With EPS Growth And More, Australian Agricultural (ASX:AAC) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Australian Agricultural (ASX:AAC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Australian Agricultural

Australian Agricultural's Improving Profits

In the last three years Australian Agricultural's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a wedge-tailed eagle on the wind, Australian Agricultural's EPS soared from AU$0.053 to AU$0.076, in just one year. That's a impressive gain of 45%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Australian Agricultural's revenue dropped 21% last year, but the silver lining is that EBIT margins improved from -68% to -55%. That falls short of ideal.

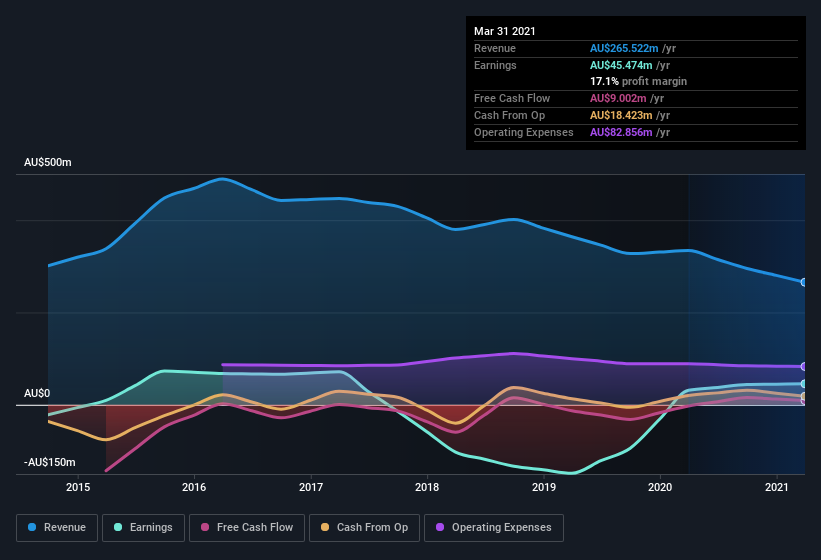

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Australian Agricultural Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Australian Agricultural shares, in the last year. So it's definitely nice that Independent Non-Executive Director Jessica Rudd bought AU$40k worth of shares at an average price of around AU$1.24.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Australian Agricultural insiders own more than a third of the company. Indeed, with a collective holding of 52%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. At the current share price, that insider holding is worth a whopping AU$433m. That means they have plenty of their own capital riding on the performance of the business!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Hugh Killen, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Australian Agricultural with market caps between AU$537m and AU$2.1b is about AU$1.3m.

The Australian Agricultural CEO received AU$949k in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Australian Agricultural Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Australian Agricultural's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. We should say that we've discovered 2 warning signs for Australian Agricultural (1 is a bit unpleasant!) that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Australian Agricultural, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.