Bear of the Day: Select Energy Services (WTTR)

Energy stocks kicked off this year with a bang. As the world economy began to reopen in the wake of COVID-19, demand on oil recovered. This helped crude prices go from the head-scratching negative event on delivery, to over $75 before a sharp downturn late last week. Even with the last week’s 9.56% downside move, the Energy sector is still up 18.49% on the year. But has the easy money already been made here?

Today’s Bear of the Day points out a downside slide in earnings for one energy name, Select Energy Services WTTR. Select Energy Services, Inc., an oilfield services company, provides water management and chemical solutions to the onshore oil and natural gas industry in the United States. The company operates through three segments: Water Services, Water Infrastructure, and Oilfield Chemicals.

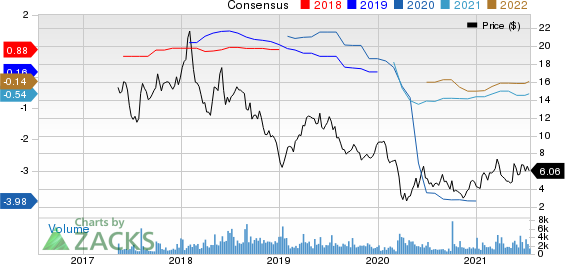

SELECT EGY SVCS Price and Consensus

SELECT EGY SVCS price-consensus-chart | SELECT EGY SVCS Quote

Currently, the stock is a Zacks Rank #5 (Strong Sell), due to negative earnings estimate revisions coming from analysts all over Wall Street. Over the last sixty days, analysts have cut their earnings estimates for the current year and next year. The moves have brought the Zacks Consensus Estimate for FY2021 from a 46-cent loss to a 59-cent loss, before it rounded out at a 54-cent loss. FY2022 has moved from a 20-cent loss to a 21-cent loss then back to a 15-cent loss.

Still, a nice feather in the cap of the bulls here on this one. FY2021 EPS growth is forecast to come in at 86% while FY2022 is 73%. Both years are forecast for a loss but there is meaningful growth there. Revenue growth is there too at 9.3% this year and 17.32% next year.

The Oil and Gas – Field Services industry ranks in the Top 44% of our Zacks Industry Rank. For investors looking to find other names in this industry to research, we have a few which are in the good graces of our Zacks Industry Rank. Those names include Zacks Rank #1 (Strong Buy) stocks Baker Hughes BKR and Helix Energy Solutions HLX.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helix Energy Solutions Group, Inc. (HLX) : Free Stock Analysis Report

Baker Hughes Company (BKR) : Free Stock Analysis Report

SELECT EGY SVCS (WTTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research