring pandemic-related costs of nearly $60 million during fiscal 2021. The company is witnessing broad-based inflation in raw and packaging materials and transportation costs. MKC also bears the brunt of supply chain bottlenecks stemming from restricted transportation capacity and labor shortages. Such supply chain hurdles are leading to higher costs. That said, the company is on track to counter the inflationary pressure through various pricing and cost-saving actions. In this regard, McCormick is focused on its Comprehensive Continuous Improvement (CCI) program, which is likely to have generated savings of nearly $110 million in fiscal 2021.

What the Zacks Model Unveils

Our proven model doesn’t conclusively predict an earnings beat for McCormick this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

McCormick carries a Zacks Rank #4 (Sell) and has an Earnings ESP of +0.63%.

Some Stocks With Favorable Combinations

Here are some companies that you may want to consider, as our model shows that these too have the right combination of elements to post an earnings beat.

Mondelez International MDLZ currently has an Earnings ESP of +1.57% and a Zacks Rank #3. MDLZ is likely to register top-and bottom-line growth when it reports fourth-quarter 2021 numbers. The Zacks Consensus Estimate for its quarterly revenues is pegged at $7.5 billion, suggesting growth of 3.3% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Mondelez International’s quarterly earnings has been unchanged in the past 30 days at 72 cents per share, suggesting growth of 7.5% from the year-ago quarter’s reported number. MDLZ delivered an earnings beat of 3.3%, on average, in the trailing four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hershey HSY currently has an Earnings ESP of +0.90% and a Zacks Rank of 3. The company is likely to register an increase in the bottom line when it reports fourth-quarter 2021 numbers. The Zacks Consensus Estimate for quarterly earnings has moved up by a penny in the last 7 days to $1.63 per share, calling for a 9.4% rise from the year-ago quarter’s reported number.

Hershey’s top line is also expected to rise year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $2.3 billion, suggesting a rise of 3.4% from the figure reported in the prior-year quarter. HSY delivered an earnings beat of 4.4%, on average, in the trailing four quarters.

Coty Inc. COTY currently has an Earnings ESP of +37.14% and a Zacks Rank #3. COTY is anticipated to register top-line growth when it reports second-quarter fiscal 2022 results. The Zacks Consensus Estimate for Coty’s quarterly revenues is pegged at $1.6 billion, indicating an improvement of 13.8% from the figure reported in the prior-year quarter.

The Zacks Consensus Estimate for Coty’s bottom line has moved up by a penny in the past seven days to 12 cents per share. However, the consensus estimate for earnings suggests a decline of 29.4% from the year-ago quarter’s reported figure. COTY delivered an earnings beat of 66.4%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research