Acadia Healthcare (ACHC) Beats on Q2 Earnings, Ups '21 EPS View

Acadia Healthcare Company, Inc. ACHC reported second-quarter 2021 adjusted earnings of 71 cents per share, which outpaced the Zacks Consensus Estimate by 12.7%. The bottom line improved 31.5% year over year.

The company’s results highlight higher revenues driven by solid demand for its behavioral health services and growing patient volumes. However, the upside was partly offset by an elevated cost level.

Revenues at Acadia Healthcare improved 18.5% year over year to $582.2 million in the quarter under review. The top line beat the consensus mark by 3.8%.

Total same facility revenues rose 18% year over year on account of 9.8% improvement in patient days and 7.5% growth in revenue per patient day.

Adjusted EBITDA advanced 25.2% year over year to $141.3 million.

The company’s adjusted EBITDA margin on same facility basis came in at 29.3%, up 180 basis points (bps) year over year.

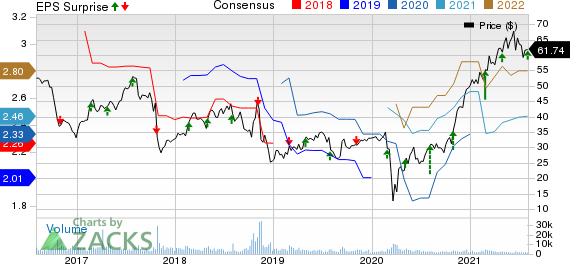

Acadia Healthcare Company, Inc. Price, Consensus and EPS Surprise

Acadia Healthcare Company, Inc. price-consensus-eps-surprise-chart | Acadia Healthcare Company, Inc. Quote

Total expenses improved 13.8% year over year to $517.2 million due to rise in salaries, wages and benefits, professional fees, supplies and other operating expenses.

In the second quarter, the company added 86 beds to its existing operations. Out of the total, 72 incremental beds resulted from opening of the replacement facility for Belmont Behavioral Hospital. The company remains well within its target of adding around 300 beds to its existing facilities through 2021-end.

Financial Update (as of Jun 30, 2021)

Acadia Healthcare exited the second quarter with cash and cash equivalents of $185.5 million, which doubled itself from the 2020-end level.

Total assets of $4.6 billion plunged 29.8% from the level at 2020 end.

Long-term debt totaled $1.4 billion, which declined 51.4% from the figure as of Dec 31, 2020.

For six months ended Jun 30, 2021, net cash provided by operating activities of $166.5 million tumbled 37.2% from the prior-year comparable period.

2021 Outlook Revised

Based on strong operating results during the first half of 2021, the company updated its 2021 guidance for certain metrics.

Revenues are now estimated between $2.28 billion and $2.32 billion for 2021, up from the prior guidance of $2.24-$2.29 billion.

Adjusted EBITDA is projected to be $530-$550 million, higher from the previous outlook of $500-$530 million.

Adjusted earnings per share is forecast within $2.50-$2.70, up from the earlier view of $2.30-$2.55.

Operating cash flows are expected to be $275-$310 million for this year.

Business Update

On May 24, 2021, Acadia Healthcare inaugurated the Ohio-based Glenwood Behavioral Health housing 80 beds in a bid to offer inpatient psychiatric treatment for individuals grappling with mental health issues.

The healthcare provider opened one comprehensive treatment center (CTC) in the second quarter and plans to inaugurate eight more CTCs in 2021.

On Jun 30, 2021, the company formed a joint venture with Bronson Healthcare in a bid to construct a freestanding behavioral health facility in Michigan.

Zacks Rank

Acadia Healthcare carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the medical sector players that have reported second-quarter results so far, Anthem, Inc. ANTM, HCA Healthcare, Inc. HCA and Universal Health Services, Inc. UHS beat the Zacks Consensus Estimate for earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Acadia Healthcare Company, Inc. (ACHC) : Free Stock Analysis Report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research