Eversource's (ES) Q2 Earnings and Revenues Miss Estimates

Eversource Energy ES reported second-quarter 2021 operating earnings of 79 cents per share, which lagged the Zacks Consensus Estimate by 1.2%.

The bottom line, however, improved 5.3% year over year. The improvement in earnings was due to strong contribution from the acquired Columbia Gas of Massachusetts assets, and solid performance of its Electric Transmission and Electric Distribution segments.

Revenues

Second-quarter revenues of $2,122.5 million missed the Zacks Consensus Estimate of $2,182 million by 2.7%. Total revenues, however, improved 8.7% from the year-ago figure of $1,953.1 million.

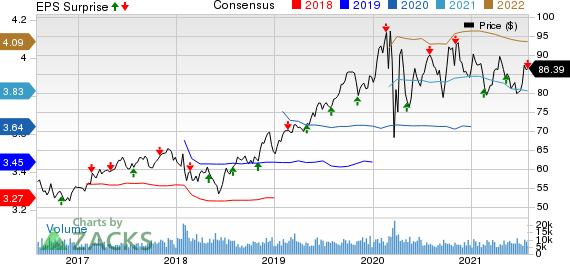

Eversource Energy Price, Consensus and EPS Surprise

Eversource Energy price-consensus-eps-surprise-chart | Eversource Energy Quote

Highlights of the Release

Operating expenses increased nearly 10% year over year to $1,670.9 million. Operating income was up 4.1% from the prior-year quarter to $451.6 million. Interest expenses increased 8.3% from the prior-year quarter to $145.4 million.

Net income for the quarter under review was $264.5 million, up 4.9% from $252.2 million recorded in the year-ago period.

Segmental Performance

Electric Distribution: Earnings from this segment were $137.6 million, down 6.3% from the prior-year quarter. The improvement was primarily due to higher revenues, offset by increased operation and maintenance expenses as well as depreciation and property taxes.

Electric Transmission: The segment’s earnings were up 5.7% year over year to $121.6 million. The upside was due to increased investment in Eversource’s transmission facilities.

Natural Gas Distribution: This segment’s earnings improved 57.7% from the prior-year quarter to $4.1 million. The year-over-year improvement was due to higher revenues and contribution from the acquired assets of Columbia Gas of Massachusetts.

Water Distribution: Earnings from this segment were $8.9 million, down 14.4% from $10.4 million in the year-ago quarter.

Eversource Parent & Other Companies: The segment’s loss was $0.9 million compared with a loss of $1.4 million in the year-ago quarter.

Guidance

Eversource expects earnings for 2021 to be at the lower end of the guided range of $3.81-$3.93 per share. The midpoint of management’s earnings guidance is $3.87, which is higher than the Zacks Consensus Estimate of $3.84 for the year.

The company also reaffirmed long-term earnings per share growth rate from existing core regulated businesses in the upper half of 5-7%, using the $3.64 per share earned in 2020 as a base.

The company expects capital expenditure for 2021 to be $3.5 billion. Its total capital expenditure for the 2021-2025 time period is expected to be $17 billion, which will assist Eversource to achieve carbon neutral target by 2030.

Zacks Rank

Eversource currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

DTE Energy Company DTE reported second-quarter 2021 operating earnings per share of $1.70, which beat the Zacks Consensus Estimate of $1.44 by 18.1%.

American Electric Power AEP reported second-quarter 2021 adjusted earnings per share of $1.18, which surpassed the Zacks Consensus Estimate of $1.14 by 3.5%.

NextEra Energy NEE reported second-quarter 2021 adjusted earnings of 71 cents per share, which beat the Zacks Consensus Estimate of 67 cents by 5.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research