Three Leading Canadian Dividend Stocks With Yields Up To 5.5%

Amidst a backdrop of fluctuating inflation rates and cautious monetary policies, the Canadian market, like its U.S. counterpart, remains a focal point for investors seeking stability and potential growth. As recent economic indicators suggest ongoing uncertainty in rate cuts and inflation management, dividend stocks emerge as appealing options for those looking to generate steady income from their investments in these turbulent times.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.61% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.35% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.53% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.46% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.84% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.36% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.99% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.11% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.35% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.57% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

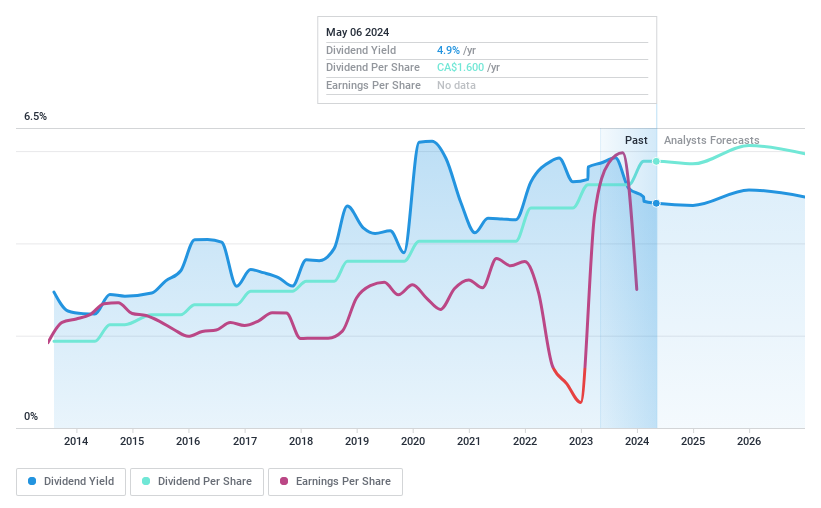

Manulife Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Manulife Financial Corporation operates globally, offering financial products and services across the United States, Canada, Asia, and other international markets, with a market capitalization of approximately CA$59.01 billion.

Operations: Manulife Financial Corporation generates revenue through its operations in Asia (CA$2.49 billion), the U.S. (CA$0.92 billion), Canada (CA$3.18 billion), and its Global Wealth and Asset Management segment (CA$5.76 billion).

Dividend Yield: 4.9%

Manulife Financial has maintained a stable dividend over the past decade, recently increasing its quarterly dividend to CA$0.40 per share, reflecting a 9.6% hike. Despite a modest yield of 4.87%, which is lower than the top Canadian dividend payers, its dividends are well-covered by earnings with a payout ratio of 55.8% and by cash flows with an even more conservative cash payout ratio of 14.1%. Additionally, Manulife's strategic decisions in preferred share management and increased buyback plans underline its commitment to shareholder returns while ensuring financial flexibility.

