General Dynamics Corp (GD) Q1 2024 Earnings: Aligns with EPS Projections, Surpasses Revenue ...

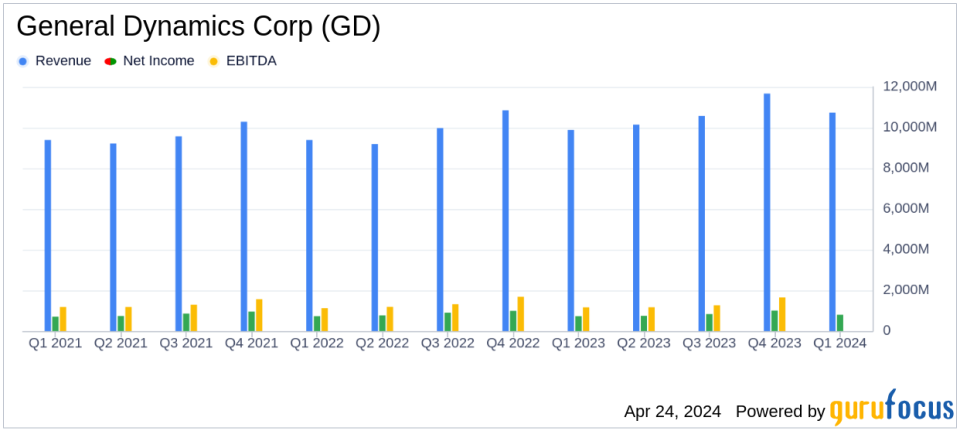

Revenue: Reported $10.7 billion, an increase of 8.6% year-over-year, surpassing the estimate of $10.317 billion.

Earnings Per Share (EPS): Diluted EPS stood at $2.88, up 9.1% from the previous year, slightly below the estimate of $2.93.

Net Income: Achieved $799 million, up 9.5% year-over-year, falling short of the estimated $820.48 million.

Operating Margin: Expanded by 20 basis points to 9.7%, indicating improved operational efficiency.

Backlog: Increased to $93.7 billion, up 4.4% from the previous year, with significant new orders in both Aerospace and Defense segments.

Capital Expenditures: Invested $159 million in capital expenditures, maintaining a strong focus on growth and operational capabilities.

Cash Position: Ended the quarter with $1 billion in cash and equivalents, despite a net cash use in operating activities of $278 million.

On April 24, 2024, General Dynamics Corp (NYSE:GD) reported its financial results for the first quarter of 2024, revealing a notable increase in revenue and earnings, as detailed in its 8-K filing. The company's revenue reached $10.7 billion, marking an 8.6% increase from the previous year and surpassing the estimated $10.317 billion. Operating earnings rose to $1 billion, up 10.4% year-over-year, with diluted earnings per share (EPS) climbing to $2.88, closely aligning with the estimated EPS of $2.93.

General Dynamics, a leading aerospace and defense company, operates through various segments including aerospace, marine systems, combat systems, and technologies. The company is renowned for its production of Gulfstream business jets, nuclear-powered submarines, and advanced combat vehicles like the M1 Abrams tank.

Financial and Operational Highlights

The first quarter saw General Dynamics achieving a consolidated book-to-bill ratio of 1-to-1, with a company-wide backlog increase of 4.4% to $93.7 billion. The aerospace segment, boosted by the FAA certification of the Gulfstream G700, reported a 6.2% increase in backlog to $20.5 billion. Defense segments also showed strong performance with significant new contracts, including a potential $3 billion deal with the U.S. Army for medium-caliber ammunition cartridges.

Despite challenges such as an increase in operating working capital which led to a net cash use of $278 million from operating activities, the company's strategic capital deploymentsincluding $361 million in dividends and $105 million in share repurchasesreflect a confident outlook for 2024. The financial stability of General Dynamics is further underscored by an operating margin improvement to 9.7%, a 20 basis-point increase from the previous year.

Detailed Financial Analysis

The income statement reveals that net earnings improved by 9.5% to $799 million. The balance sheet remains robust with total assets increasing to $55.246 billion as of March 31, 2024, from $54.810 billion at the end of 2023. The company's liquidity position, however, showed a decrease in cash and equivalents to $1.036 billion from $1.913 billion, reflecting the higher cash used in operations and investments during the quarter.

General Dynamics' commitment to innovation and operational excellence is evident from its increased investments in research and development, totaling $137 million for the quarter, up from $110 million in the previous year. This investment is crucial for maintaining competitive advantage and driving future growth in its high-tech product offerings.

Outlook and Strategic Moves

Looking ahead, General Dynamics' leadership remains optimistic about the company's trajectory. "Our businesses delivered solid operating results in the quarter, growing revenue and backlog, while expanding margins," stated Phebe N. Novakovic, chairman and chief executive officer. The company is well-positioned to continue its growth, supported by a strong backlog and ongoing strategic contracts.

In summary, General Dynamics Corp (NYSE:GD) has demonstrated a strong start to 2024, with financial performances that align closely with analyst expectations on EPS and exceed them on revenue forecasts. The company's strategic positioning and robust backlog suggest a stable outlook, making it a noteworthy consideration for investors interested in the aerospace and defense sector.

Explore the complete 8-K earnings release (here) from General Dynamics Corp for further details.

This article first appeared on GuruFocus.