Horizon Bancorp (IN) (HBNC) Reports Q1 2024 Earnings: A Detailed Analysis

Earnings Per Share (EPS): Reported at $0.32, surpassing the estimate of $0.31.

Net Income: Achieved $14.0 million, exceeding the estimated $13.60 million.

Revenue: Net interest income reached $43.3 million, below the quarterly revenue estimate of $54.38 million.

Net Interest Margin: Increased to 2.50% from 2.43% in the previous quarter.

Loan Growth: Total loans expanded to $4.62 billion, marking an 18.2% annualized increase during the quarter.

Asset Quality: Maintained excellent with net charge-offs at only 0.01% of average loans and non-performing loans at 0.41%.

Deposits: Ended the quarter at $5.58 billion, slightly down from $5.66 billion at the end of the previous quarter.

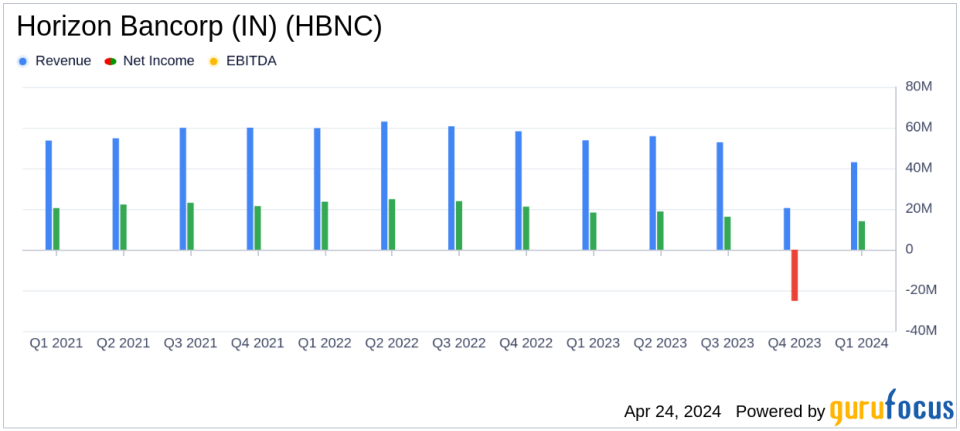

On April 24, 2024, Horizon Bancorp (IN) (NASDAQ:HBNC) released its 8-K filing, announcing a robust start to the year with first-quarter earnings that exceeded analyst expectations. The company reported earnings per share (EPS) of $0.32, surpassing the estimated EPS of $0.31. Net income reached $14.0 million, also topping the forecast of $13.60 million. These results mark a significant turnaround from a net loss in the previous quarter and highlight Horizon Bancorp's strategic financial management and operational efficiency.

Company Overview

Horizon Bancorp, Inc., based in the United States, operates as a bank holding company primarily through its subsidiary, Horizon Bank. The company offers a wide range of banking services including commercial and retail banking, trust and agency services, and other related financial activities. It focuses on commercial loans, real estate loans, mortgage warehouse loans, consumer loans, and other credit facilities, maintaining a strong presence in commercial banking.

Financial Performance Highlights

The first quarter of 2024 saw Horizon Bancorp achieve a net interest margin (NIM) of 2.50%, an improvement from 2.43% in the previous quarter. This expansion is attributed to strategic investments in higher yielding commercial and consumer loan portfolios. Total loans exhibited an 18.2% annualized increase, reaching $4.62 billion, driven by significant growth in commercial loans and strategic deployment into high-quality residential mortgages and consumer loans.

Despite a slight decrease in total deposits from $5.66 billion at the end of the previous quarter to $5.58 billion, the bank maintained a stable deposit base with disciplined pricing. Non-interest income recovered to $9.9 million, a stark contrast to the negative figures in the prior quarter, reflecting solid fee income performance and controlled operational expenses.

Operational and Strategic Developments

President and CEO Thomas M. Prame highlighted the banks resilience and strategic execution, stating,

We are very pleased with our positive first quarter results which included a second consecutive quarter of margin and net interest income expansion... We feel confident in our ability to continue to improve our net interest margin and the financial performance of the organization moving forward."

This optimism is underpinned by consistent growth in relationship banking and a diversified operating model that continues to perform well across local markets.

Challenges and Forward Outlook

Despite the positive outcomes, Horizon Bancorp faces an economic environment characterized by higher prolonged interest rates. However, the banks conservative lending approach and active portfolio management have positioned it well to navigate these challenges. The banks focus on expanding its equipment finance and residential lending, alongside robust credit quality metrics, supports a positive outlook for the upcoming quarters.

Conclusion

Horizon Bancorp (IN) (NASDAQ:HBNC)'s first-quarter results for 2024 reflect a strong financial position and strategic foresight in managing its loan portfolio and capitalizing on interest income opportunities. With a disciplined approach to expenses and an effective asset quality management, Horizon is well-equipped to sustain its growth trajectory and continue delivering value to its stakeholders.

For detailed insights and further information, refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Horizon Bancorp (IN) for further details.

This article first appeared on GuruFocus.