Why Should You Hold Owl Rock Capital (ORCC) in Your Portfolio?

Owl Rock Capital Corporation ORCC is well-poised for growth on the back of a robust portfolio, healthy revenue stream and strategic measures.

Founded in 2015, Owl Rock Capital is a specialty finance company that lends funds to the U.S. middle market companies.

With a market cap of $5.77 billion, ORCC has been in investors’ good books for a while owing to a wide range of investments. Owl Rock Capital exited the third quarter with $12.1 billion investment in a portfolio of 130 companies. Moreover, the financial miscellaneous services provider's dominance in the market is evident from its $13 billion worth of assets.

Despite the current market uncertainty, ORCC managed to deploy capital to attractive investments and drive an incremental yield in the portfolio. It continues to seek opportunities in stable, large and recession-resistant businesses.

Now let’s see what makes this currently Zacks Rank #3 (Hold) player an investor’s favorite.

Owl Rock Capital has been enjoying meaty investment income since its inception in 2015. In fact, its investment income saw a CAGR of 129.8% during the 2016-2020 forecast period, which is impressive. In the first nine months of 2021, total investment income rose 27.1% year over year on the back of an expanded investment portfolio.

Its inorganic growth story also impresses. Owl Rock Capital Group and Owl Capital Partners announced their merger with Baltimore Acquisition Corp, a special purpose acquisition company.

All these strategic moves poise it well for long-term growth. Despite the COVID-19 scenario, ORCC deployed capital owing to its strong balance sheet. This is pretty evident from its dividend yield of 8.4%, which is way higher than the industry's average of 1.7%.

However, ORCC's expenses rose over the last few years, which might put pressure on the margins.

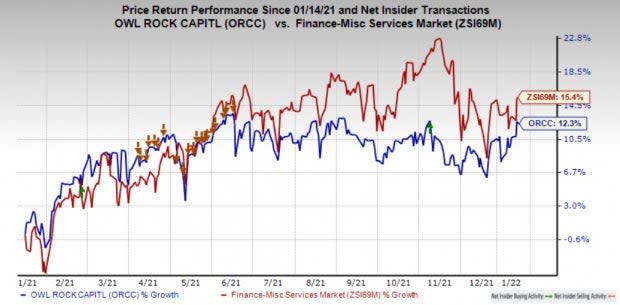

Shares of ORCC have gained 12.3% in a year’s time, underperforming the industry's growth of 15.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the same space are Alerus Financial Corporation ALRS, Houlihan Lokey, Inc. HLI and Jefferies Financial Group Inc. JEF, all sporting a Zacks Rank of 1, currently.

Alerus Financial is a financial services company. ALRS’ bottom line managed to beat estimates in three of its trailing four quarters (missing the mark in one), the average beat being 23.58%.

Houlihan Lokey is an investment bank, focusing on mergers and acquisitions, financings, financial restructurings and financial advisory services. HLI delivered a trailing four-quarter surprise of 39.53%, on average.

Jefferies Financial Group is a diversified financial services company. Earnings of JEF managed to beat estimates in all its trailing four quarters, the average being 222.85%.

While shares of Jefferies Financial Group and Houlihan Lokey have gained 42.4% and 68% each, the stock of Alerus Financial has lost 1.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jefferies Financial Group Inc. (JEF) : Free Stock Analysis Report

Owl Rock Capital Corporation (ORCC) : Free Stock Analysis Report

Houlihan Lokey, Inc. (HLI) : Free Stock Analysis Report

Alerus Financial (ALRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research