Evolus Inc (EOLS) Q1 2024 Earnings: Surpasses Revenue Estimates with Significant Growth

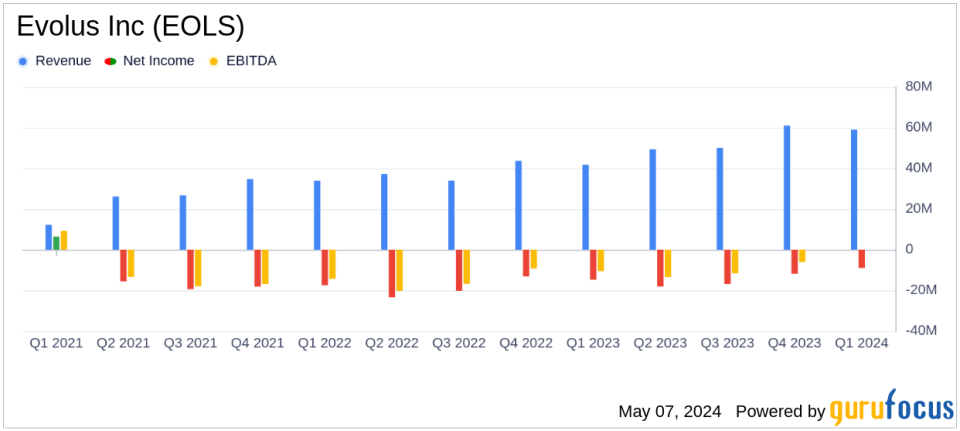

Q1 2024 Revenue: $59.3 million, a 42% increase from Q1 2023, surpassing the estimated $57.32 million.

Net Loss: Reported a net loss of $13.1 million in Q1 2024, compared to a net loss of $14.8 million in Q1 2023, showing a reduction in losses year-over-year.

Adjusted Gross Profit Margin: Achieved 69.5% in Q1 2024, slightly below the previous year's 70.9%.

Operating Expenses: Total operating expenses were $68.3 million in Q1 2024, a decrease from $69.6 million in Q4 2023.

Non-GAAP Loss from Operations: Improved to $0.9 million in Q1 2024 from $3.7 million in Q4 2023, indicating progress toward profitability.

Cash Position: Ended Q1 2024 with $97.0 million in cash and cash equivalents, significantly higher than the $62.8 million at the end of 2023.

Full-Year Revenue Guidance: Reaffirmed at $255 million to $265 million, indicating expected year-over-year growth of up to 31%.

On May 7, 2024, Evolus Inc (NASDAQ:EOLS) announced its first-quarter results for 2024, revealing a robust performance with net revenues reaching $59.3 million, a 42% increase from the previous year. This performance notably surpasses the analyst's revenue estimate of $57.32 million. The company released these figures in its latest 8-K filing. Evolus, a performance beauty company, is known for its flagship product, Jeuveau, a botulinum toxin type A formulation used primarily for aesthetic purposes.

Company Overview and Market Position

Evolus Inc operates in the self-pay aesthetic market, offering innovative products like Jeuveau for improving moderate to severe frown lines. The company's strategy focuses on a customer-centric approach, catering mainly to the cash-pay aesthetic sector, which includes products purchased by physicians and other customers for consumer use.

Financial and Operational Highlights

The first quarter of 2024 was marked by significant achievements for Evolus, including the addition of over 700 new customer accounts, bringing the total to over 13,000 since the launch of Jeuveau. The reorder rate among existing customers remains strong at approximately 70%. Additionally, membership in the Evolus Rewards consumer loyalty program grew by over 75,000, reaching around 825,000 members.

Despite these operational successes, Evolus reported a non-GAAP loss from operations of $0.9 million. However, this represents a move towards profitability, with the company on track to achieve non-GAAP profitability in Q4 2024 and for the full year 2025. The gross profit margin stood at 68.3%, with an adjusted gross profit margin slightly higher at 69.5%.

Strategic Developments and Future Outlook

Evolus is actively expanding its product portfolio and expects to submit Premarket Approval (PMA) applications for its new Evolysse dermal fillers to the FDA within the next 90 days. The company also anticipates regulatory approvals for its Estyme dermal fillers in Europe by late 2024. With these developments, Evolus reaffirms its full-year 2024 net revenue guidance of $255 million to $265 million, projecting a growth rate of 31% at the top end and aiming for a total net revenue goal of at least $700 million by 2028.

Financial Stability and Investment Insights

The financial stability of Evolus has been bolstered by a successful underwritten offering of common stock, which contributed $47.0 million in net proceeds. As of March 31, 2024, the company's cash and cash equivalents stood at $97.0 million, up from $62.8 million at the end of 2023. This strong liquidity position supports the company's strategic initiatives and moves towards profitability.

Evolus' performance in Q1 2024 not only demonstrates its ability to exceed revenue expectations but also highlights its potential for sustained growth and profitability in the competitive aesthetic market. Investors and stakeholders may look forward to the company's continued expansion and operational advancements as it aims to solidify its market position and deliver value in the coming years.

For detailed financial figures and further information, refer to Evolus Inc's full earnings report and join their upcoming conference call, details of which can be found on the Investor Relations page of their website.

Explore the complete 8-K earnings release (here) from Evolus Inc for further details.

This article first appeared on GuruFocus.