3 Buy-Rated Small Caps Flexing Big Growth

As many know, small-caps’ volatile nature can sometimes turn investors away.

However, many small-cap stocks turn out to be big winners in the long run, and they typically have fewer eyes on them, providing investors an opportunity to get in "early" before the crowd.

For those seeking exposure to small-caps, three stocks – EZCORP EZPW, Artivion AORT, and QuickLogic QUIK – could all be considered.

All three sport a favorable Zacks Rank, indicating optimism among analysts. Let’s take a closer look at each.

EZCORP

EZCORP establishes, acquires, and operates pawnshops that function as convenient consumer credit sources and value-oriented specialty retailers of previously owned merchandise.

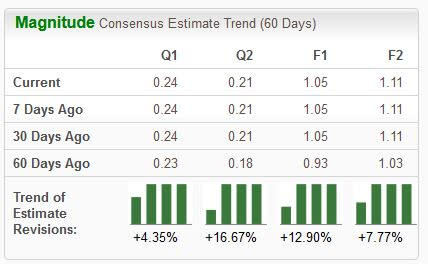

Analysts have raised their earnings expectations across all timeframes, landing the stock a favorable Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

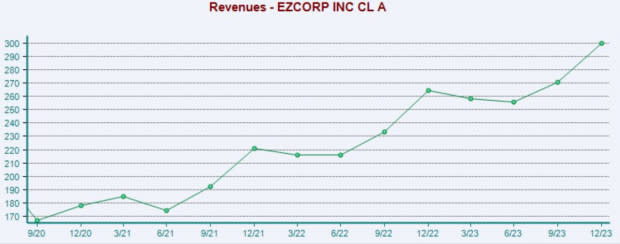

The company’s shares aren’t valuation stretched given its forecasted growth, with earnings forecasted to climb 14% in its current fiscal year on 12% higher sales. The current forward earnings multiple (F1) sits at 9.8X, a few ticks above the respective Zacks Finance – Consumer Loans industry average.

EZPW’s sales have remained strong, as we can see illustrated below.

Image Source: Zacks Investment Research

Artivion

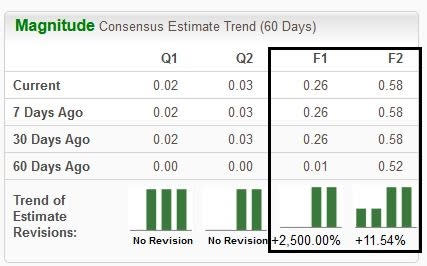

Artivion is a medical device company that develops simple, elegant solutions for cardiac and vascular surgery. Analysts have raised their current and next-year outlooks considerably, helping push the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

The company’s quarterly performance shouldn’t be overlooked, exceeding our consensus EPS estimates by an average of 240% across its last four releases. Just in its latest print, AORT posted a 185% beat relative to the Zacks Consensus EPS estimate and posted revenue 4.4% ahead of expectations.

Investors have been pleased with the quarterly results, with AORT shares seeing post-earnings positivity in back-to-back releases.

Image Source: Zacks Investment Research

QuickLogic

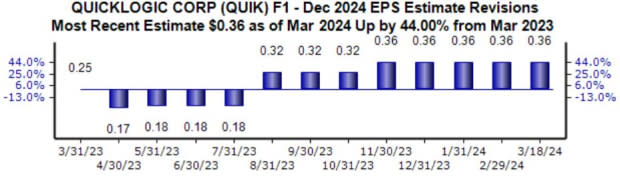

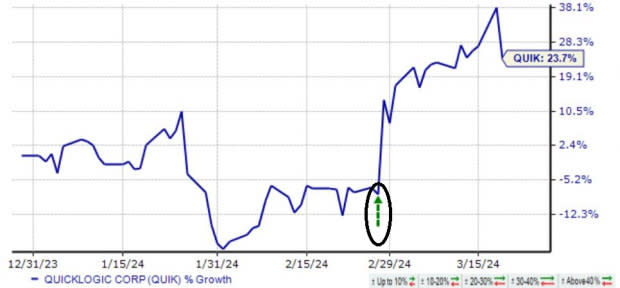

QuickLogic, a current Zacks Rank #1 (Strong Buy), is a semiconductor provider of ultra-low power, comprehensive, flexible sensor processing solutions. The earnings estimate revisions trend has been particularly bullish for its current year, up 44% to $0.36 per share over the last year and suggesting 110% growth.

Image Source: Zacks Investment Research

The company snapped a streak of negative earnings surprises in its latest release, exceeding the Zacks Consensus EPS estimate by nearly 30%. Sales grew 80% year-over-year, whereas earnings climbed 255%.

Investors cheered on the results, with QUIK shares now up a rock-solid +24% year-to-date.

Image Source: Zacks Investment Research

QuickLogic’s growth profile shouldn’t be overlooked, with earnings forecasted to climb 110% on 30% higher sales in its current year (FY24). Peeking ahead to FY25 expectations, earnings and revenue are suggested to improve by an additional 60% and 25%, respectively.

Bottom Line

Small-cap stocks can be solid considerations for those who can handle a higher level of volatility and have a less conservative approach.

While their price swings can undoubtedly become spooky, their potential is undeniable.

And all three above – EZCORP EZPW, Artivion AORT, and QuickLogic QUIK – boast strong growth trajectories paired with improved earnings outlooks and positive price action.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EZCORP, Inc. (EZPW) : Free Stock Analysis Report

QuickLogic Corporation (QUIK) : Free Stock Analysis Report

Artivion, Inc. (AORT) : Free Stock Analysis Report