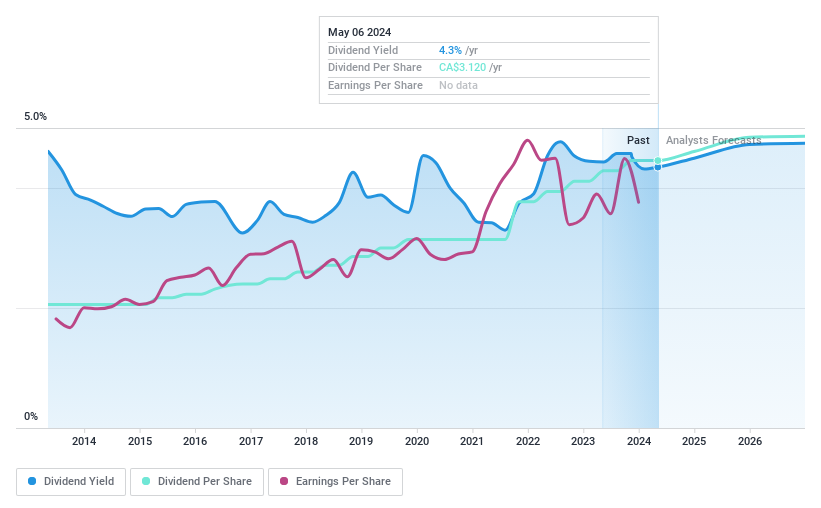

Sun Life Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sun Life Financial Inc. is a global financial services company offering savings, retirement, and pension products, with a market capitalization of approximately CA$41.79 billion.

Operations: Sun Life Financial Inc. generates its revenue through various segments, with CA$17.16 billion from Canada, CA$13.50 billion from the United States, CA$6.14 billion from Asset Management, and CA$4.03 billion from Asia.

Dividend Yield: 4.3%

Sun Life Financial has demonstrated a consistent commitment to its dividend strategy, marked by a decade of stable and growing dividends. The company's dividend sustainability is supported by a payout ratio of 57% from earnings and an even more conservative cash payout ratio of 33.4%. Despite offering a lower yield of 4.35% compared to the top quartile in the Canadian market, Sun Life's dividends are reliably covered by both earnings and cash flows, ensuring long-term stability for investors. Recent executive changes with Timothy Deacon stepping in as CFO could signal continued strategic financial stewardship.

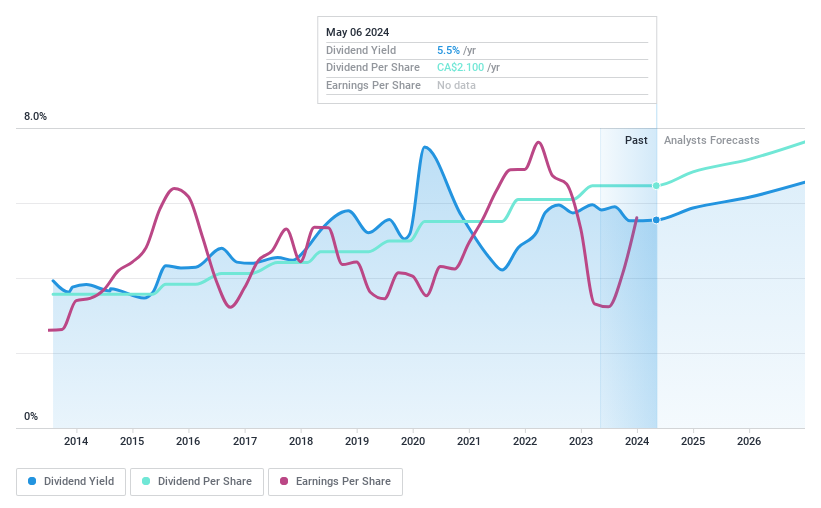

Power Corporation of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, provides financial services across North America, Europe, and Asia with a market capitalization of approximately CA$24.75 billion.

Operations: Power Corporation of Canada generates revenue primarily through its Lifeco segment at CA$27.80 billion, Power Financial - IGM at CA$3.87 billion, and Alternative Asset Investment Platforms at CA$1.37 billion.

Dividend Yield: 5.5%

Power Corporation of Canada has maintained stable dividends over the past decade, with a recent 7.1% increase to its quarterly dividend, reflecting a consistent payout strategy. Despite a lower yield of 5.55% compared to some Canadian peers, the dividends are well-supported by earnings and cash flows, with payout ratios at 59.1% and 28.6%, respectively. Recent shareholder activism highlights governance concerns but also underscores active stakeholder engagement. Additionally, substantial share buybacks totaling CAD 677 million enhance shareholder value by reducing share count and potentially increasing earnings per share.

Next Steps

Explore the 34 names from our Top Dividend Stocks screener here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:MFCTSX:SLF TSX:POW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com